Partner content in association with

Will COVID-19 finally trigger consolidation in Indian life insurance industry?

A life insurance form is attached to a clipboard.

In December 2017, the Insurance Regulatory and Development Authority of India (IRDAI) finally made it easier for PE firms to enter the Indian insurance space. If a flood of investments was expected, it has not happened so far.

There has been some sporadic activity: Warburg Pincus buying a 26 per cent stake in IndiaFirst Life Insurance in 2019, or more recently, Indian PE firm Kedaara Capital picking a stake in Religare Health Insurance. Media reports indicated that Multiples Alternate Asset Management and True North could be looking to acquire a stake in Future Generali as the Future Group eyes an exit.

But the cases are few and far between. Among the reasons: life insurance in India is a long-haul investment where the cycle is likely to extend far longer than the 3 to 5 year horizon that most PE firms are comfortable with.

The regulatory framework which caps FDI in insurance at 49 per cent means global PE firms are unable to invest in insurers where a foreign promoter already holds the maximum permissible stake. Besides, returns are likely to be anaemic for a while due to reasons that are explored in greater detail in an exclusive article for DealStreetAsia by Milliman’s Sanket Kawatkar, Principal & Consulting Actuary – Life Insurance (India). The article provides a historic overview of the insurance sector in India and what, if anything, is likely to change after the COVID-19 pandemic.

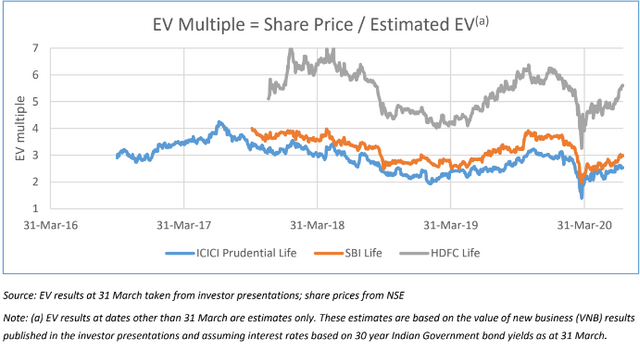

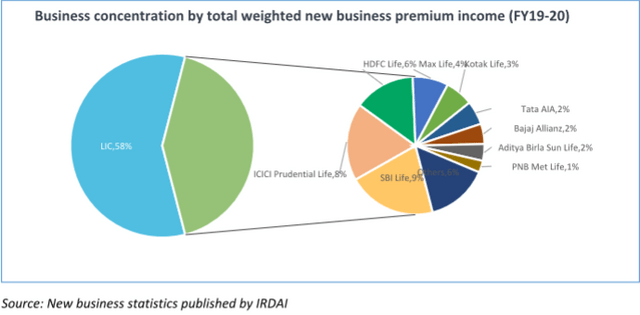

The Indian government opened up the life insurance space to private sector participants 20 years ago. There are now 23 private sector life insurers operating in the market, with three of these listed on the Indian stock exchanges. The Indian life insurance industry has grown its new business annualised premium equivalent (APE) over the past five years at a CAGR of approximately 17.5 per cent and the three listed players have been able to command a high valuation because of their successful business models. With a population of 1.3 billion people, an attractive demographic profile with approximately 65 per cent of the population less than 35 years of age, a growing middle class with high savings potential and an extremely under-penetrated ‘protection’ and pension/retirement savings segment, there should not be any doubt about the longer-term potential of the life insurance sector in India.

However, despite the many successes of the sector over the past 20 years and the potential it offers, the industry continues to face challenges on several fronts. These include having a tied agency distribution model that is largely part-time, under-productive and cost inefficient; relatively high lapse rates compared to some other Asian markets; bank distributors with greater negotiating power than the insurers themselves; and relatively high capital requirements due to delay in the adoption of risk-based approaches, etc. Business volumes are largely concentrated in the hands of only a few large players, with several small to medium sized players finding it challenging to increase market share.

With these challenges, despite having invested a significant amount of capital of approximately US$4.9 billion, many life insurers are yet to achieve their desired level of profitability. Indian life insurers’ new business margins (around 20 per cent – 25 per cent level) are lower than those achieved by insurers in other Asian markets (many markets have margins of around 50 per cent – 60 per cent). The complex joint venture structures of many of these companies often results in them not getting much needed capital to support future growth, unless all promoters are willing and able to inject fresh capital. Several Indian promoters have capital requirements arising at the promoter level, making them less keen to put further investment into their life insurance subsidiaries. This has resulted in several promoters expressing an interest to exit the sector. It is estimated that currently, as many as 14 promoters in 13 companies may be interested in some form of divestment.

A few attempts at divestment in the recent past have proven to be difficult for several reasons:

- Diverging perspectives amongst promoters concerning the future strategy of the business, commitment to capital investments and the level and method of divestment from the business etc.

- Expectations from promoters for high valuations and return on investments from their life insurance businesses commensurate with those achieved by listed players, but without the same level of success.

- Regulatory limits on foreign direct investment (FDI) in the sector (currently at 49 per cent) as well as the requirement of ‘Indian management and control’, making it difficult to attract new investors to the sector.

The ongoing Covid-19 pandemic presents a different paradigm and may provide the catalyst for the industry to consolidate.

Impact of Covid-19 on life insurers in India

Even before the onset of the pandemic, several promoters of Indian life insurers had been contemplating divestment from the businesses. A few had also been considering raising additional capital to support future growth.

So what’s changed with Covid-19?

Low business volumes: The imposed lockdown and the accompanying low economic activity, job losses and the resulting low savings among the population has resulted in a significant slowdown in insurance new business volumes. Up to July 2020, a large proportion of life insurers are experiencing a negative year-to-date growth of their new business APE.

Uncertainties around recovery: Insurers are uncertain about the timing of recovery. Even after the restrictions are finally lifted, it may take several months or more before people get the confidence to allow distributors to visit them to promote or sell life insurance policies. Besides, the economy in general would also need to bounce back for the savings potential to re-emerge in the typical customer segments of life insurance policies.

Increased lapses: Early indicative data suggests that the industry may also experience an increase in policy lapses with customers being unable to pay renewal premiums and surrendering policies to meet their immediate cash requirements.

Increased cost pressures: The industry was already experiencing cost pressure prior to the current pandemic which only seems to have intensified with the low business volumes, high fixed costs and high policy lapses.

Low interest rate environment: Efforts by the Government and the Reserve Bank of India (RBI) to increase the level of liquidity in the economy to spur growth could mean that interest rates may continue to remain low. Having sold non-participating savings business in large volumes (some of which may be unhedged), a persistent low interest rate environment would put additional pressure on insurers in terms of capital requirements.

Likelihood of further defaults on corporate bonds : After the IL&FS, DHFL and Yes Bank crises, a continued economic downturn may result in a few other bond issues coming under stress. Insurers holding such assets may need to make allowance for possible default or to revalue to reflect rating downgrades if they happen and to ultimately address the impact of asset write-off.

Enhanced focus on ‘protection’ business: The pandemic has increased awareness among consumers about the need for protection cover. Because protection policies are ‘cheaper’ (as compared to savings/investment oriented life insurance policies), insurers are also finding it to be easier to sell such policies in the current environment. However, protection business is relatively more capital intensive. Hence, large volumes of protection business are likely to result in increased capital requirements for life insurers.

Overall, lower new business volumes may result in lower new business strain and lower capital requirements. However, the factors above may require insurers to inject additional capital to meet regulatory solvency requirements or take other measures. Such actions could include carrying out significant cost reductions or placing constraints on volumes (especially protection business). Furthermore, with volumes declining from those projected, several insurers may see a sharp increase in expense overruns and ongoing value destruction. Such a scenario may see more Indian promoters looking to divest.

Possible scenarios for consolidation

So which insurers/promoters are likely to experience consolidation? The list below chronicles the main factors that may influence insurers’/promoters’ decision to exit from or merge their business. Please note that it would need a combination of factors and not just any one of the factors listed below, which may influence a promoters’ decision.

Promoter considerations: Capital constraints at the promoter level may result in an increased likelihood of an exit from the sector. This may include, for example, smaller public sector banks (those banks that merged with larger banks recently). Or large promoters with relatively small holdings in life insurance joint ventures, who may not see it as a strategic focus in the long term.

Distribution model: If the life insurance company lacks access to large bank distributors and/or has a relatively unsuccessful tied agency/other distribution model, the promoter may be more likely consider an exit from the business

Risk management practices: If the life insurer has large proportion of non-participating savings business offering high customer internal rate of return (IRR), but the business is largely unhedged, the promoter may have to consider exit if the low interest rate environment results in higher capital requirements.

New business volumes/growth/profitability: Promoters who have not achieved high new business volumes/growth/profitability levels in the past 5-6 years may be more willing to consider exiting from the sector.

Even when a promoter or the insurer is interested in exiting or consolidation, in practice it may take several months or even years for this to materialise because of the following factors:

- Regulatory constraints: As examples, there were media reports that IRDAI had raised concerns over the proposed merger of Max Life and HDFC Life several years ago, and more recently over the increase of Axis Bank’s stake in Max Life.

- Valuation: All parties involved may need to agree on the valuation of the concerned life insurance business. This has not been a straightforward task in the past. However, in the recently announced transactions covering the IDBI Bank stake sale to AGEAS and Federal Bank in IDBI Federal Life and Axis Bank’s proposed investment in Max Life, there are signs that promoters’ valuation expectations are moderating. This may help facilitate future exits by other promoters.

- Change of leadership: There have been several instances in the past, where a change in leadership at the promoter level has resulted in a change of view about the life insurance business. Any such change in the future could affect prospects for consolidation of the businesses.

- Uncertainty: Promoters, if they have the financial resources, may adopt a ‘wait and watch’ approach to see how the macroeconomic environment develops and the industry fares during the ongoing crisis, before finally deciding to exit from the life insurance business. Indeed, several promoters have adopted such an approach in the past.

In conclusion

It has been close to 20 years for the private sector life insurance industry in India. Several analysts and industry observers believe that some consolidation in the industry is overdue. While there has been a lot of talk about consolidation for several years, it has yet to happen. Will the Covid-19 scenario push the industry towards consolidation? Certainly, the ongoing pandemic will affect several companies, testing the tolerance and commitment levels of many promoters. This may well lead to the possible outcome of some consolidation in the near future.