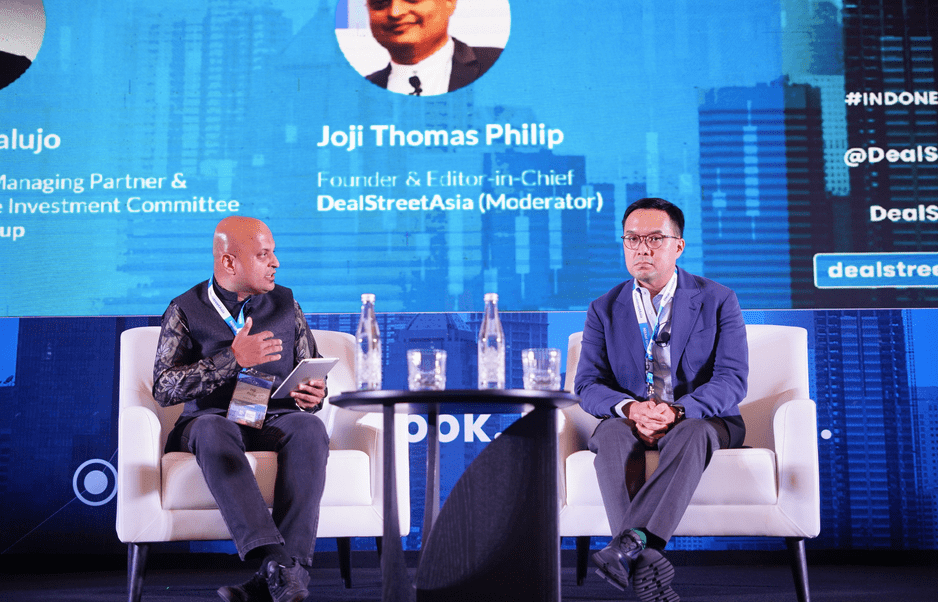

We are delighted to announce Patrick Walujo, GoTo CEO and Co-Founder and Managing Partner of Northstar Group, as the keynote speaker at the Indonesia PE-VC Summit 2024.

In the keynote session, Walujo, a seasoned investor and entrepreneur, will speak on driving GoTo towards profitability and share perspectives on Indonesia’s tech ecosystem.

GoTo Group undertook a massive leadership shakeup in June 2023 that saw Northstar Group managing partner Patrick Walujo taking over as the new CEO. In the driver’s seat, Walujo is widely expected to prepare the Indonesia-listed tech giant for a faster move toward profitability and an eventual US public offering.

After assuming charge, Walujo’s main focus has been on cost-cutting measures, driving synergies, and shutting down non-core divisions.

In the keynote chat at the summit, Patrick Walujo, who is also an early investor in Gojek, will dwell on the challenges of managing heated competition from rivals, on one hand, and investor expectations on the other.

GoTo CEO also wears the hat of Co-Founder and Co-Managing Partner of the Northstar Group, a Singapore headquartered private equity and venture capital firm.

Since its founding in 2003, the Northstar Group has raised five private equity funds and a venture capital fund and is now one of the largest private investors in Southeast Asia. The Northstar Group focuses on Indonesia with a current strategy of investing in the financial services, consumer and digital economy sectors.

Do catch this riveting session with Walujo on SE Asia’s most prominent mobility and e-commerce enterprise at Indonesia PE-VC Summit 2023.

Click here for more information about our early bird ticket which ends in one week!