We are happy to announce five diverse sessions featuring 11 top-notch and seasoned investors and founders from the region who will shine the light on significant topics and trends dominating the SE Asian investment landscape.

Save your seat at the Asia PE-VC Summit 2021, from Sept 28-Oct 1, to join insightful conversations around the funding gap for women founders, Indonesia’s digital opportunity landscape and SE Asia’s potential to build the next wave of unicorns.

A strong believer in the SE Asia growth story, former Sea Group president Nick Nash is the co-founder of Singapore-

The Harvard graduate spent more than a decade at General Atlantic as principal and head of Southeast Asia between 2002 and 2014 before moving to Sea Group, where he led the largest-ever SE Asian internet IPO, a $989-million offering on the NYSE in 2017. He left Sea Group in December 2018 to launch Asia Partners that seeks to bridge the growth-stage funding gap by investing $20 million to $100 million into Southeast Asian tech startups.

Nash believes that Southeast Asia has the potential to create over $400 billion of new technology sector equity value over the next decade. Asia Partners is betting on that potential with its debut technology fund, which has attracted strong investor appetite for fast-growing tech verticals such as e-commerce, payments, mobile apps and so on. The pandemic-induced accelerated digital adoption has only added to the overall opportunities landscape.

Asia Partners predicts SE Asia will see the rise of over 20 billion-dollar value tech companies by 2029, with at least half of these companies pursuing IPOs over the next decade. Join this data-led presentation to know more about the long-term potential and outlook for SE Asia.

Online marketplace Bulakapak became Indonesia’s first tech unicorn of this generation to successfully list on the Indonesia Stock Exchange after raising $1.52 billion in its initial public offering, five times more than the original target of $300 million. After the IPO, Bukalapak’s top three backers include Emtek subsidiary PT Kreatif Media Karya, Ant Group’s API Investment Ltd, and GIC – who together own 46% of the company.

Bukalapak’s listing is significant as it not only tested the depth of the local bourse but also set the stage for other tech unicorn listings in the SE Asian region. GoTo, the entity formed after the merger of Tokopedia and ride-hailing and deliveries giant Gojek earlier this year, is also eyeing a listing by the end of this year in Indonesia before it lists in the US. Singapore-based Grab is set to list on the NASDAQ by the fourth quarter of this year.

The path to IPO was actually laid nearly two years back in December 2019 when Bukalapak appointed ex-banker Muhammad Rachmat Kaimuddin as the CEO. Kaimuddin had the challenging task of keeping his eyes trained sharply on costs, efficiencies and business sustainability. Many industry observers had marked that the move was aligned to help the company maintain growth and meet investor expectations in a highly competitive market.

Kaimuddin was a director of finance and planning at local lender Bank Bukopin prior to joining Bukalapak. He has served stints at Quvat Management, Baring Private Equity, Bosowa Corporindo, and Semen Bosowa.

After steering Bukalapak to a blockbuster IPO, what are the next targets for Kaimuddin? We will ask the seasoned finance veteran about the most remarkable milestone in Indonesian public markets and what it means for the exit landscape for the tech startup ecosystem.

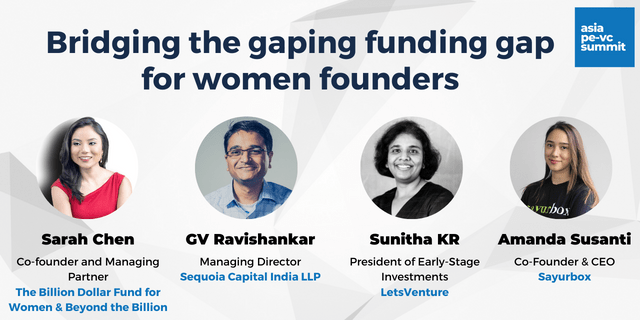

Data on funding for women-led enterprises reveals a rather discouraging story. Deals involving women founders or co-founders accounted for a mere 17.1% of the total PE and VC activity tracked in 2020 in Southeast Asia. If Grab is taken out of the equation, the number dips to just 4.7%, per a DealStreetAsia DATA VANTAGE report. As of 2020, just 12% of venture-backed startups in India and 20% in ASEAN have at least one female founder, per Tracxn and Crunchbase. According to a LetsVenture study, India has about 10,000 angel investors and only 1% of these are women.

Our panelists will take us through the steps that would be required to correct the imbalance, foster an ecosystem conducive for women entrepreneurs and improve access to capital. Our speakers represent Sequoia Capital and LetsVenture who have been in the news for initiatives that seek to address the funding gap.

Sequoia Capital India has launched Sequoia Spark, a fellowship programme for women founders in Southeast Asia and India. Sequoia India will offer a $100,000 fellowship grant to 15 women entrepreneurs per year. Sequoia is looking to increase the top of the funnel for all venture firms, with the Spark initiative.

G V Ravishankar from Sequoia India advises on both technology as well as non-technology investments. He’s deeply interested in technology’s role in helping to drive efficiencies, reduce costs and improve access in consumer and healthcare markets. He currently serves on the boards of BYJUs, Capital Float, Eruditus Learning, Faces Cosmetics, Five Star finance, Rebel Foods, among others.

From the investing community we also have Sunitha KR who is overseeing LetsVenture’s new angel investment initiative that seeks to provide access to women CXOs to invest in early and growth stage startups. LetsVenture aims to onboard at least 100 women angel investors in 2021, and will launch at least five investment syndicates led by women.

Representing the startup ecosystem is Sayurbox co-founder Amanda Susanti who set up a farm-to-table grocery platform that is also backed by Indonesian e-commerce unicorn Tokopedia. Sayurbox has also raised funding from Astra Digital International, Syngenta Group Ventures, Ondine Capital, among others.

Moderating this panel will be Sarah Chen, co-founder of The Billion Dollar Fund for Women, a global consortium of venture funds that have now pledged to invest and are actively deploying beyond $1 billion towards women-founded companies. To date, the consortium consists of close to 100 VCs and LPs and boasts 6 female founded unicorns. Do join this much-needed critical and high-impact discussion.

Indonesia too mirrored the growth trends in the digital economy space riding on macro drivers, favourable demographics and the pandemic-induced restrictions bringing millions of users online for the first time. Looking at 2025, the overall digital economy will likely reach $124 billion in value, re-accelerating to ~23% CAGR, per the Google-Bain-Temasek report on the internet economy. The e-commerce segment especially has driven significant growth in Indonesia at 54%. The overall 2020 GMV is estimated to have reached a total value of $44 billion in 2020, having grown at 11% YoY.

Our panelists, who are well-entrenched to capture opportunities in SE Asia’s maximum market, will further deep-dive into the pandemic-driven digital adoption trends across an array of sectors and how that is changing the landscape for tech investments in the archipelago.

In this discussion, we feature Soon Sze Meng, president (SE Asia), JD.com, China’s largest retailer that is deepening its presence in the region. Sze Meng is responsible for the Chinese tech major’s businesses and investments in South East Asia. He also serves as a member on the boards of Indonesian decacorn Gojek, JD.com’s local unit JD.ID, JD’s Thai venture, JD Central and Vietnamese e-commerce Tiki. Sze Meng joined JD.com from Singtel and has served stints at PayPal and Visa.

We also have Ashish Saboo who leads the Indonesia operations for General Atlantic, which opened its office in the country in 2019. The PE firm made its first investment way earlier in 2016 in listed food and beverage retailer PT MAP Boga Adiperkasa Tbk. Subsequently, it has invested in edtech startup Ruangguru and life sciences company KGBio. The PE firm started investing in India and SE Asia in 1999 – it was amongst the early investors of Singapore-based internet and mobile platforms Sea in 2014. Prior to joining General Atlantic, Saboo has served as business development director at Indonesia’s diversified player CT CORPORA. He is also a co-founder of Mansionly, a global service platform for interior and lifestyle solutions.

Our third panelist Sachin Bhanot is the Head of Southeast Asia Investments at Prosus Ventures, where he covers a range of sectors including consumer enablement, B2B commerce, fintech, logistics and more. Prosus’s Indonesia portfolio includes logistics startup Shipper, investment firm Bibit; and fishery platform Aruna. Prior to joining Prosus, Bhanot was a member of the investment team at B Capital Group, where he focused on venture investments in Southeast Asia. Before B Capital, he was part of The Abraaj Group’s PE team in Southeast Asia and MENA region.

Join this session for a comprehensive coverage of the region’s most happening market.

What are the challenges that founders face while shifting from an informal workplace to a process-driven work culture as the organisation grows? How do founders keep communication channels open with different stakeholders, employees, investors, partners and clients? How to navigate regulatory authorities in the various markets of operations? How to manage a diverse cap table? How to go about putting in place formal corporate governance, financial accounting and compliance standards? We will learn from our panelists on how they are navigating many of these growth challenges as they steer their startups in some of the fastest-growing segments.

Our panelist Anderson Sumarli is the co-founder and CEO of Ajaib, an online wealth management tool that brings personalised mutual fund and stock investing to the masses, potentially mobilising billions of investable assets across Southeast Asia. Ajaib recently raised $90 million in possibly the largest-ever Series A round by a Southeast Asian startup. The startup is bullish on deepening its play in the stock investment space given that only 1% of Indonesia’s over 260 million population invests in stocks. Sumarli, whose venture is backed by Robinhood investor Ribbit Capital, as well as Horizons Ventures and SoftBank Ventures, is looking to expand its reach into the country’s tier two and three cities, where he believes the bulk of the opportunity lies. Ajaib’s Indian counterparts Zerodha and Groww saw growth coming from second and third-tier cities. Sumarli expects a similar trend to unfold in Indonesia.

Our other panelist Gillian Tee is the co-founder and CEO of Homage, a senior home care solution that combines professional caregivers with smart technology to provide home caregiving to seniors. To date, Homage has provided more than 100,000 hours of home caregiving to seniors in Singapore and Malaysia. Homage’s investor roster includes names such as Golden Gate Ventures, SeedPlus, KDV Capital, EV Growth, HealthXCapital, Alternate Ventures, among others. Prior to Homage, Gillian Tee co-founded Rocketrip, a Y-Combinator and Bessemer Ventures-backed travel tech startup based in New York City and Silicon Valley that raised more than $30 million. Prior to Rocketrip, Gillian held various sales, business development, product management and technology leadership positions at Amazon and Accenture.

Join this AMA session to get some honest answers from their rich and varied startup experience.