The coronavirus pandemic pushed financial markets into a tailspin, while fundraising in private equity had all but dried up in the first few months of this year.

The market dislocation, however, is presenting a different set of investment opportunities – alternative financing strategies that could see a rise in demand as businesses reach for lifelines.

Private credit specialist Indies Capital, for one, has just secured $100 million for its third flagship fund targeted at structured credit opportunities, particularly in Indonesia.

At Xen Capital, investors are primed to deploy, eyeing opportunities in distressed credit, and other income-yielding assets.

Meanwhile, ShawKwei & Partners, which closed its fourth pan-Asia fund at $812 million in 2018, has focussed on debt restructuring, as seen in its investment in Singapore oil and gas company Gaylin Holdings in late 2017.

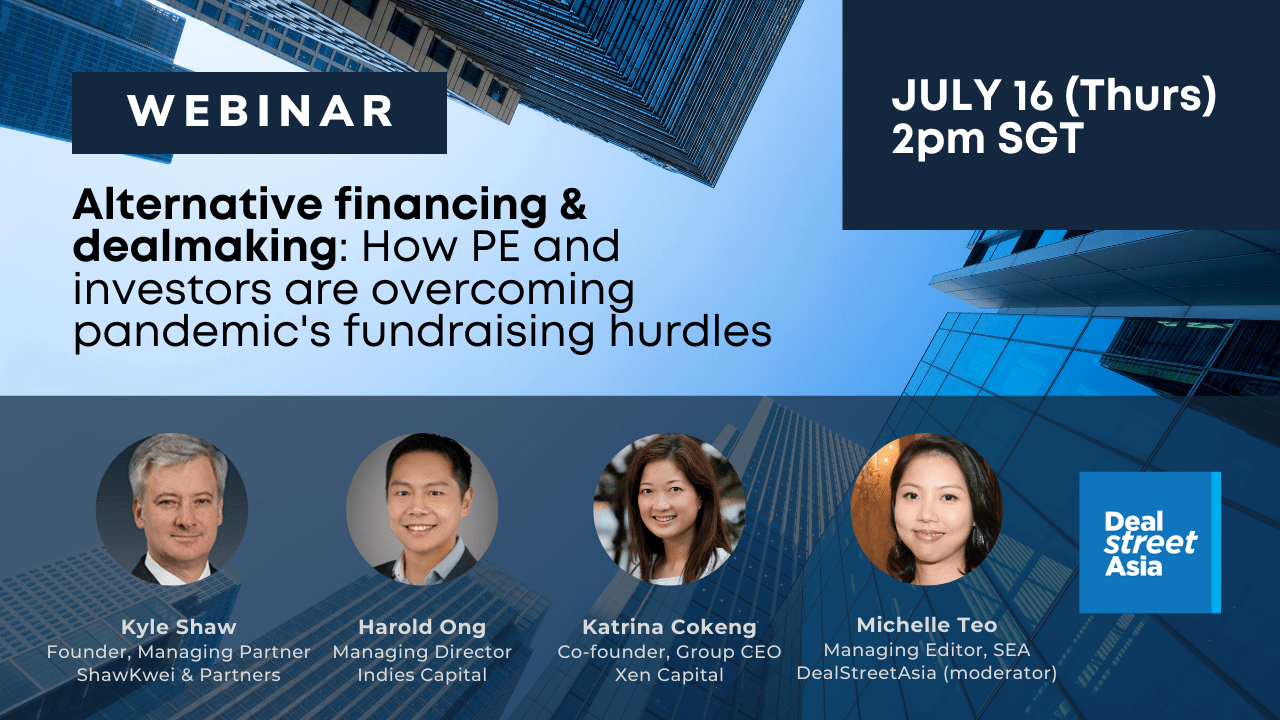

On July 16 (2pm SGT), join Indies’ managing director Harold Ong; Xen Capital co-founder & group CEO Katrina Cokeng; and ShawKwei & Partners founder & managing partner Kyle Shaw, in our next webinar, as they discuss how alternative financing strategies are rising to the fore and throwing up new opportunities.

The webinar is open to all but as slots are limited we encourage you to register soon to guarantee attendance.

We will be taking audience questions for the webinar with priority given to DealStreetAsia’s premium subscribers. If you have a burning question that warrants our attention, pick up a premium plan with a webinar special 20% discount code. The code will be attached to your registration confirmation.

We look forward to having you join us on July 16. Register Now →