Partner content in association with

SE Asia will be home to 59 billion-dollar tech firms by 2029. Watch Asia Partners explain

Photo: Greg Rosenke / Unsplash.com

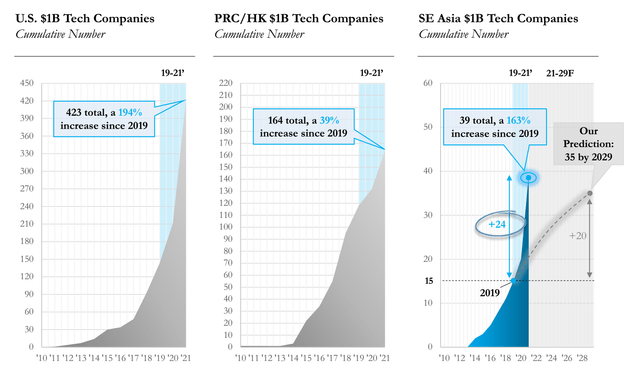

In 2019, a year before COVID-19 roiled financial markets across the globe, private equity firm Asia Partners predicted that Southeast Asia would be home to 35 billion-dollar tech companies by 2029. That meant adding 20 such firms, to the existing 15, in the span of a decade.

Only two years since the firm made the forecast in its first-ever Internet Report, that target has already been surpassed. Between 2019 and 2021, Southeast Asia added 24 billion-dollar tech firms and is now home to 39 of them.

What’s more, at least 20 billion-dollar tech companies will be created between now and 2029 in the region, according to an upwardly revised estimate by Asia Partners in its 2022 Internet Report. Moreover, at least half of these 20 companies will pursue IPOs over the next decade.

“Back in 2018, when we interacted with people and 2019 when we published the report, they thought we were nuts to project 35 unicorns in the region by 2029,” Nick Nash, co-founder and managing partner of Asia Partners, said in a video presentation marking the latest version of the report. “Look at the difference that two years have made.”

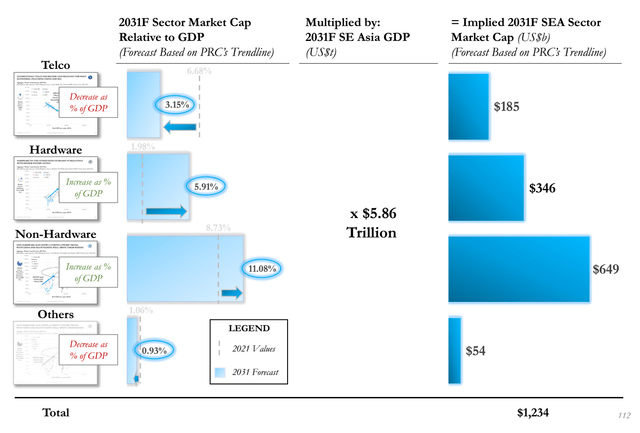

In the 2019 report, Asia Partners had also projected that the region’s tech market cap would zoom by $425 billion over the next decade from $86 billion at the time.

Cut to 2021, and nearly half of that journey has already been covered. Southeast Asia’s tech companies added $209 billion to their combined market cap in 2019-21.

Most of the increase ($140 billion) was contributed by Sea Ltd., which currently has a market cap of over $160 billion. Shares of NYSE-listed Sea Ltd have surged from around $11.56 apiece in early Jan 2019 to around $261 apiece now — an over 22x increase.

The 2022 Internet report now forecasts the region’s tech market cap to reach a whopping $1.234 trillion within the next 10 years, assuming that Southeast Asia follows Greater China’s trend line.

The Asia Partners report adds that Southeast Asia is the world’s fifth-largest region in terms of IPO transactions valued at $100 million, after Latin America, the US, Greater China, and Europe.

“In the next 5-10 years, Southeast Asia and Latin America will flip positions. It’s an important development and implication for how portfolio allocation should be thought about,” said Nash.

The report also sounded a few warning bells such as the shortage of growth capital. This gap widened, from an estimated $0.93 billion annual shortage to $1.1 billion now, in order for Southeast Asia to catch up with China.

Watch the full video version of the 2022 Internet Report below. A shorter executive summary version of the video can be viewed here.

The PDF version of the Asia Partners 2022 Internet Report report Southeast Asia’s Golden Age: Recovery and Rebound can be downloaded here