- Mobile payments have reached critical mass when it comes to adoption with 97% of offline MSMEs becoming a part of Indonesia’s digital economy.

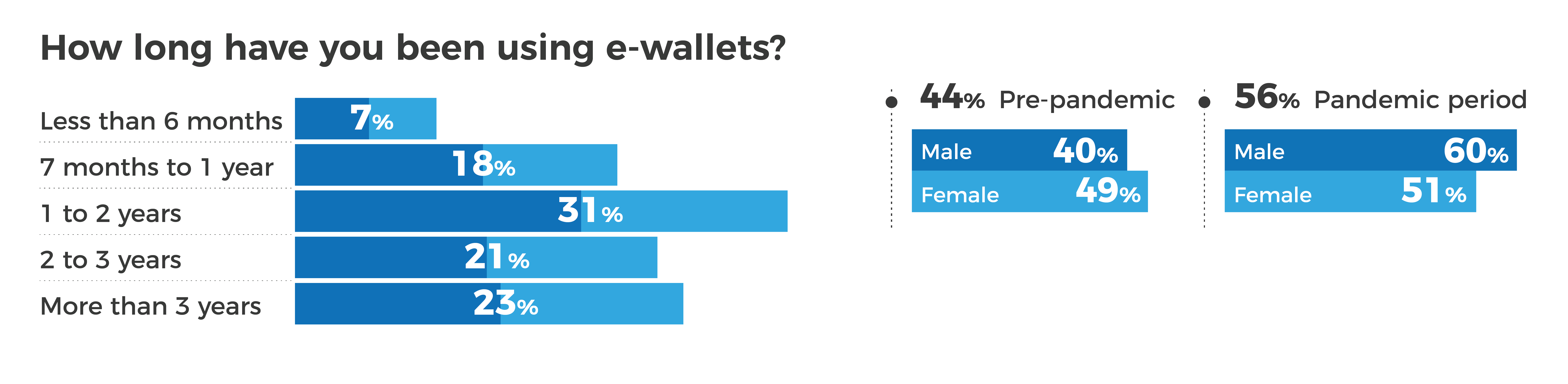

- The pandemic was a major accelerant — mobile wallet adoption doubled through this period. Before the pandemic, it stood at a mere 23%.

- Convenience and discounts are the main reasons driving mobile wallet adoption, with the former winning the day.

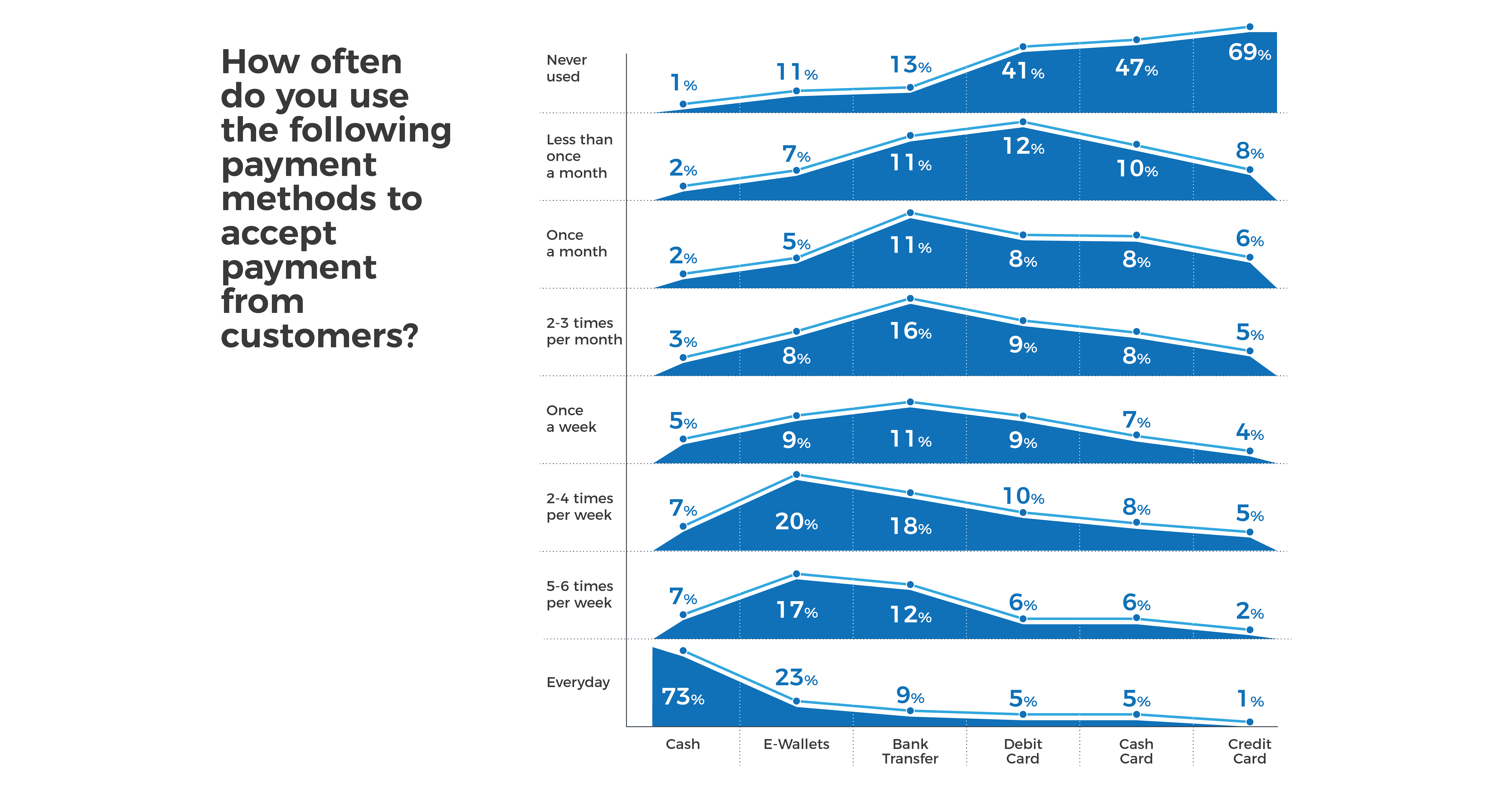

- While cash still rules, e-wallets are catching up — emerging as the second most preferred payment mechanism.

- MSMEs are showing an increasing preference for e-wallets over traditional banking.

These were just some of the topline findings of an upcoming research-backed report on the digital finance industry in Indonesia created by DealStreetAsia, and sponsored by LinkAja.