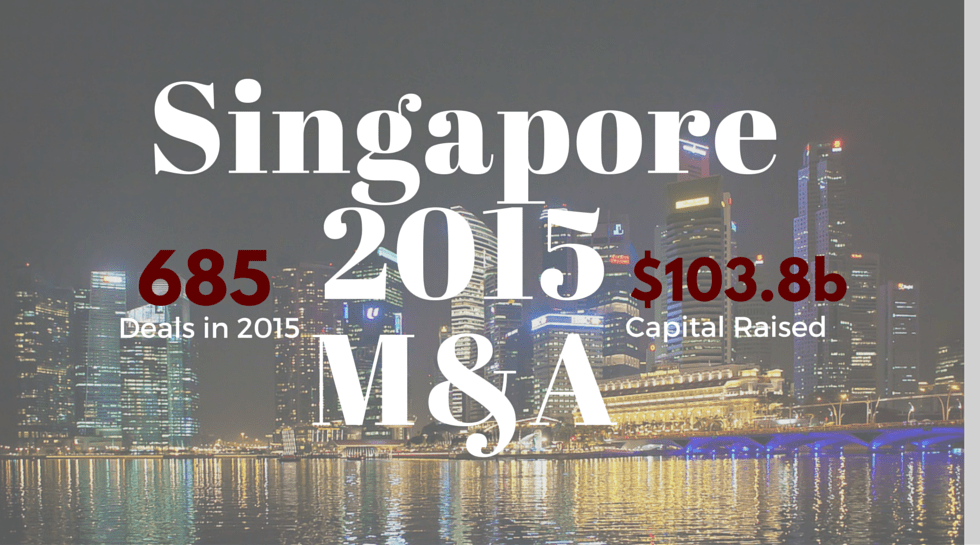

For Singapore, 2015 has been the ‘year of M&A’. The city-state witnessed close to 90 per cent increase in total deal values, including private equity and venture capital transactions, and doubling of M&A values in 2015 over 2014.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com