We are happy to announce four new panels and one fireside chat featuring 11 top-notch speakers who will take up diverse themes, from LP allocations to Asia, to impact investing and the rise of the crypto asset class, at our upcoming Asia PE-VC Summit 2021 on 28 September – 1 October.

At DealStreetAsia‘s flagship Asia PE-VC Summit, you will get the most comprehensive conference experience related to the region’s private equity, venture capital and startup ecosystem.

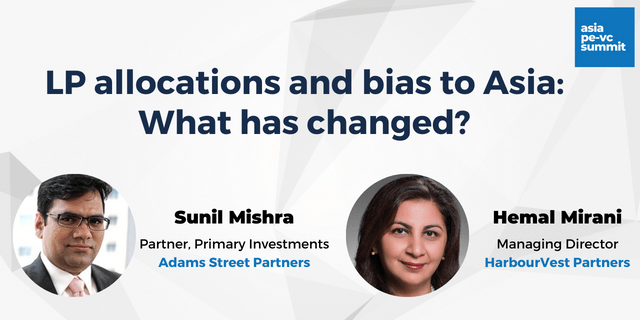

As exit timelines for private equity portfolios in Asia stretch longer particularly in the post-COVID context, the region is fast turning into a play for patient capital and longer-tenure investments. In this panel, we will explore themes such as portfolio adjustments, valuation trends, rebalancing and weighing of short and long-term risks of exposure to the region, under-invested sectors and overhang of tech deals.

We feature Adams Street Partners’s Sunil Mishra who specialises in fund selection, due diligence, negotiations, and monitoring of Asian investments ex-China, specifically in India, Australia, Japan, Southeast Asia, and Korea. He sits on advisory boards of more than a dozen private equity firms within the Adams Street Partners portfolio. Adams Street manages $45 billion of assets across our primary, secondary, growth equity, credit, and co-investment strategies.

Hemal Mirani rejoined HarbourVest’s senior management team in Asia in 2015 to focus on investments and investor relations across the Asia Pacific region. Boston-based HarbourVest Partners is bullish on Southeast Asia from the opportunity lens of consumer tech, software and healthcare sectors, aided by favourable macro drivers, demographics and urbanisation trends. HarbourVest recently announced the opening of its office in Singapore, expanding its footprint to 11 locations worldwide. Besides Singapore, Mirani oversees the firm’s operations and strategy for Beijing, Hong Kong, Seoul, and Tokyo.

Be a part of this session for insights into LP perspectives on Asia.

Singapore’s Vertex Holdings, the venture capital arm of state investor Temasek, has had a rather busy year with fundraising milestones, a potential SPAC listing, and headline events from portfolio companies. Vertex, which became Grab’s [then GrabTaxi] first institutional investor back in 2014, will see the SE Asian decacorn target a listing on the Nasdaq in Q4 following a $40-billion SPAC deal with Altimeter Capital in April.

On the fundraising side, Vertex Holdings launched a third fund-of-funds vehicle with a target size of $800 million to deploy capital directly into Vertex’s network of six funds. Vertex is also raising about $330 million through the issuance of seven-year senior unsecured Singapore dollar bonds as part of the firm’s maiden $2-billion multicurrency debt issuance programme. The first SGD corporate bond issuance by a global VC firm was upsized due to the “overwhelming investor demand”. This is the first time Vertex, which has AUM in excess of $4.5 billion, is publicly issuing bonds. The bond issue seeks to not only diversify its sources of funding but also allow investors an exposure to venture capital as an asset class. Vertex is targeting the first close of its $330-million second fund for which it has secured Korea Venture Investment Corporation as an LP. Vertex is reportedly planning to raise funds for dealmaking by listing a SPAC on the SGX.

For Chua Kee Lock, venture investing, at its heart, is a “people business.” He believes top-tier teams and talent are core to building great enterprises. Vertex has an active portfolio of over 200 firms in technology and healthcare across key global innovation hubs. Its regional portfolio includes Grab, Patsnap, Validus, Tickled Media, FirstCry, Warung Pintar and Nium [the latest unicorn under its fold]. Join us in this conversation to know more about value creation that goes beyond capital.

Canada’s top pension funds CDPQ, CPPIB and OMERS – among the most active institutional investors in the alternative asset class – have been stepping up their presence and exposure in the region in both public and private markets and setting up platforms for investments.

Canada’s CDPQ, which set up its Singapore office back in 2014, typically allocates 13.6% of its investments towards markets such as SE Asia, China, India and Latam nations. In SE Asia, CDPQ has primarily invested in Indonesian government bonds and infrastructure projects. Through its real estate arm Ivanhoe Cambridge, which backs LOGOS Group, CDPQ recently formed two JVs with CPPIB to develop logistics facilities in Jakarta. An active LP, CDPQ is also looking at co-investment opportunities and an increased presence in the technology vertical. The pension fund manager has over $50 billion assets in its PE portfolio.

Our featured speaker Wai Leng Leong is responsible for the regional management of CDPQ Global in Asia Pacific. She has over 30 years of experience in the finance and banking sectors, including 13 years in China, where she built a commercial banking business from the ground up.

For OMERS, which has assets worth $109 billion under management, the Asia market is a strategic priority. Prateek Maheshwari believes the energy transition theme is going to be very strong in Asia as it tries to decarbonise. OMERS manages a diversified portfolio of investments in public markets, private equity, infrastructure, and real estate. OMERS is looking to expand its portfolio of infrastructure assets in Asia. The investment manager is eyeing sectors such as telecom, renewable energy, and road. Maheshwari leads investment efforts in transport and renewable energy infrastructure. Prior to joining OMERS, Prateek was a Senior Principal with Global Infrastructure Partners for 12 years.

We will speak to them about the Asia opportunities and the long-term returns outlook.

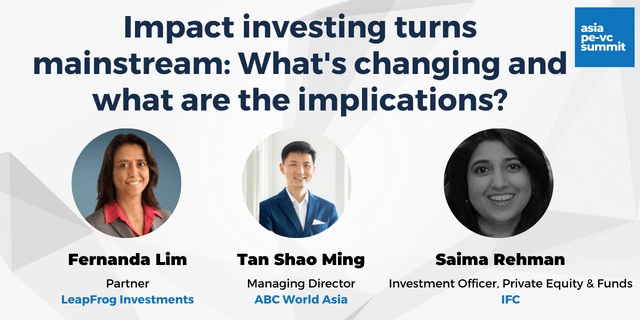

The private market for impact investing has grown as much as $2.1 trillion last year, according to IFC estimates. In 2019 alone, private capital firms raised more than $76 billion in funds with an impact mandate. Still more funds are to come: Canada’s Brookfield Asset Management is in the market to raise as much as $12.5 billion for its new impact investment fund. Yet, according to IFC, only a quarter of the market is clearly measured for financial and development impact.

As interest in investing for impact continues to grow, driven by evolving investor profiles and clear development needs, how is the industry set for sustainable growth? What are the implications of the influx in capital? What drives real returns in impact investments?

The panel brings together seasoned investors focused on impact in Asia, to discuss measurable impact investing. Joining us from IFC is Saima Rehman, who brings 17 years of investment experience across South Asia, and East Asia Pacific. Also on the panel is Fernanda Lima from LeapFrog Investments, which has raised more than $2 billion across four private equity funds from institutional investors, including from Singapore state investor Temasek.

The UK-headquartered private equity firm drives impact through its investments in high-growth financial services and healthcare companies in emerging markets. Its latest investments include leading a $54 million funding round in PasarPolis, the Indonesian insurtech company; and a $55 million round into India’s MedGenome, a genetic diagnostics company.

ABC World Asia’s Tan Shao Ming drives investments at the PE fund, which raised S$385 million in 2019 to target companies in China, Southeast Asia, and South Asia. The fund focuses on financial and digital inclusion; health and education; climate and water solutions; sustainable food and agriculture; and smart and liveable cities.

Interest in the cryptocurrency space has accelerated globally since the beginning of last year as institutional investors embrace the emerging alternative asset class. Mirroring the global trends, crypto-related startups in SE Asia have also reported increased user traction and deal activity.

In this panel, we feature two startups who have landed double-digit funding, and a seasoned global investor bullish on the crypto space.

Singapore-based Ethereum analytics platform Nansen has recently raised $12 million in a Series A round led by Andreessen Horowitz. The startup focuses on Ethereum research because there is more activity on the blockchain than bitcoin, which can only be used as a currency, believes Nansen’s co-founder and chief executive Alex Svaneik, who has a background in AI and first got interested in crypto in 2017.

Indonesian cryptocurrency exchange Pintu recently landed a $35-million Series A+ funding round led by US-based Lightspeed Venture Partners barely months after it raised $6 million in its Series A financing. Launched in April 2020, Pintu is a licenced crypto broker whose platform is designed for both entry-level and experienced crypto investors. Indonesia is home to over 6.6 million crypto investors as of June 2021, roughly triple the 2.2 million public equity investors. Pintu CEO Jeth Soetoyo believes there is an immense opportunity for retail investors to gain access to the diversified and dynamic investment opportunities.

Pintu-backer Lightspeed has backed over 17 crypto and blockchain companies globally. Partner Hemant Mohapatra feels crypto is at an inflection point to become an important asset class globally and will give rise to massive companies that will become regional leaders.

Despite growing investor interest, there are concerns related to the opaqueness of the crypto market, the volatility of its prices and tightening regulatory scrutiny on the nascent industry. Join this session to get a nuanced perspective on the niche sector.