Get in Front of Asia’s

Most Influential Private Capital Decision-Makers

Partner with DealStreetAsia to reach top investors, founders, and dealmakers shaping the future of Asia’s private markets.

Connect with our team

Why Partner with DealStreetAsia

Through content, data, and events, we help partners spark meaningful conversations and build lasting credibility.

Testimonials

Who you are reaching out to?

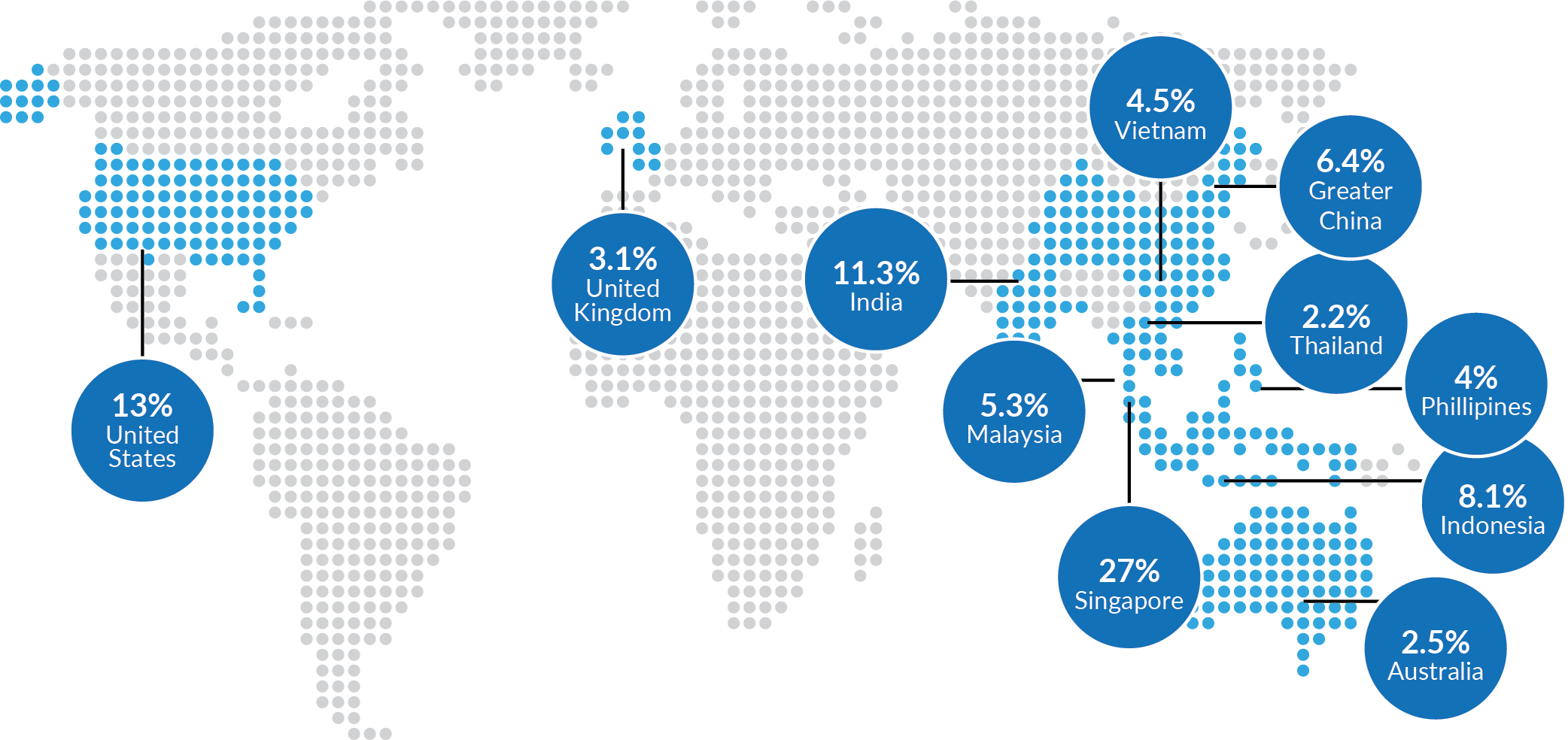

Our audience includes the most influential LPs, GPs, founders, and corporate leaders shaping private capital across Asia.

Top Readership

Month page views

Newsletter Subscribers

Newsletter open rate

Linked In Followers

What Collaboration Looks Like

Establish Thought Leadership

Co-create content and co-branded reports with DealStreetAsia to showcase expertise, backed by our editorial credibility and reach among top investors and corporates.

Speak Where It Matters

Gain visibility through curated panels, roundtables, and keynotes at our summits connecting directly with Asia’s private capital decision-makers.

Amplify Your Brand

Advertise across our premium platforms or sponsor flagship summits in Singapore and Jakarta to boost visibility, generate leads, and stay top-of-mind in Asia’s deal ecosystem.

Don't just take our word for it.