Partner content in association with

Tracking the impending F&B boom in Indonesia

Photo: Fikri Nyzar on Unsplash

With a series C funding round of close to $100 million, Kopi Kenangan has emerged as Indonesia’s first unicorn from the F&B sector.

It’s a development that brings into sharp focus the opportunities that the F&B business presents to private capital investors scoping out Indonesia in particular and the larger Southeast Asia region in general.

In our report ‘Tapping into Indonesia’s F&B Revolution’, created by DealStreetAsia and Alpha JWC Ventures, you will find some of these opportunities highlighted as well as a comprehensive view of the trends and companies driving the growth of the industry.

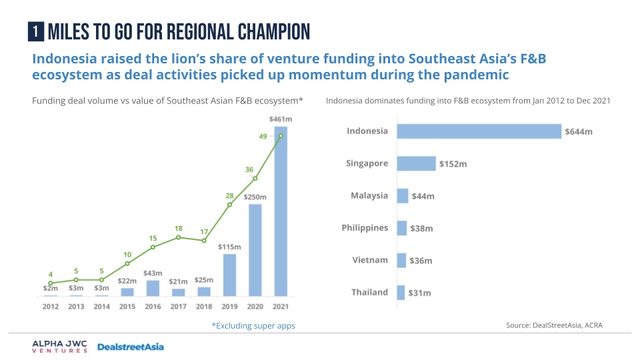

A notable trend is Indonesia’s absolute domination when it comes to investments in the F&B sector across Southeast Asia. It accounts for over two-thirds of equity funding raised in the region from January 2012 to December 2021, a little over four times the sum drawn by Singapore at the No. 2 spot.

The growth potential of Indonesian F&B has been unleashed by a number of factors – a younger, more experimental demographic; the rise of restaurant tech which enables the digitalisation journey for even predominantly offline F&B operations, and the imminently realisable goal of putting cuisine from Indonesia — a country with a unique and diverse culinary heritage — on first the regional and then the global map. Finally, the impact of the pandemic which brought with it a sea change in people’s eating and food ordering habits, and saw an increased reliance on food delivery worldwide, has played a vital role in the growth and development of F&B.

However, one of the most important facts to keep in mind is Kopi Kenagan’s unicorn status is not a destination or an end in itself. It marks an important waypoint in a journey that has been ongoing from the late 1940s.

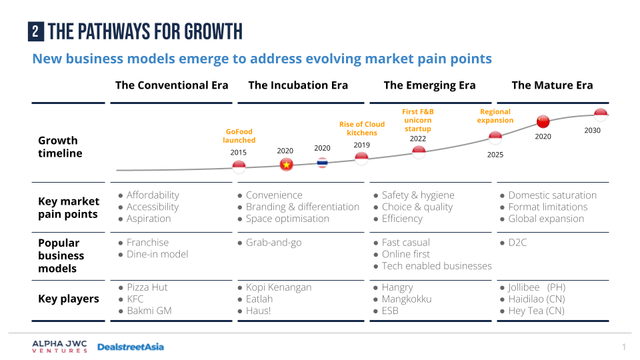

If the “conventional era” was dominated by marquee global QSR brands and a few homegrown heroes, the “incubation era” (2015-2020) saw an uptick in delivery which offered inexpensive options while meeting consumer demands for convenience. The “emerging era” (2020-2025) is defined by the industry’s response to the pandemic, and the proliferation of cloud kitchens who create their own brands. Local contenders have come to the fore, offering a contemporary take on traditional flavours and tastes.

The “mature era” (2025 onwards), will be dominated by global expansion as Indonesian brands search for fresh pastures

To know more about the companies, business models and investments at the vanguard of expanding this new category, how they have surmounted the challenges that have characterised each of these eras, and for deep insights into what the future holds, read the full report.