Starting in January 2022, all DealStreetAsia’s subscription prices will rise as they will be subject to 7% Goods and Services Tax in Singapore (GST).

You can avoid this increase and lock-in our current rate by subscribing or renewing before year end.

Need more reasons to subscribe?

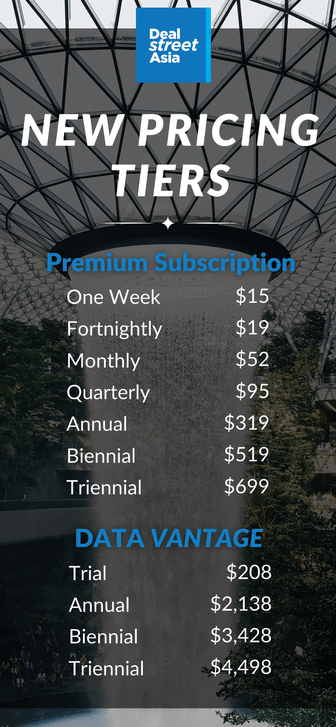

Premium Subscription

- All premium in-depth stories, breaking news and long reads on the ecosystem across Asia

- Analytical pieces from our on-the-ground reporters in Singapore and across the region

- Unlimited access to exclusive content and archives

- Exclusive discounts to our highly coveted Asia PE-VC Summit and Indonesia PE-VC Summit

DATA VANTAGE

- Key financials of close to 2,000 Asian venture-backed companies registered in SG Track competitors and industries

- Premium subscription paywall stories

- Up to 2 research reports per month

- Deal Monitors (India / China / SEA)

- Exclusive Data-led Stories

- Free Ticket to Virtual DSA Summit – per user