Get ready to kick off 2024 with a bang at the Indonesia PE-VC Summit!

We’ve got an incredible Black Friday deal you won’t want to miss – Indonesia Summit Pass plus DealStreetAsia Premium Plus subscription, all for just $599!

Here’s what you get as part of this once-a-year deal:

- Our recently announced Premium Pass subscription (usual price $1,200) which gives you access to:

- Premium news content (up to 30 articles/day)

- 36 in-depth research reports released throughout the year. (ind. price $199-$299)

- Summit Pass valued at almost 70% off the regular price (usual price $2,199)

This is the best package to stay ahead with breaking news and diving deep into the Asian business ecosystem with these comprehensive reports.

But here’s the kicker – this exclusive offer expires this Sunday. Time is ticking, so grab this opportunity now before it’s gone!

Avail the Black Friday Offer Here

|

As we gather top speakers and curate the most contextual and comprehensive agenda for the Indonesia PE-VC Summit 2024 to be held on January 25 at The Langham in Jakarta, we are happy to share top updates so far from the summit. We have identified the top three themes and trends defining Indonesia’s growth story. Through fireside chats and panel discussions with the region’s top investors, founders and deal-makers, we will bring these topics alive.

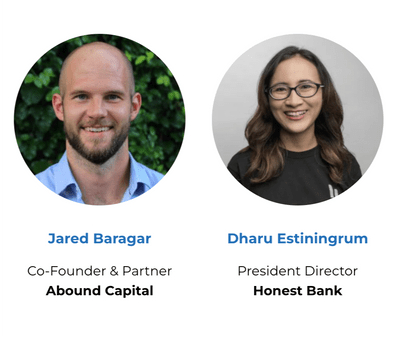

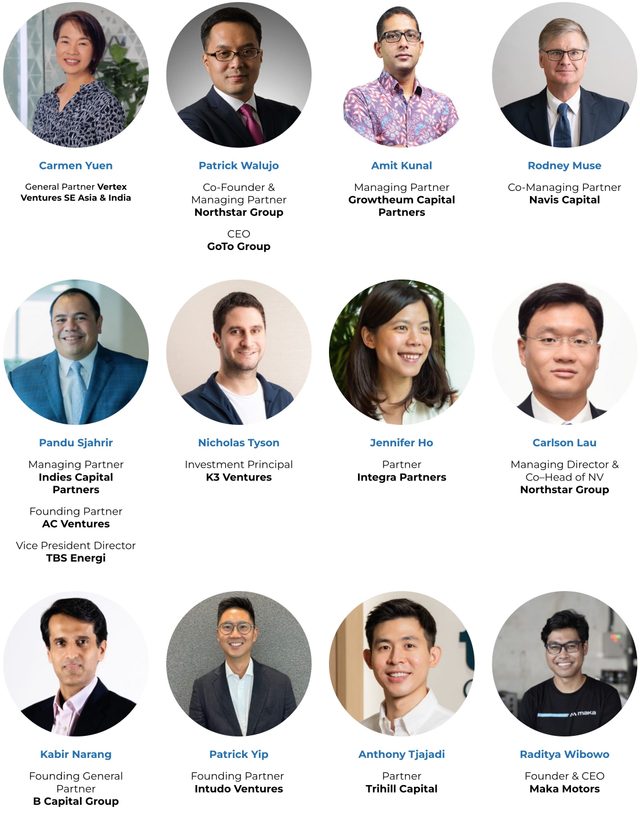

We are delighted to have Patrick Walujo, GoTo CEO and Co-Founder and Managing Partner of Northstar Group, as the keynote speaker at our Jakarta summit. Walujo, a seasoned investor and entrepreneur, will be the keynote speaker at the session and share his views on driving GoTo toward profitability and lessons for Indonesia’s tech ecosystem. Additionally, we have already got on board 12 speakers who represent the top deal-makers and founders from the region. |

|

|