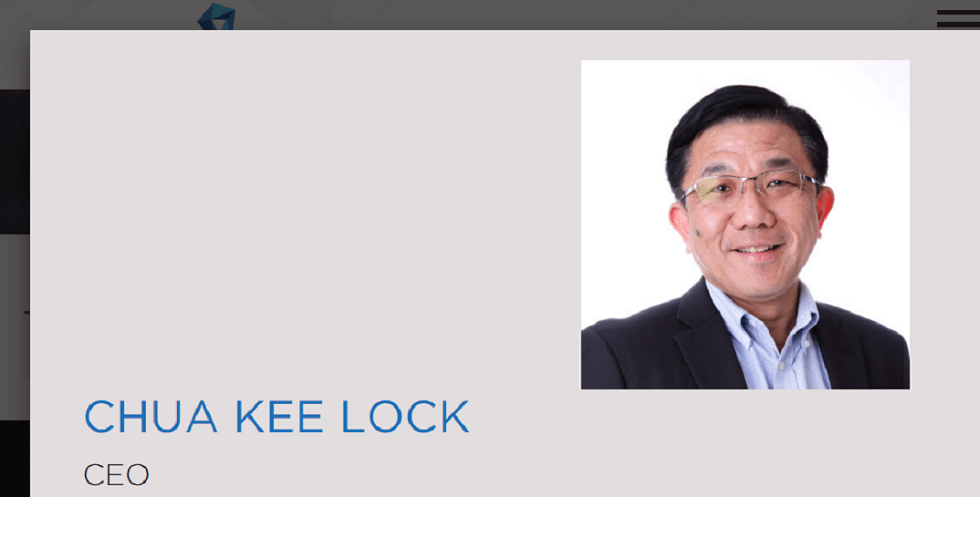

“We have launched a new $200 million fund this year for Southeast Asia and India, and are currently making investments from it. Valuations in Southeast Asia are reasonable, and we don’t have that frenzy of India yet, where investors are rushing in, and chasing startups,” says Chua Kee Lock, group president and chief executive at Vertex Venture Holdings, the venture capital (VC) arm of Singapore’s state-run investment firm Temasek Holdings Pte. Ltd.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com