You may have noticed that we recently changed our product name and identity from DealStreetAsia – Research & Analytics to DealStreetAsia – DATA VANTAGE. The rebranding follows the launch of our latest product that supplements our extensive news coverage with invaluable industry data and insights.

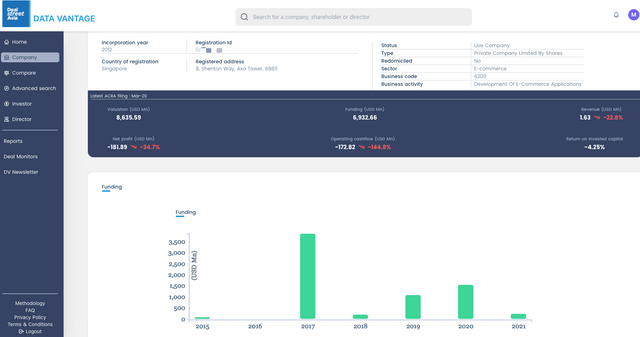

The new DealStreetAsia Data Vantage platform offers you up-to-date data on startups’ fundraising, valuations, financial performance and investors, allowing you to make strategic business decisions with conviction, speed, and unparalleled insight.

Are you still wondering how you can benefit from DealStreetAsia – DATA VANTAGE? Here are the reasons:

-

Boost Your Deal Pipeline

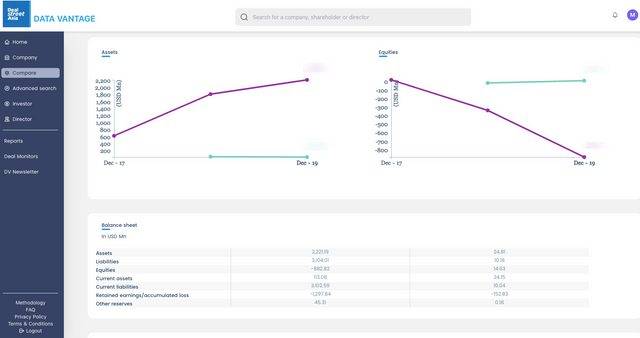

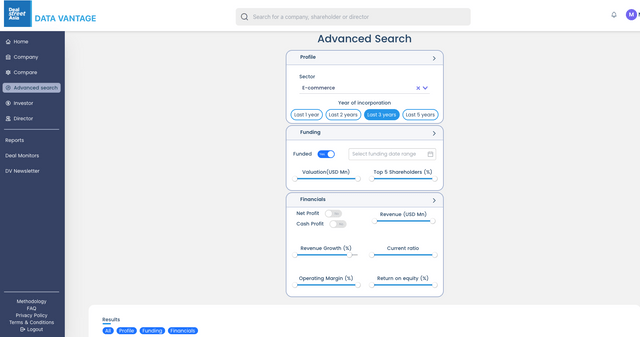

You are starved for time and every second counts. Log in to Data Vantage to review 1,000s of companies in our database. Whether you are starting your search phase or beginning initial due diligence, you can review financial information based on up-to-date regulatory filings.

-

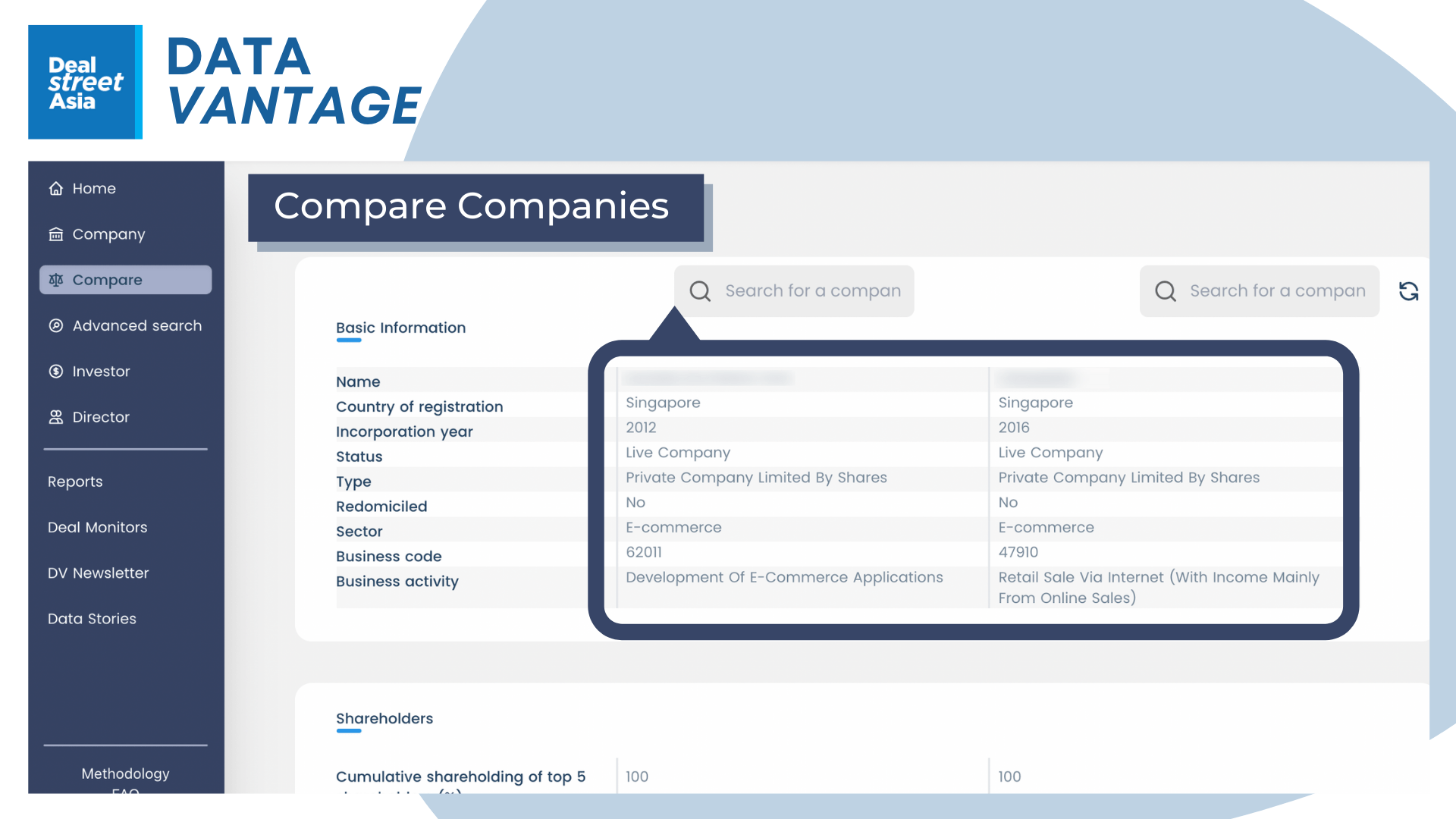

Track Competitors and Industries

Your industry is dynamic and getting an edge on the competition can make a huge difference to your company’s performance. Use Data Vantage to track financial performance and funding rounds of your key competitors. You can also use it to identify possible investors by screening related deals.

-

Get Sector Focused News

With daily access to hundreds of in-depth articles across a broad industry spectrum, the vital news you need is always within reach. Our journalists immerse themselves in the market to obtain fresh perspectives and stay abreast of market disruption. And they arm you with intelligence that you won’t find anywhere else.

- Exclusive data-led stories and newsletters – We provide unique insights with in-depth stories that uses our propietary data to provide information you need to make important investment and entrepreneurial decisions.

- Weekly Deal Monitors – We track deals across the region and compile all smaller deals in Southeast Asia, India and China into deal monitors for our audience. The deals are tabulated and contextualized within the larger investment narrative, keeping you abreast of even the most minute activity in the region.

- Bimonthly detailed reports – We do thematic reports that details the businesses, growth and challenges within the private equity and venture capital ecosystems we cover. Our current segmentation is as follows – Periodic deal reviews (within a year) Theme/Sector-focussed reports Annual review & projections.

A standard, annual plan is priced at $1,999.

For a limited time, you can sample the benefits of a DATA VANTAGE subscription for one month at only $199*