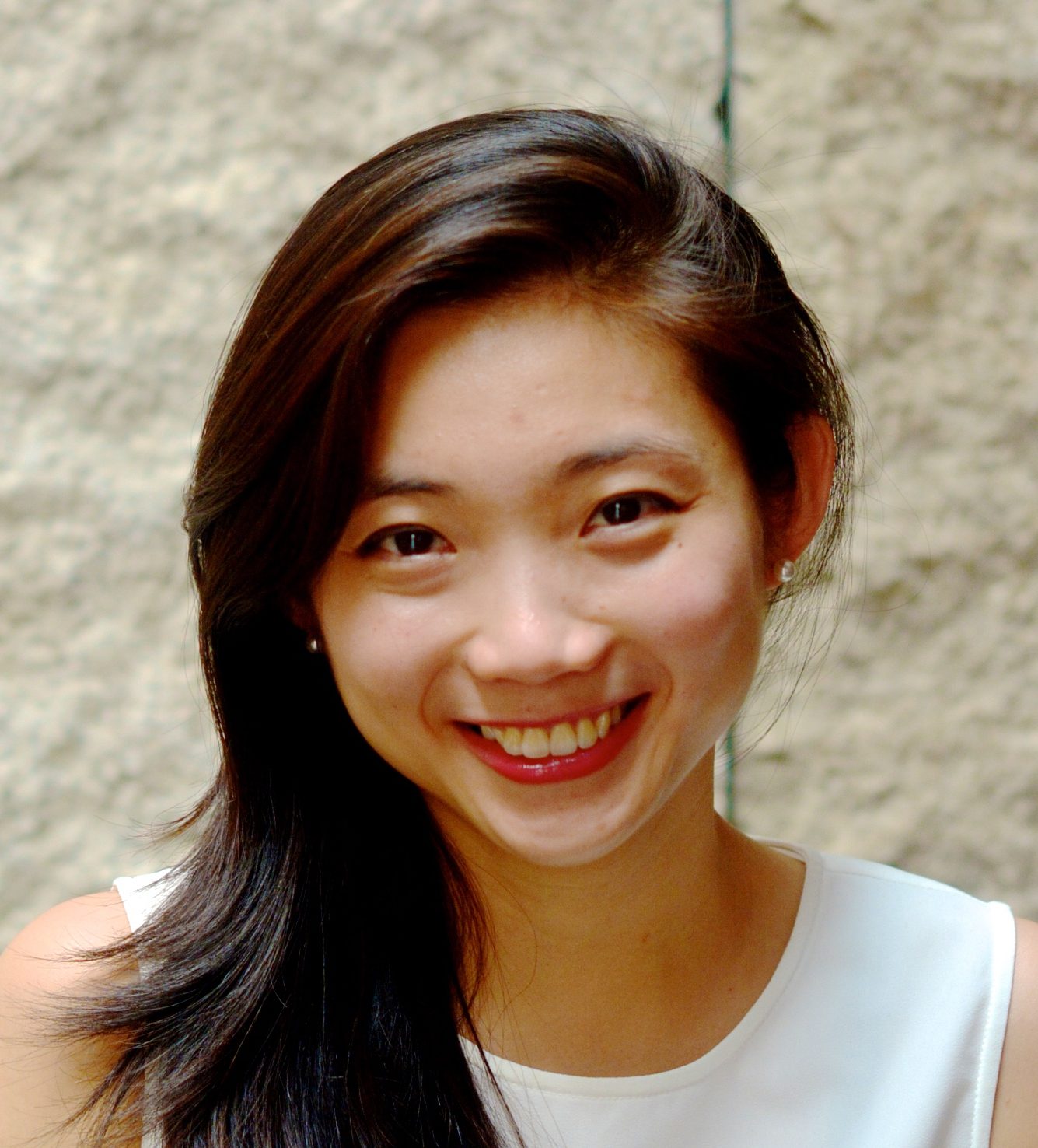

RHL Ventures‘ co-founder Rachel Lau, is candid in admitting that her journey in the VC/PE industry has been a rather good one. At the same time, she acknowledges that finance in general as this sector is skewed towards masculinity. One is often negotiating deal terms and be tough on one’s feet, she says.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com