Healthcare and financial services were often considered the prerogative of either governments or NGOs. But vast sections of the population across Asia are not adequately covered by these services, despite the best efforts of both governmental and non-governmental bodies.

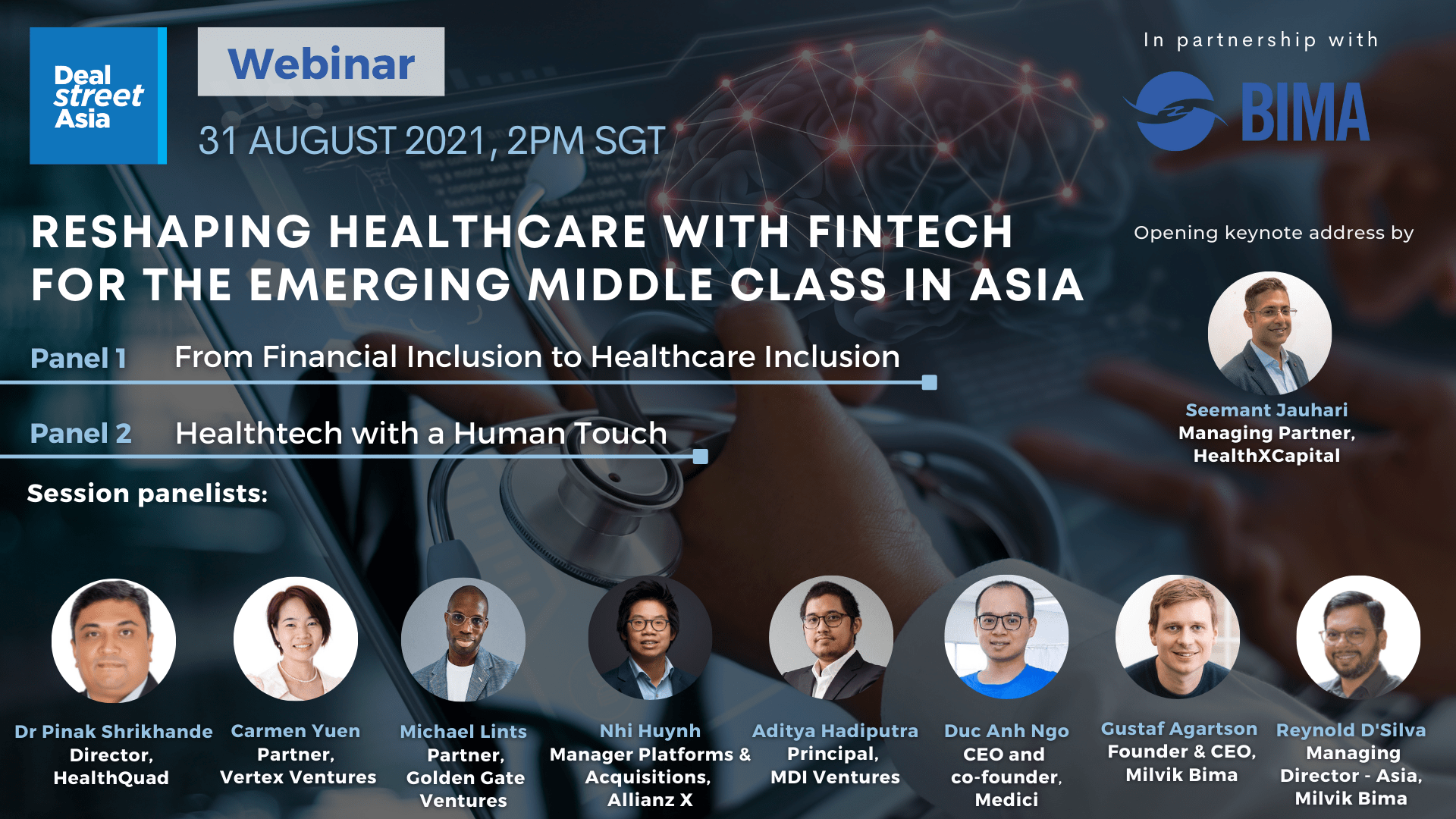

Hear about the difference private capital investments have made to this space in our next webinar: ‘Reshaping healthcare with fintech for the emerging middle class in Asia’.

Aspects that will be covered will be best practices, the role of private and public partnerships and how impact investing can be both impactful from a social point of view, as well as profitable.

Our panel of speakers is full of practitioners and investors eminently qualified to address the themes of the webinar and includes Michael Lints from Golden Gate Ventures; Carmen Yuen from Vertex Ventures; HealthXCapital’s Seemant Jauhari; Dr. Pinak Shrikhande from HealthQuad; Allianz X‘s Nhi Huynh; Aditya Hadiputra from MDI Ventures; Duc Anh Ngo from Medici, and Gustaf Agartson and Reynold D’Silva from Milvik Bima.

The discussion will be spread over three sessions: ‘Building tech solutions for the health of the emerging middle class in Asia’, ‘From financial inclusion to healthcare inclusion’, and ‘Healthtech with a human touch’.

The webinar is sponsored by Milvik Bima. Sign up at the earliest to reserve your place.

- 2:00-2:30 pm SGT | Opening Keynote: Building tech solutions for the health of the emerging middle class in Asia

- Seemant Jauhari (Managing Partner, HealthXCapital)

- Moderator: Joji Thomas Philip (Founder & Editor-in-Chief, DealStreetAsia)

- 2:30-3:40 pm SGT | Panel 1: From Financial Inclusion to Healthcare Inclusion Panel

- Gustaf Agartson (Founder & CEO, Milvik Bima)

- Michael Lints (Partner, Golden Gate Ventures)

- Carmen Yuen (Partner, Vertex Ventures)

- Aditya Hadiputra (Principal, MDI Ventures)

- Moderator: Andi Haswidi (Head, Asean Research, DealStreetAsia)

- 3:40-4:45 pm SGT | Panel 2: Healthtech with a Human Touch

- Reynold D’Silva (Managing Director – Asia, Milvik Bima)

- Nhi Huynh (Manager Platforms & Acquisitions, Allianz X)

- Dr. Pinak Shrikhande (Director, HealthQuad)

- Duc Anh Ngo (CEO and co-founder, Medici)

- Moderator: Joji Thomas Philip (Founder & Editor-in-Chief, DealStreetAsia)