Food delivery is pegged to be worth $28 billion by 2025. To find out if it will meet that mark, tune into our next webinar – The future of food delivery in Southeast Asia.

Our panel is well placed to offer informed perspectives on the growth and sustainability of food delivery.

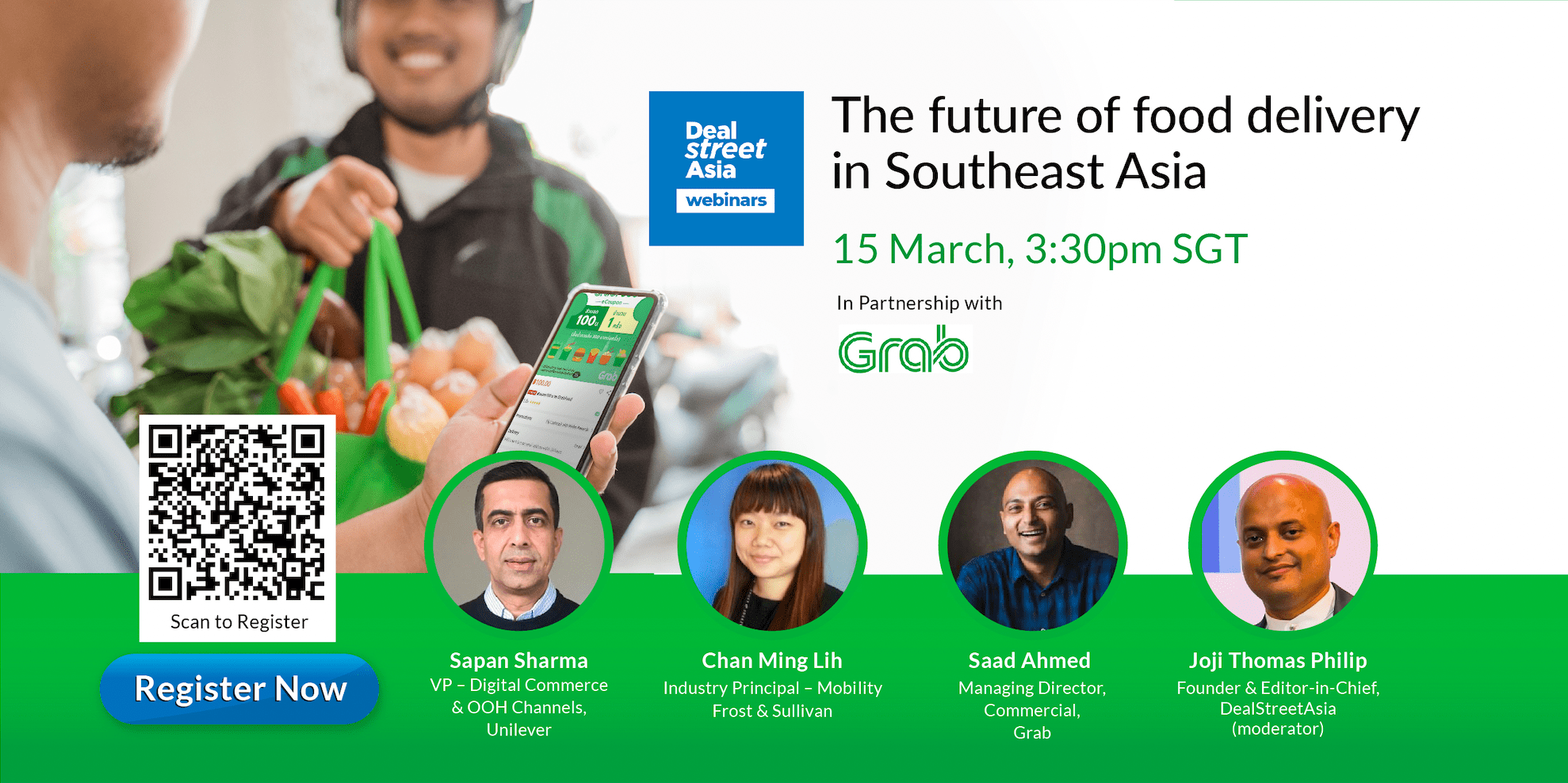

Sapan Sharma is VP – digital commerce & OOH channels at Unilever and has extensive experience in the quick commerce / rapid delivery space. In a previous role, he was in charge of the global on-demand delivery model for ice creams, foods, and refreshment. In just 24 months through his tenure, the business grew from €240 million (over $272 million) to €1 billion (over $1.1 billion) GMV (Gross Merchandise Value)/CSV (Consumer Sales Value).

Grab’s managing director – commercial, Saad Ahmed, leads the team that supports Grab’s enterprise merchant partners, helping them optimise their presence across the entire Grab ecosystem. As regional head of business development and partnership at GrabFood, he has a ringwide view to the growth and development of the food delivery vertical.

Frost & Sullivan’s Chan Ming Lih has specialised in researching mobility solutions and has worked closely with leading OEMs across Asia, North America and Europe.

In a panel discussion moderated by DealStreetAsia’s Joji Philip, they will have a candid discussion on the lessons learnt by companies – both traditional and new – as they modify their business models to fully realise the value inherent in food delivery.

Sign up for what promises to be an extremely engaging discussion on one of the hottest sectors today. Signing up also gives you instant access to our latest report Female Founders in SE Asia 2021, which tracks the capital raised and challenges faced by women founders and co-founders in the region.

The webinar is scheduled for 3:30 pm SGT on March 15, 2022 and sponsored by Grab.