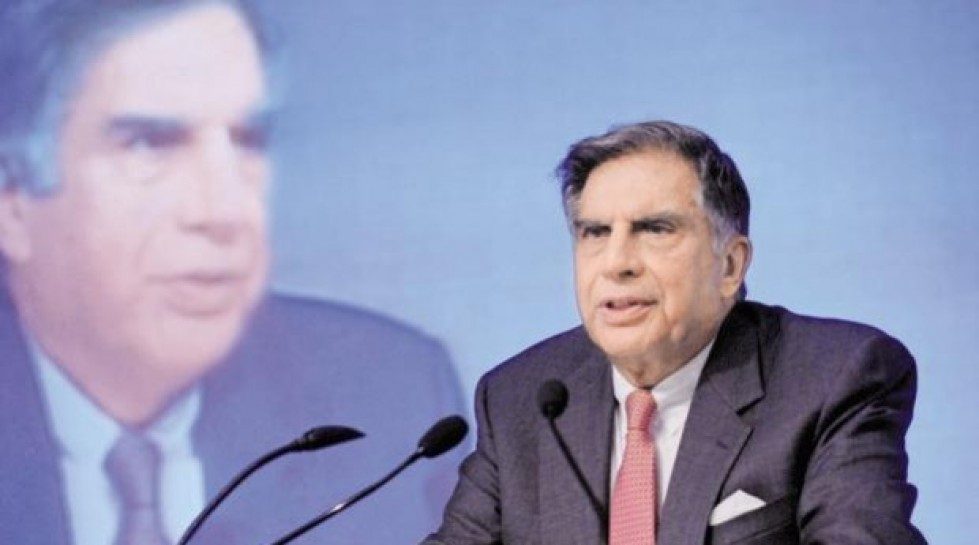

Healthcare technologies will be the next frontier for investments as researchers make progress on inventing treatments for some of the diseases that currently have no cure, said Ratan Tata, chairman emeritus of Tata Sons.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com