At $97 billion, Buy Now Pay Later accounted for 2.1% of ecommerce purchases worldwide in 2020, according to research from the U.S. based fintech company FIS. The company expects that figure to double by 2024.

With a large proportion of unbanked and underbanked population who have not had access to credit so far, BNPL offers convenience and choice on an unprecedented scale.

How will companies in the BNPL space build on and sustain its current momentum across 2022 and beyond? To find out and to get answers directly from a panel of industry experts best placed to address these questions, tune into DealStreetAsia’s next webinar.

Titled ‘How BNPL has unleashed the potential of the emerging Asian consumer’, the webinar is created in association with Grab and scheduled for November 11, 2021.

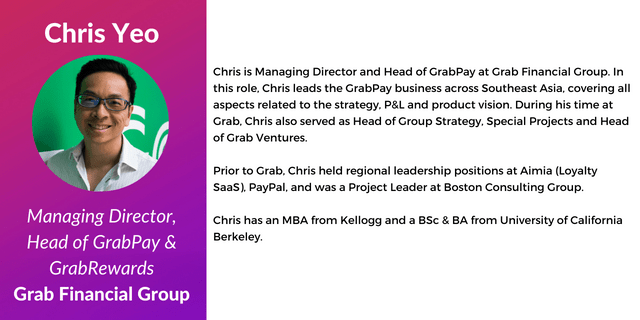

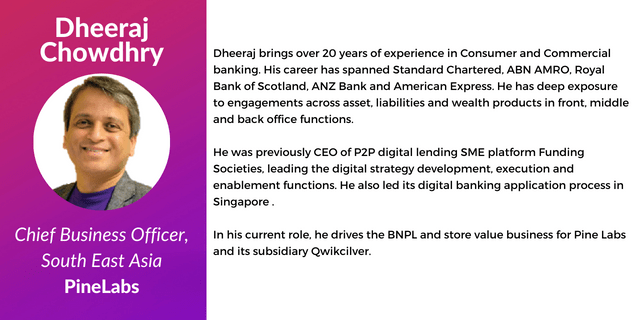

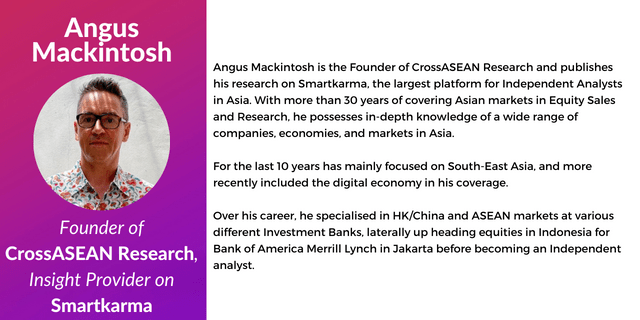

Speaking about the BNPL phenomenon will be Chris Yeo, Managing Director, Head of GrabPay & GrabRewards, Grab Financial Group; Dheeraj Chowdhry, Chief Business Officer, South East Asia of PineLabs and Angus Mackintosh, Founder of CrossASEAN Research, Insight Provider on Smartkarma.

The discussion will be moderated by Joji Thomas Philip, Founder & Editor-in-Chief of DealStreetAsia. Ample opportunities will be provided for an audience Q&A, immediately after the session.

Aspects the discussion will cover will include key trends in the space; how it benefits merchants, what sets the different players in the space apart; how the industry will evolve and strategies to mitigate the risk factors associated with this payment model.

Sign up now, so you don’t miss out on what promises to be one of the most essential discussions on BNPL this year and which will set the tone for 2022 and the years to come.