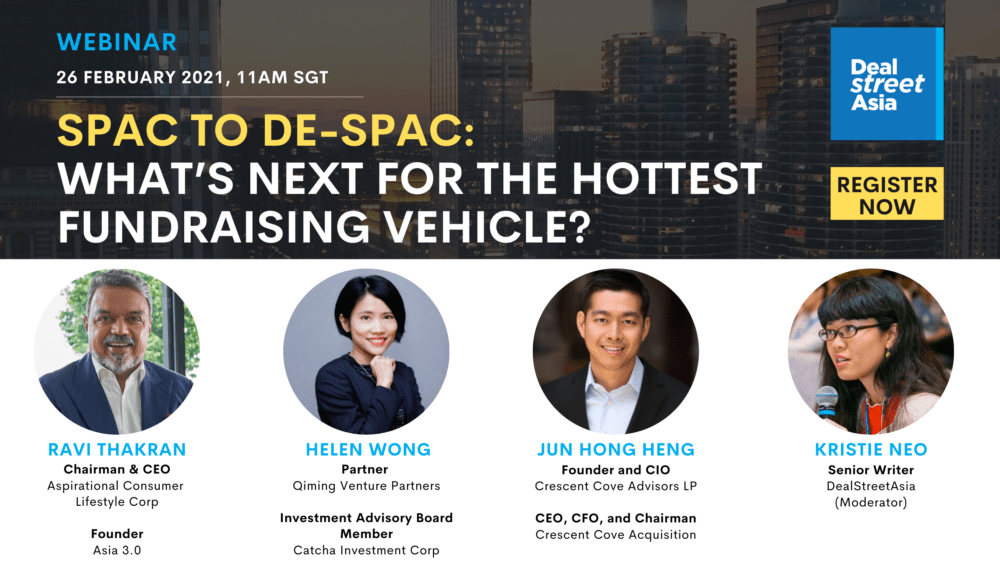

DealStreetAsia’s first webinar of 2021 will take place this 26 February

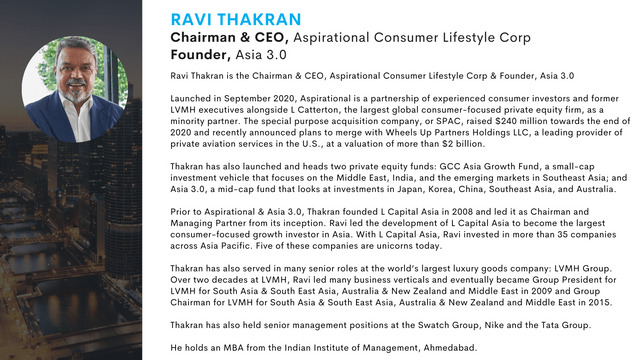

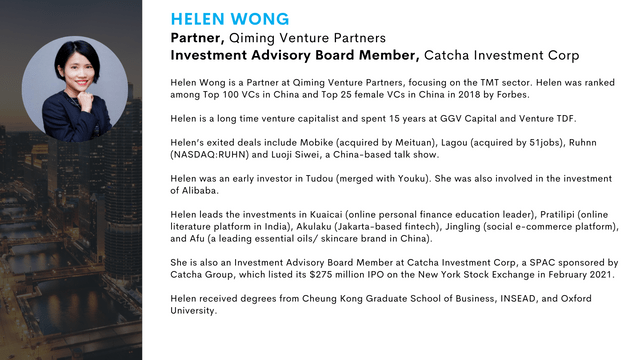

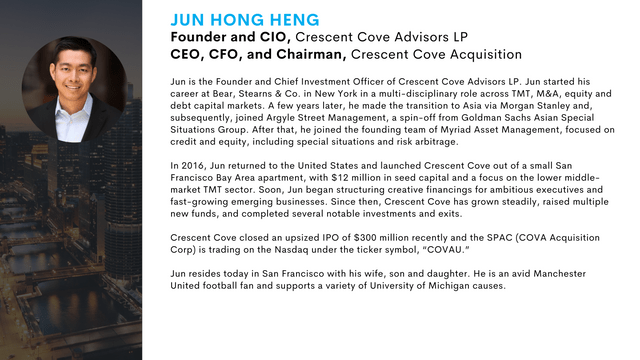

Join us as we bring Ravi Thakran (Aspirational Consumer Lifestyle Corp), Helen Wong (Qiming Venture Partners) & Jun Hong Heng (Crescent Cove Advisors) to decode the SPAC frenzy and the way ahead.

As global SPACs raised $79 billion in 2020; and $24.26 billion in January 2021 alone, sponsors are now racing to find acquisition targets, even as more capital continues to be raised by SPACs. Asia is a prime hunting ground, with a number of ready-to-list tech unicorns.

Southeast Asia, too, has caught the SPAC fever, even as the vehicle’s track record remains patchy.

What is making players, including venture capital and private equity firms, jump into the SPAC fray? What makes for a successful de-SPAC? Are SPACs likely to disrupt deal flow for alternative asset firms?

Let’s discuss and hear from them in this exclusive webinar. Register now