What is a Gift Article?

Subscribers can share up to 5 different gift articles each month to anyone who does not have a DealStreetAsia subscription. This new feature is to help our subscribers easily share stories with friends and colleagues who are not yet DealStreetAsia subscribers.

How can I gift an article?

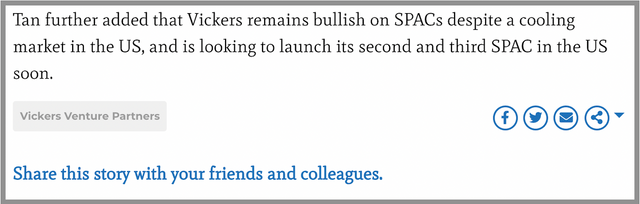

As a subscriber, you will see ‘Share this story with your friends and colleagues’ on the bottom of every premium article on dealstreetasia.com.

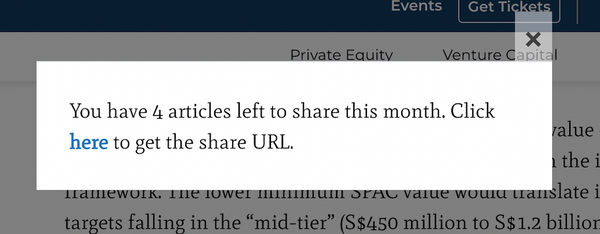

Once you click on ‘Share this story with your friends and colleagues’, a pop-up will appear showing how many gift articles you have remaining to share this month. Please note that your monthly allocation of articles will reduce when you click this share option regardless of whether or not you ultimately share the gift article.

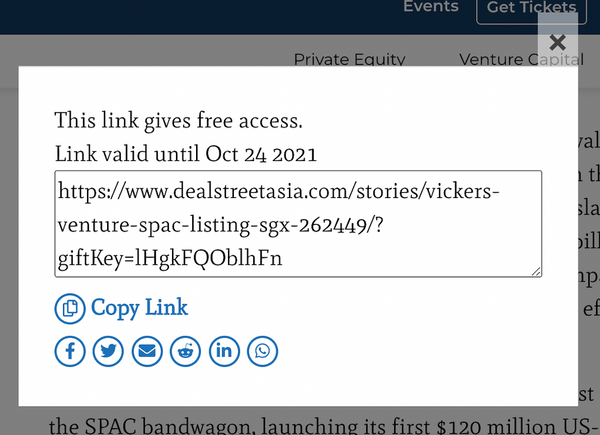

You can then click to get the URL of the gift article and will see several options of sharing the article, including copying the link, sharing via your email, social media (Twitter, LinkedIn, Facebook), and more. Note: what is counted is the number of articles, not the number of gifts. In other words, you could issue the same article to more than 5 people.

For Gift Article recipients

When a gift article is shared, recipients can read it regardless of whether they are subscribers. Gift articles do not count against the one free article you can read without site registration. The gift article will be available for 14 days.

Please contact us at subs@dealstreetasia.com if you have any questions or are experiencing any issues.