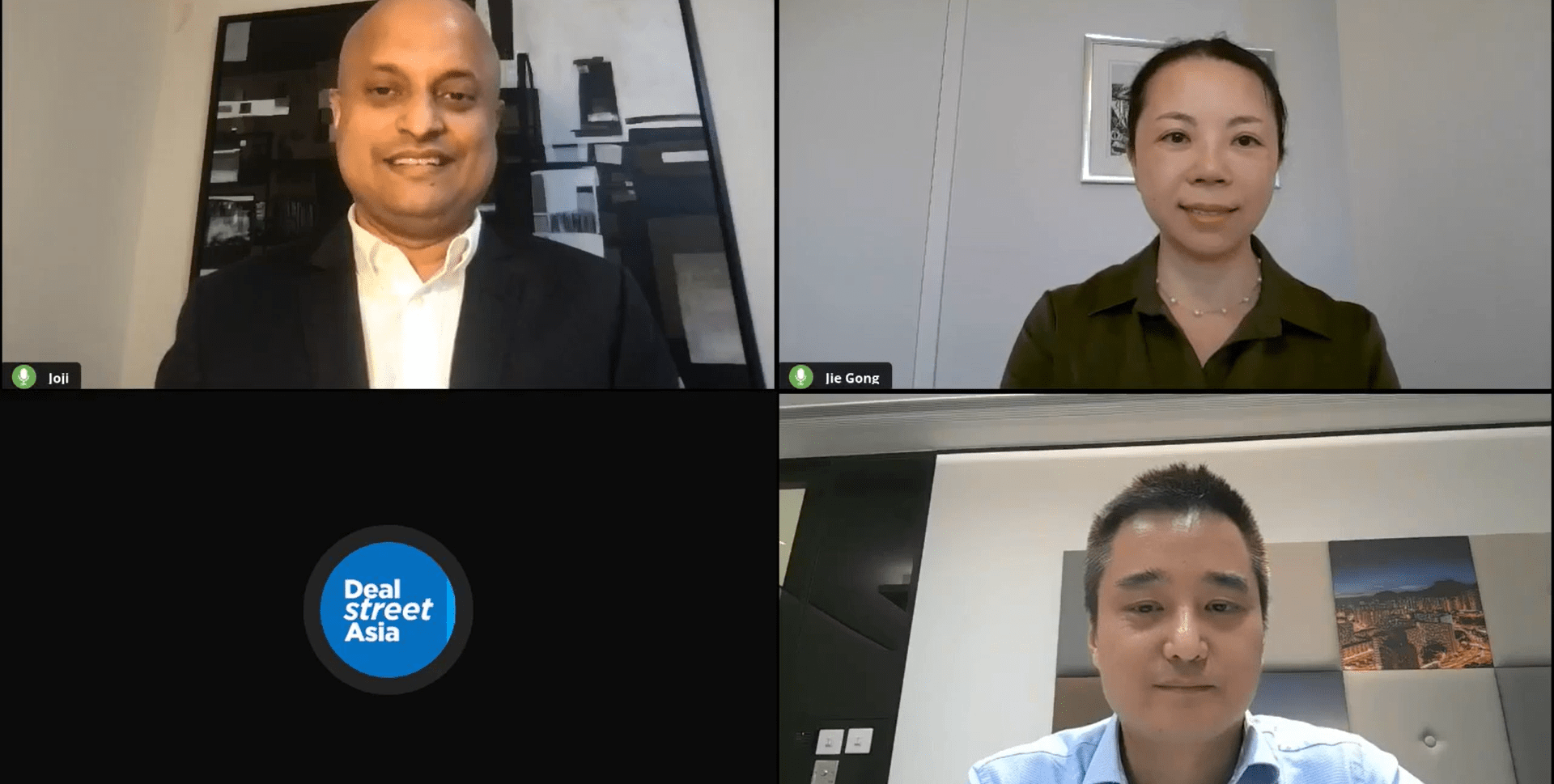

Recent events related to tighter scrutiny and a regulatory crackdown on a variety of sectors in China, the second-largest market outside the US for limited partners, have sharpened the focus on ESG as a key investment theme, according to panelists participating in DealStreetAsia’s Asia PE-VC Summit 2021, during the session titled – “Evolving LP-GP dynamics, private markets opportunities & Asian co-investments.”

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com