Partner content in association with

How digital finance is fostering inclusion and transforming Indonesia’s MSME industry

- Mobile payments have reached critical mass when it comes to adoption with 97% of offline MSMEs becoming a part of Indonesia’s digital economy.

- The pandemic was a major accelerant — mobile wallet adoption doubled through this period. Before the pandemic, it stood at a mere 23%.

- Convenience and discounts are the main reasons driving mobile wallet adoption, with the former winning the day.

- While cash still rules, e-wallets are catching up — emerging as the second most preferred payment mechanism.

- MSMEs are showing an increasing preference for e-wallets over traditional banking.

These were just some of the topline findings of an upcoming research-backed report on the digital finance industry in Indonesia created by DealStreetAsia, and sponsored by LinkAja.

They were revealed in ‘The financial inclusion opportunity in the digitalisation of MSMEs’, a special presentation at the Indonesia PE-VC Summit.

The findings of the report, which will go live shortly, were followed by an insightful discussion featuring many of the figures at the vanguard of the digital payments revolution in Indonesia.

The panel included Eddi Danusaputro, CEO, Mandiri Capital Indonesia; Aldi Haryopratomo, Board of Commissioner Halodoc, Efishery, Mapan; Pandu Sjahrir, chairman of the Indonesian Fintech Association (AFTECH), and Wibawa Prasetyawan, acting CEO, LinkAja.

The discussion was moderated by DealStreetAsia editor-in-chief Joji Philip.

Click here to watch a video of the presentation and the discussion.

Read on for a transcript of the event, edited for brevity and clarity.

Last year, the annual transaction value on mobile payments reached approximately $21 billion — a 49% growth compared to 2020 and 43 times what it was in 2016. But the data does not necessarily inform us about penetration levels, especially among MSMEs. How should these numbers be understood in terms of financial inclusion?

Eddi Danusaputro (ED): Since Indonesia is so vast, what is happening in the urban areas or Tier 1 cities may not occur at the same pace in Tier 2 and 3. There needs to be more infrastructure in place, as well as an increase in the ownership and usage of smartphones.

From a bank’s perspective, we have to differentiate methods of payments. I personally believe payments are just an entry point. From an investor’s perspective, it’s a space where you make very little or no money. While it’s a loss leader, it remains necessary in order to acquire a customer base. You can then cross-sell other products: whether in lending or investment.

Regulators have been trying to introduce and encourage a cashless society. It started as being card or chip-based, and now we are moving towards server-based money. Funds are accessible so long as you have a smartphone, mobile banking or e-wallet.

There’s no one solution for a large, diverse economy like Indonesia. We need everything — be it server or chip-based money, or traditional banking through mobile. We welcome all players in this sector: payments companies, e-wallets, lending companies that also do customer acquisition for SMEs and individuals in the rural areas.

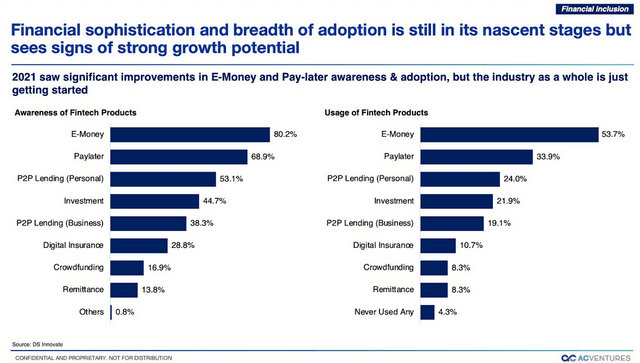

Pandu, the Indonesian Fintech Association (Aftech), of which you are the current chairman, is all about improving financial inclusion. What can you tell about the level of financial sophistication or the quality of adoption?

Pandu Sjahrir (PS): If you look at the adoption of digital services, you see a significant growth in awareness and usage of e-money and paylater (Buy Now Pay Later).

But investments, digital insurance, remittance and other businesses are also growing. Fintech has seen one of the largest investment flows in the last 24 to 36 months and a lot of innovation has been happening in financial services. Over the next 12 months, you will see more innovation, further growth, and adoption.

Aldi, You have long been involved in initiatives to enable Indonesian MSMEs by using technology. How is the state of play different today compared to when you were still active in Mapan?

Aldi Haryopratomo (AH): The biggest change is the movement away from paper in rural areas. Back in 2011, when Mapan wanted to promote products from SMEs to women in villages and provide financing, we had to go on motorcycles, equipped with paper catalogues. Women would browse them and figure out financing, using pen and paper to calculate. It was really difficult to change.

With digital payments and the adoption of smartphones – 70% of people have a smartphone in Indonesia – Mapan has shifted to become 100% digital.

Seeing this transition in the furthest parts of Indonesia is transformational and gives you an estimate of the opportunity. It’s the beginning of infrastructure being built. As the internet becomes faster and the phones better, it won’t only be goods on sale, but content and education. You will eventually lift the penetration of services across the economic spectrum in Indonesia, which will increase the country’s overall productivity.

In addition, the ease of technology from LinkAja through Quick Response Code Indonesia Standard (QRIS) allows people in the low-income bracket to participate.

LinkAja is one of the largest players in the e-payment space in Indonesia and you serve a lot of MSMEs through your Mitra program. Can you tell us a little more about the action that you are seeing?

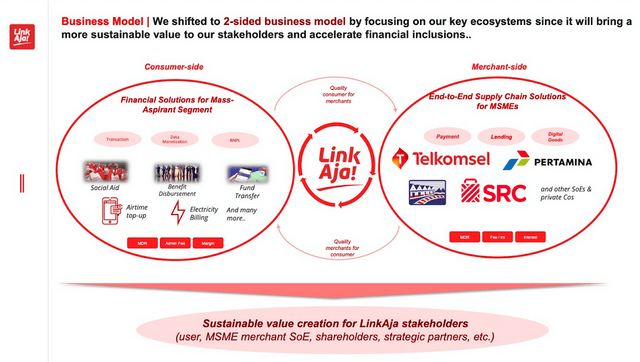

Wibawa Prasetyawan (WP): We want to implement a two-sided business model which matches the user and the merchant, in an ecosystem owned by our shareholder.

In the last three months, we have seen higher customer lifetime value (CLV) and lower acquisition costs. It means focusing on our shareholder ecosystem has put us on the right track.

Telkomsel is our parent company and has given us the opportunity to digitalise the supply chain ecosystem. Most merchants are ours which solves the problem of the principal not having a clear visibility on the retail side. It gives us the opportunity to offer lending services and to cross sell other products to retailers.

Moreover, we can replicate this success story in the other state-owned enterprise ecosystems.

Last year, the total demand for financing of MSMEs was approximately $190 billion, of which the banking sector could provide very little — less than 40%. Fintech lending has barely made a dent in reducing the financing gap. Why hasn’t fintech lending been able to fulfill the gap and democratise access to financing?

AH: Inclusion has increased dramatically in the digital world. A recent survey pegged it at 76.2%.

But a really important part is literacy. If MSMEs are not sure about how a product can help them, it makes them pause. Really good lending products may not reach the people who need them — that’s 38% in Indonesia right now.

I am also the chair of entrepreneurship at Kadin (the Indonesian chamber of commerce and industry). One of the things that we are trying to crack is how do we get MSMES to access programs that are available? The Ministry of Cooperatives has a really cool program called LPDB. Many fintechs have approached us to promote this to MSMEs. But if it is merely promoted through conferences, traditional media or TV, it doesn’t connect.

This consumer gets information through WhatsApp, cooperatives, and friends. As digital natives, we must try to understand how they consume information. We know that consumers receive information via WhatsApp groups, so we have to use the same channels to spread true information to combat hoaxes! For inclusion to be beneficial, we have to increase literacy, and access to consumers.

Otherwise, you can create something that is meant to be good, like fintech lending, but then have bad actors coming in. It’s our role as the industry to figure out a way to educate the consumers and in this case, the MSME so that they don’t fall prey to these unscrupulous actors.

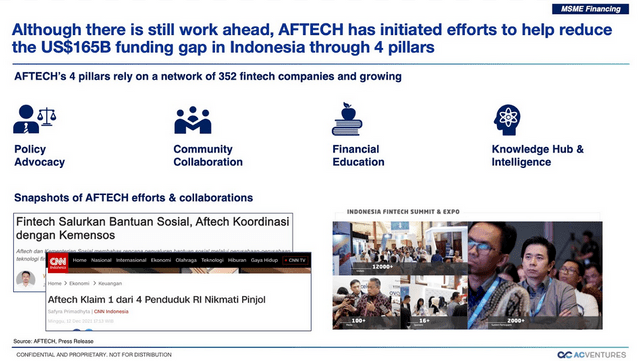

What’s sort of a role can Aftech play here?

PS: Our role is for policy advocacy, community collaboration, financial education, and creating knowledge hubs. We are the largest organisation on anything related to fintech. This is our main job: to communicate policy, and help promote digitalisation and financial services.

Yesterday was International Women’s Day and in MSMEs half the entrepreneurs are women. They have played a key role in pushing forward this MSME movement.

Linkaja acquired a P2P lender last year. With so many players, what’s your differentiator?

WP: We realise that the risks are high in lending. Our key is to focus on the value chain of the ecosystem. In doing so, we play in a closed loop. The interest rates remain low which enables us to offer lending at a reasonable price.

Since we have already succeeded in digitalising the ecosystem, we have clear visibility on the financials of each merchant. This gives us the confidence to disburse loans in a safe environment.

QRIS was introduced in 2019 to ensure interoperability between different mobile payment systems and reduce costs. What’s been the impact and how has it altered the scene?

AH: QRIS provided a bridge from financial service providers — whether in lending, insurance, or asset management — to SMEs.

When we were launching payments in GoPay, everybody was using a device — something to scan a phone or to input a number into. Those devices were expensive which naturally restricted the number of merchants who could access them.

But with GoPay and LinkAja, we pushed QR codes. QRIS is now the national standard with 15 million merchants – which means many more customers. They have a record of transaction data produced over a month, which helps with credit scoring. It also makes it easy for an insurer to assess the risk for those SMEs.

On the flip side, because more merchants beyond the formal sector are using QR, more consumers in the middle-and-lower income classes now use it, aided by the discounts that accrue to them. The same benefit of access backed by financial history becomes available to this segment of consumers. With QR, the cloud is lifted: banks and financial service companies can now provide services at a much lower cost. Even healthcare companies like Halodoc can access more customers, because payment no longer is a barrier. It’s just the beginning of the bridge that’s being built for this middle and mass income class.

Do you think at some point in the future Indonesia can be at the level that China is today?

PS: There’s significant scope for this to happen. We need massive investments for the rollout of 5G. We also need to have some sovereignty and control over data. From a digital infrastructure investment point of view, data centres have to be a focus if we are to get to where China is today. Coupled with that, we need a view on national data sovereignty and cloud-based systems.

India has the United Payments Interface or UPI — a single system for payments. We’ve not seen that in many other countries. Do you think a large country like Indonesia should go for a unified payment system?

ED: We have to be masters in our own country, and cannot rely too much on outside infrastructure providers, whether it’s cloud or data-based payment systems. The regulator has a roadmap for this and we are all supportive.

But it will take time. At present, we have the National Payment Gateway which is a precursor to reducing our dependence on players like Mastercard or Visa. There will be pivots along the way, since nothing goes according to plan. But if we don’t have a plan at all, then we are not going to go anywhere.

Indonesia has one of the largest Muslim populations in the world, but it has not made much progress in terms of the Islamic finance. Any plans for LinkAja to tap the space?

WP: The mandate from the government for LinkAja is financial inclusion. The Muslim population of Indonesia look for serenity and security during transactions. That’s why LinkAja is the first and leading sharia electronic money platform in Indonesia.

We have seen the Muslim community accept sharia electronic money. Users of sharia wallets have a higher CLV and are wealthier than the non-sharia category. They are not as sensitive to promotions or discounts, but instead look for compliance with their beliefs. The growth in sharia is higher than conventional wallets.

There are many opportunities for us to tap and we can increase the portfolio of sharia compliant products. Moreover, we are working with communities like the Muslimat Nahdatul Ulama that has massive Muslim followers in Indonesia to introduce and socialise the first sharia e-wallet In Indonesia, LinkAja Syariah.

A lot of millennials are actively trading on the stock market using apps. Are you very bullish on the upcoming IPOs in Indonesia?

PS: We have grown the number of people that invested in the stock market from 2 million to over 8 million within 18. months. A lot of them are young millennials — people still learning about investing.

The key takeaway is that younger people now have more knowledge on what to do with their income, whether they invest in stocks or other asset classes. Because they are young, the assets will grow over time.

The next challenge is to also bring larger, higher quality companies in. Last year was a banner year for the stock exchange, with the largest number of rights issues or IPO. This year we already have a couple of IPOs and are waiting for one or two of the largest companies to go public. I’m bullish about a larger number of high-quality companies listing on the IDX. It has been a good platform for fundraising and investing.

What are the consideration criteria for startups in the Mera Putih (red and white) fund which is backed by several state-owned enterprises?

ED: In Indonesia, we have done a relatively good job in producing unicorns and decacorns. As of now, we have 11 unicorns and two decacorns. The ownership is predominantly foreign. There’s nothing wrong with that — it’s just how the industry works.

While we are not against foreign funding, we need to level up in terms of domestic investment. One of the ways is to increase investments into soonicorns from domestic investors, including state-owned enterprises. These investments have been going on for the past five years to seven years, but have been made individually. Now, we are pooling out investments together into the Merah Putih fund.

The target is not an early stage but growth-stage startups, with approximate valuation of about $200 million pre-investment. The general criteria are that all the founders be Indonesian; the operating companies be located in Indonesia; and that there be a roadmap to exit within Indonesia, either via IPO — which is preferred — or via a strategic sale. We are sector agnostic, as long as there’s a strong possibility of the company becoming a unicorn.

Considering the number of soonicorns in Indonesia, $300 million is not much. Are there likely to be second and third funds?

ED: The $300 million figure that’s out in the media is the first close. We will have a second and third. Hopefully, we are moving towards $600 million, $800 million or maybe a billion dollars, but it will be in stages.

LinkAja has issued about $140 million in paid up share capital, and I understand you are in the market to raise more. Can you share some plans in terms of how much you intend to raise and by when? Also, is there anything you can share on LinkAja’s IPO?

WP: Our focus now is to strengthen our fundamentals — sustainability instead of a ‘growth at all costs’ strategy. It is important for us to prepare for what’s next. In our third year, we have a clearer path to profitability.

We are currently among the top five soonicorns in Indonesia, and probably the largest fintech soonicorn in ASEAN. By strengthening our fundamentals, going in for an IPO will not be a problem for us. I’m sorry but I cannot reveal any more details at this stage.

A big development over the last 12 months is that everybody in Indonesia is rushing to buy a bank. How do you see this play out?

AH: The difference between the payment and banking industry is that in the former, there are multiple network effects, and it is generally acknowledged that the winner takes all.

The banking industry is more diversified. Even Indonesia has over a hundred banks. I expect them to cater to a lot of different niches.

In the US, most digital banks are really focused on a niche that uses only a portion of the total banking services on offer. A digital bank can zero in on a specific market segment, and try to partner with different players to provide a more comprehensive solution. For instance, consider how Jago has partnered with the Gojek ecosystem.

What are your predictions for 2022?

AH: Hopefully, we will start seeing a bounce back. We started the last year with many issues around fintech and P2P lending and have begun educating the consumer about the importance of safety. With the regulators becoming more open, I hope we see innovations beyond just lending for MSMEs, in areas like asset management, insurance, and supply chain financing.

ED: To wear my investor cap, over the last couple of years we have seen a lot of inflated, high valuation in terms of ask, from predominantly early-stage startups. Hopefully that will come down to a much more reasonable level, which is good for the ecosystem.

Please click here to see the full video of the panel discussion, and visit the official website for more information on LinkAja and its services