Partner content in association with

How Krungsri Finnovate is helping corporate venture capital come of age in Southeast Asia with Finnoventure Fund 1

Sam Tanskul, Managing Director at Krungsri Finnovate

For its upcoming Finnoventure Fund 1, Krungsri Finnovate, the corporate venture capital (CVC) arm of Thailand-based Bank of Ayudhya is targeting a close of approximately $100 million. Popularly known as Krungsri, Bank of Ayudhya is a member of the Japan headquartered MUFG global finance group. Krungsri Finnovate will put up $15 million for Finnoventure Fund 1, with investors including corporate and ultra HNI clientele also contributing to the corpus.

Krungsri has been making increasingly bold moves in the CVC space, starting with an accelerator in 2017. Ever since, the firm has forged valuable partnerships with startups as well as regional giants like Grab, which bolster the capabilities and offering of Krungsri itself, as well as some of its key clients.

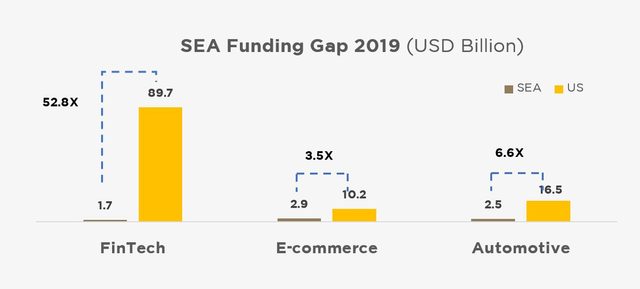

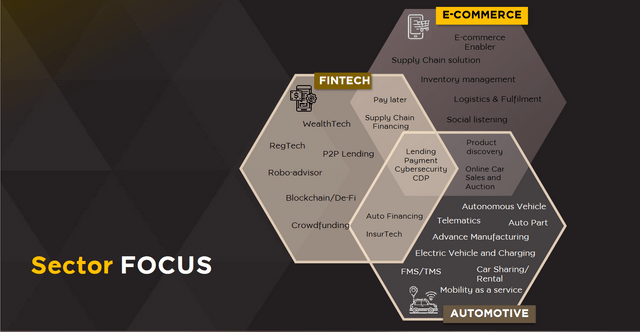

Finnoventure Fund 1 is the company’s most ambitious play to date. It’s aimed at addressing the funding gap in areas like fintech, ecommerce and the automotive category across Southeast Asia.

Speaking of his objectives for the fund, Sam Tanskul, managing director at Krungsri Finnovate, said, “The idea came from requests made by our corporate and ultra HNI clients, who wanted to be angel investors. For a corporate to set up its own VC team or CVC department would mean starting from scratch and a huge investment.” Finnoventure Fund 1 allows investors a chance to back startups in Series A and beyond.

Read on for excerpts from an interview with Tanskul and Kampanat (Jom) Vimolnoht, head of VC investment and strategic partnership at Krungsri Finnovate on the conception of Finnoventure Fund 1 and what sets it apart. The interview has been edited for brevity and clarity:

Could you give us a brief history of how Krungsri Finnovate came into existence?

Sam Tanskul (ST): We began around four years ago, after we heard that fintech was going to disrupt banking. The convenient option for the bank at the time was to access talent via an accelerator. A startup called Finnomena — an app-based robo advisor wealth management platform — won the first batch. It was competing with banks by selling products across all mutual funds in Thailand. Krungsri on the other hand could only sell in-house products.

The Bank of Thailand changed its regulatory framework, allowing CVC structures. That enabled us to invest in startups like Finnomena. We built this ecosystem over the years, finding startups who can synergise with Krungsri or help our corporate clients. Since starting operations, Krungsri Finnovate has invested in a total of 13 startup businesses.

How did you arrive at the structure and vision for Finnoventure Fund 1?

Kampanat Vimolnoht (KV): Corporates have changed quite radically over the last five years. On one hand, they have lots of money from cash cow businesses, which startups lack. On the other hand, VC-funded startups intend to tackle customer problems and are typically not answerable to corporate partners.

After a trial-and-error process, we realised how corporates can work with startups and vice versa. Startup founders now look to us as advisors and partners on working with corporates. And corporates understand the nuances of working with a startup: respecting their funds, time and resources. We try to create a win-win situation, solving pain points for both parties.

In parts of the founder community, there’s a view that CVCs are ‘tourists’ — unwilling to commit the time and resources that a startup needs. How do you react to this critique?

ST: We have worked with over 60 startups across small initiatives and megaprojects – none of them have that complaint. They have been very appreciative.

In Thailand, there are 80% CVC and only 20% VC. It’s the other way round in Singapore or America. And so, especially in Thailand, startups should possess a clear understanding of the pain points that the CVCs are looking to address. CVCs looking for synergistic investments should be aware of the tech they would like to focus on, and if a particular startup is the right partner.

At Krungsri we have an innovation lab, which has been built for about three years. This helps startups work with us as a CVC.

How did you decide on a fund size of $100 million?

ST: The number comes from our first fund that we invested from our own balance sheet, which is approximately $60 million. We see the size of about $100 million as something that we can invest over 2 or 3 years. Once we have completed about 70%, we will come up with Fund 2.

We expect corporates as well as ultra HNI investors, to commit approximately $75 million — about 75% — into the fund, to ensure that we can grow together. To build trust and confidence for our investors, $15 million will be invested by Krungsri Finnovate to show strong commitment to the fund. Besides, it gives our investors a shortcut into the startup ecosystem.

What were some of the reasons for Finnoventure Fund 1 picking the automotive category?

ST: Our corporate clients include large auto companies like Toyota, Mitsubishi and Honda. On the auto retail side, we have a third of market share. To win the retail, corporate and supply chain sides of the business, we focused on automotive technologies: production, sale, and after sales service.

We previously did not invest in the auto supply chain since we felt it was too early. However, from 2022 onwards, it will play a big role, with supply chain innovations or even autonomous cars. We already see a lot of EVs in Thailand and Southeast Asia.

Why the interest in e-commerce given the dominance of large regional players like Shopee and Lazada?

ST: We won’t be investing in fiercely competitive categories like e-commerce marketplaces or social commerce. However, within the ecosystem, there are technologies to help platforms become more productive. This helps our corporate and SME clients, as well as online sellers.

Banking and e-commerce make for a good combination since they are closely tied to payment and lending in Southeast Asia. We can introduce BaaS or banking as a service for these platforms. Or support technology that makes it easier to sell online, build tracking or data platforms to give these firms a deeper understanding of consumers, or create a membership programme to increase customer loyalty. We have seen more technologies evolve in this ecosystem, rather than in traditional retail.

Is there enough potential to deploy all of Finnoventure Fund 1 in Thailand? Or will you look at exciting opportunities wherever they exist?

ST: If a Thai tech startup has a competitive advantage, it will be our first priority. But if it doesn’t, it is our job to find the ones that have this advantage – whether they be from Silicon Valley, New York, Europe or London. Teams from MUFG help source good technology, and bring it back to Thailand.

We already work with Silicon Valley startups. Some of them even have regional offices in Singapore, rather than being based on the other side of the world.

How does being associated with Krungsri benefit the companies that will be a part of Finnoventure Fund 1?

ST: Krungsri’s medium-term business plan from 2021 to 2023 is to build the ecosystem and partnerships, as well as to develop digital and information technology, to drive the financial institution forward.

We have a strategic partnership team which works closely with all the business units in the group. They source and whet startups to find if they are a good business fit. We also have a corporate banking team which includes Thai, Japanese and MNC clients, with an open mindset about working with startups. We work closely with them to discuss or introduce relevant technology.

We see a very good synergy among the bank’s business units with Krungsri Finnovate. For instance, neobanks in Europe and America are startups who join forces with banks and plug fintech into their platforms. The banks don’t have to build any new features and instead connect with the startup via API technology. To cite our own case, our app does not have a robo advisor. But in the future, we intend to connect with Finnomena and offer this service to our customers.

Similarly, Krungsri Finnovate can help the bank offer decentralised finance and digital assets. Many financial planners believe there should be at least 5% to 10% of digital assets in fund allocation for HNIs. HSBC and JP Morgan already offer crypto funds. Krungsri would like to be among the first in Thailand with this service.

What makes Finnoventure Fund 1 an attractive opportunity for investors?

ST: The corporate investor will get back synergy, a clearer understanding of technology and an insight into the inflow of our investments. We typically have a deal flow of over 100 vehicles a year. If they are part of Krungsri, all investors in the group will have the first right to the technology, apart from the returns that we offer.

What’s your take on the Thai startup ecosystem?

KV: We are the second largest economy in Southeast Asia with a 69 million population; a mobile first country with large smartphone penetration, and number one when it comes to ecommerce.

But we don’t have unicorns. When I began my career as a VC 8 years ago, I was among a small group. Not many Thais wanted to be VCs or startup founders. Then in 2015, Rocket Internet made a big impact, burning a lot of money. They are not here anymore, because they have established markets elsewhere and have to be a responsible listed company in Germany.

Even for tech giants from China, Thailand was the first market in Southeast Asia. Since many tech giants are already well established, it has become harder for local startups to compete. Most of the core quality founders had to fight entrenched companies from China or Germany. In the meantime, countries like Vietnam, the Philippines and Indonesia began to develop their own ecosystems.

Today, not many Thai startups can go regional. Which is why Thailand is a little bit lacking when it comes to great founders like you see in Singapore or Indonesia. Or even Vietnam which has lots of South Korean VCs pouring in money. Indonesia has the largest population, a large number of islands and pre-existing inefficiencies which is why VCs are pouring money into that market.

Another problem is lack of tech talent — only 5% of software engineers in Thailand actually work as programmers. Similar to China and India, we are trying very hard to get skilled people back to Thailand from Silicon Valley. Most of the successful CTOs come in from the US, but often get absorbed by giant tech companies. And so, it’s harder for Thai startups to get good talent.

ST: We see the opportunity for Thai startups to grow to be the next unicorns. We have one or two already like logistics firm Flash Express. But we lack developers. If we could tap into other geographies to make up for that lack, we can ramp up tech in this region. It doesn’t have to be a pure Thai team. We need to work on combining the strengths of each other from across the region to build for Asian countries.

This article was created in collaboration with Krungsri Finnovate. If you are interested in investing in Finnoventure Fund 1 or want more information, please visit the official website