DealStreetAsia’s Asia PE-VC Summit makes its return as a live event this year, scheduled to be held in Singapore on 27 and 28 September, 2022. Attending DealStreetAsia’s next webinar – The circle of trust: Unlocking the full lifetime value of today’s digital consumers will give one lucky winner a free two-day pass to the summit (valued at $1,999), one of the region’s largest gatherings of private capital investors.

The subject of the next webinar is e-commerce: a sector that’s likely to draw a lot of attention even during the upcoming Asia PE-VC Summit.

E-commerce companies across the world have been at the vanguard of the digital revolution – especially so in Southeast Asia where 80% of the online population has made at least one purchase.

And yet, harnessing customer value has been relatively low on the list of priorities of many e-commerce companies. On one hand, a sizable number of e-tailers have pursued cash burn driven approaches, relying mainly on discounts and high volume marketing campaigns.

On the other, overzealous fraud prevention has alienated many potential new consumers who never return to a platform, after even one less than satisfactory experience.

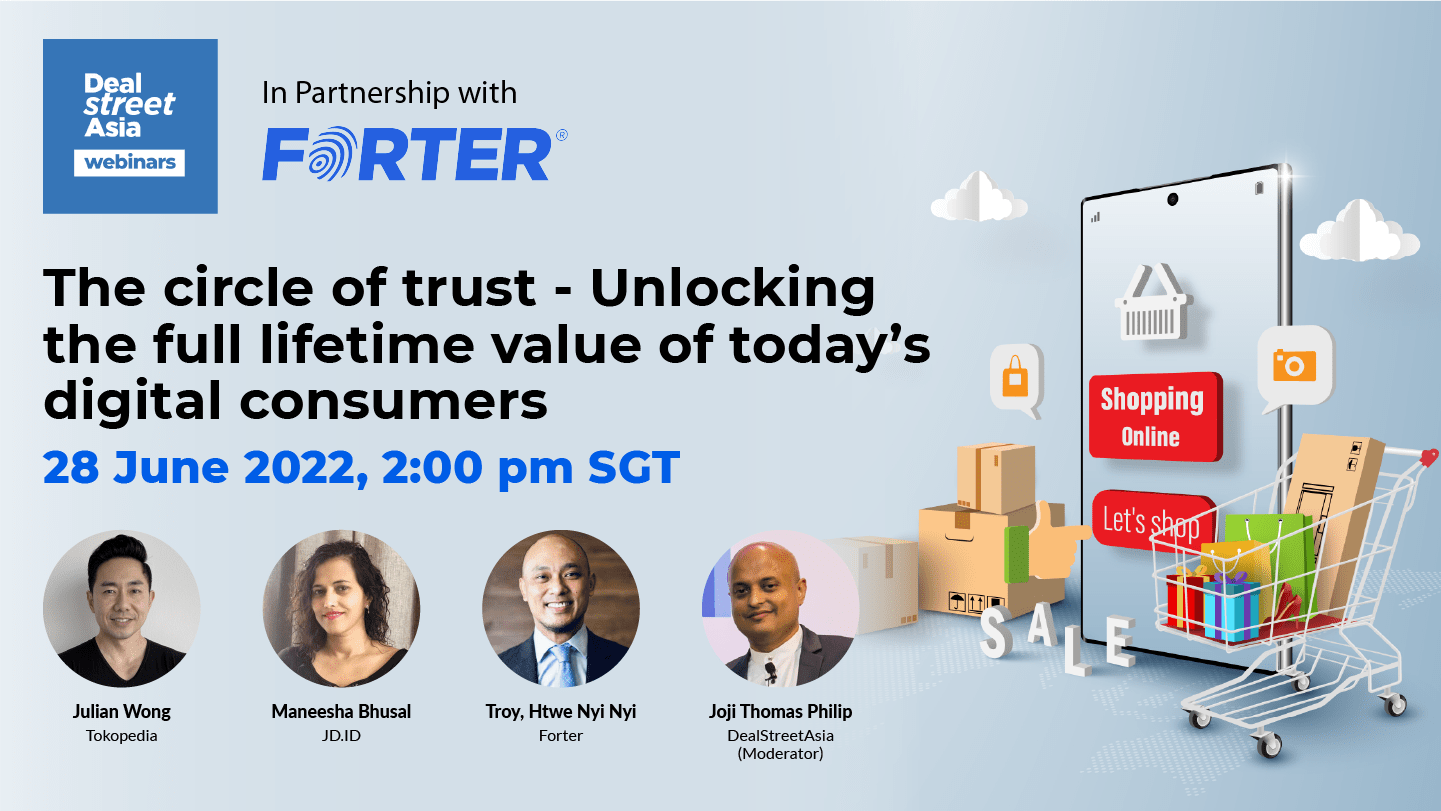

Through the course of the webinar, our panel will discuss the importance of unlocking customer lifetime value by securing their loyalty. Issues that will be highlighted include the role that can be played by a friction free pre-order, purchase, and delivery experience, which helps keep a platform’s most valuable customers happy, even as it mitigates fraud.

We have a panel best placed to address these issues including:

- Julian Wong, VP of risk management at Tokopedia, who has previous experience with Walmart, fraud prevention specialist DataVisor, and funding platform Indiegogo.

- Maneesha Bhusal, Director of Customer Experience at JD Indonesia, who has previously worked for Lazada as head of regional CX operations and with Singapore-based real estate startup PropertyGuru.

- Troy, Htwe Nyi Nyi, Regional Director, SEA & India, Forter, who has extensive experience in fraud prevention.

The webinar will be moderated by DealStreetAsia Editor-in-Chief Joji Philip and is sponsored by Forter. Sign up now to get a deep insight into a hitherto ignored aspect of e-commerce, and get in the running to win a free pass to the Asia PE-VC Summit.

REGISTER NOW ⇒