DealStreetAsia’s next webinar addresses an issue that has become more relevant than ever in a post-pandemic world – the need for holistic healthcare solutions.

Through the pandemic, many Indians acutely felt the lack of health insurance, due to low penetration of the category in the country. However, even for the insured, OPD medical expenses not accounted for by their policies were crippling – they are pegged at a staggering $380 billion.

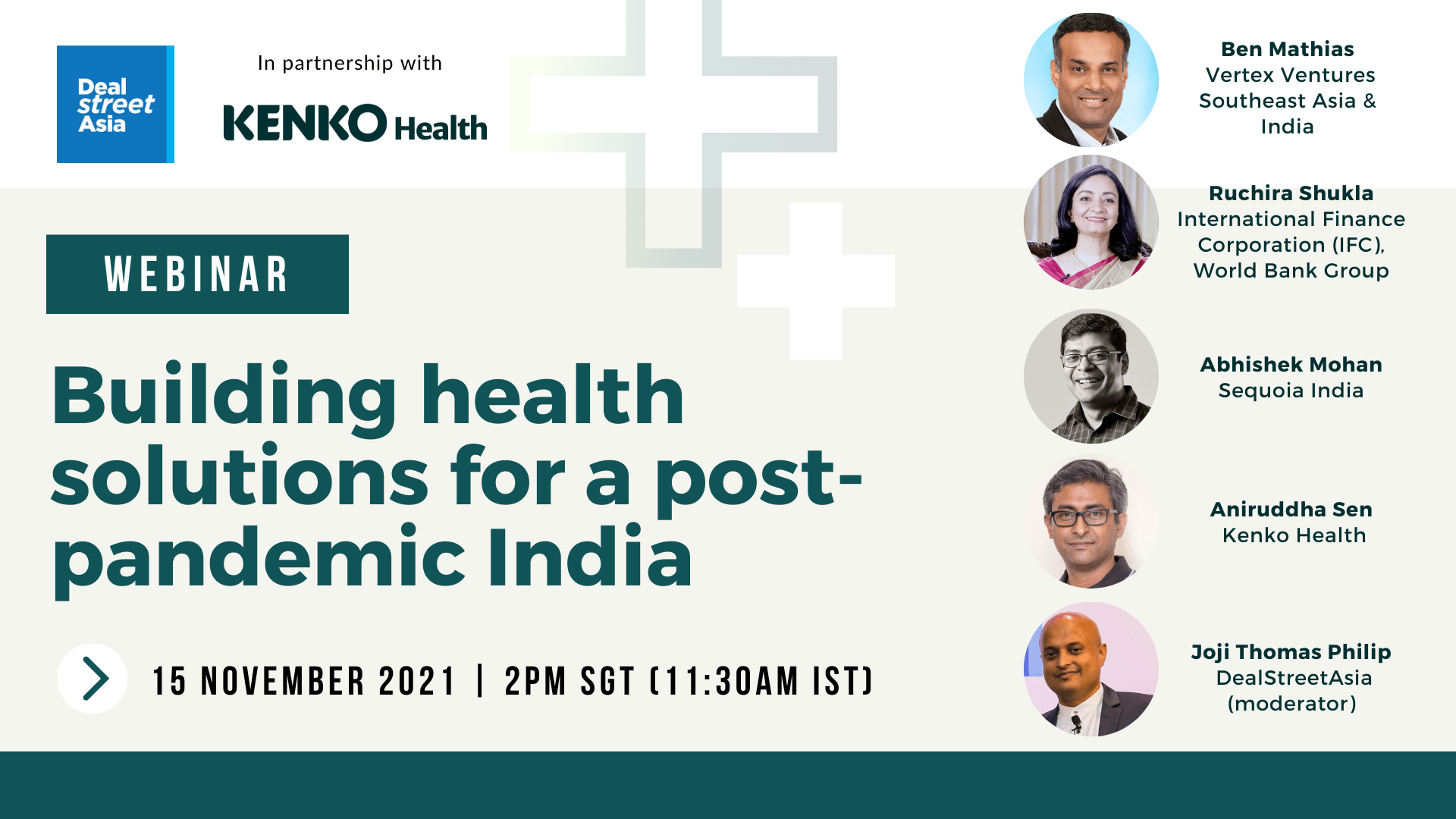

In our webinar, speakers from Vertex Ventures, Sequoia, The World Bank and Kenko Health will discuss the role private capital can play in moving beyond insurance to a holistic approach to care. The event is sponsored by Kenko Health and is scheduled for November 15 at 2 pm SGT (11:30 am IST).

Attending the webinar puts you in the running for a month long subscription to DealStreetAsia. Pre-existing subscribers get a month added to their package.

Signing up not only gives you a chance to attend the webinar, it allows you instant access to our Q3 Deals Report for India – a quarter that saw $18.7 billion deployed across 525 PE-VC deals.

You also get immediate access to the following stories that chart the course of healthtech investments in the region:

- Hybrid model seen as way ahead for Vietnam’s digital health firms despite pandemic boom

- Impact investing turns mainstream amid growing interest in Asia, says LeapFrog partner

- Everstone to step up focus on Indonesia’s healthcare sector, says co-founder Atul Kapur.

Monday, November 15, 2021

2:00 – 3:00 pm SGT (11:30 am – 12:30 pm IST)

Ben Mathias, Managing Partner, Vertex Ventures Southeast Asia & India

Ruchira Shukla, Regional Lead, South Asia, Disruptive Technologies (Direct Investing and VC Funds), Global Sector Lead – HealthTech International Finance Corporation (IFC), World Bank Group

Abhishek Mohan, Principal, Sequoia India

Aniruddha Sen, Co-Founder, Kenko Health

Joji Thomas Philip, Founder & Editor-in-Chief, DealStreetAsia (Moderator)