|

|

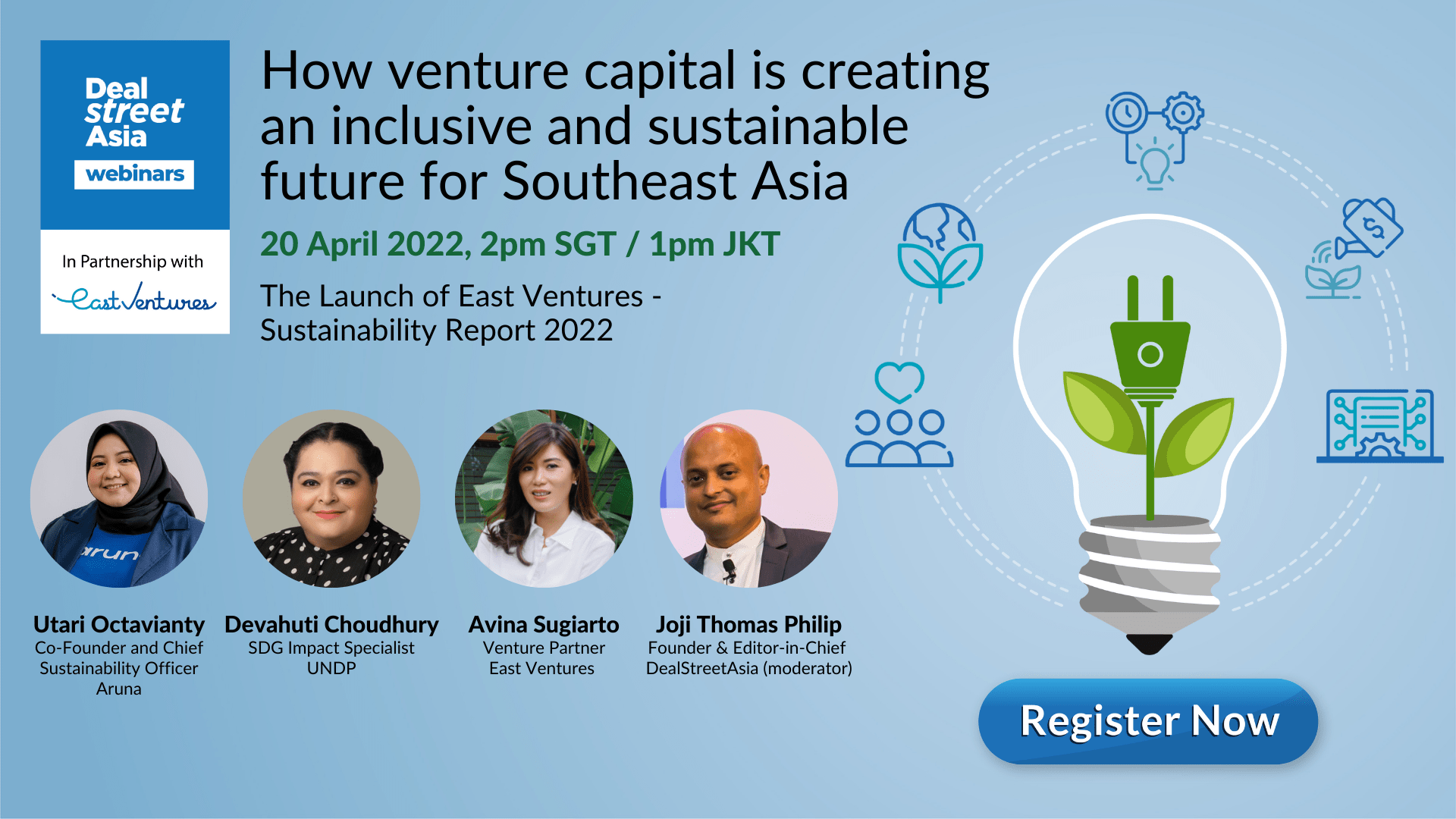

April 15, 2022

|

|

© Copyright DEALSTREETASIA 2014-2024 All rights reserved.

We will never share your information with third parties.

Unlock your competitive advantage in a

rapidly evolving landscape. Our packages

come with exclusive access to archive

content, data, discount on summit tickets & more.

Be a part of our growing community now.

In Singapore, we are looking to double our reporting team by this year-end to comprehensively cover the fast-moving world of funded startups and VC, PE & M&A deals. We want reporters who can tell our readers what is really happening in these sectors and why it matters to markets, companies and consumers. The ability to write precisely and urgently is crucial for these roles. Ideal candidates must have to ability to work in a collaborative, dynamic, and fast-changing environment. We want our new hires to be digitally savvy and ready to experiment with new forms of storytelling. Most importantly, we are looking for hard-hitting reporters who work well in a team. Collaboration and collegiality are a must.

Following vacancies can be applied for (only in Singapore).

Following vacancies can be applied for (only in Singapore).

In Singapore, we are looking to double our reporting team by this year-end to comprehensively cover the fast-moving world of funded startups and VC, PE & M&A deals. We want reporters who can tell our readers what is really happening in these sectors and why it matters to markets, companies and consumers. The ability to write precisely and urgently is crucial for these roles. Ideal candidates must have to ability to work in a collaborative, dynamic, and fast-changing environment. We want our new hires to be digitally savvy and ready to experiment with new forms of storytelling. Most importantly, we are looking for hard-hitting reporters who work well in a team. Collaboration and collegiality are a must.

Following vacancies can be applied for (only in Singapore).

Following vacancies can be applied for (only in Singapore).