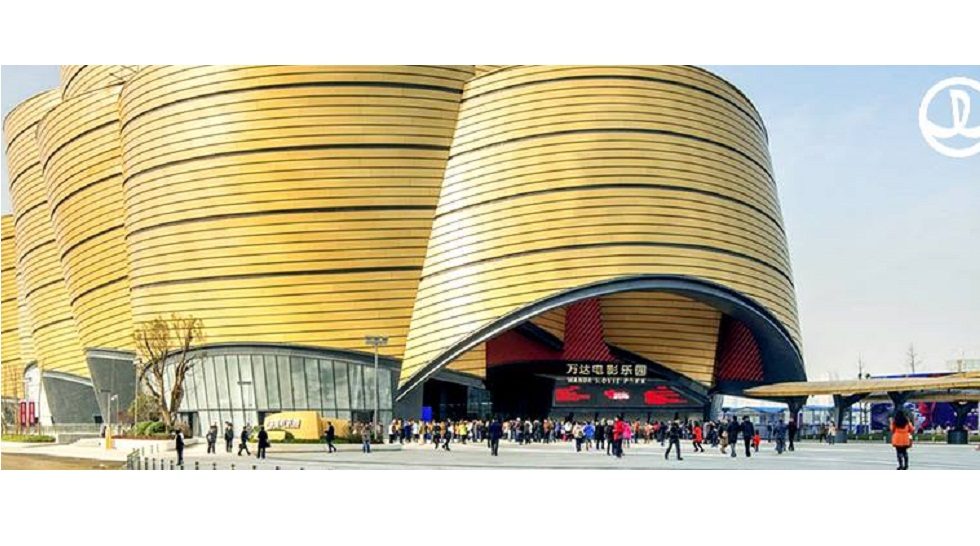

Chinese conglomerate Dalian Wanda Group plans an initial public offering (IPO) for its Internet finance business, betting on booming growth as it leverages the millions of customers packing its shopping malls, Chairman Wang Jianlin said on Monday.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com