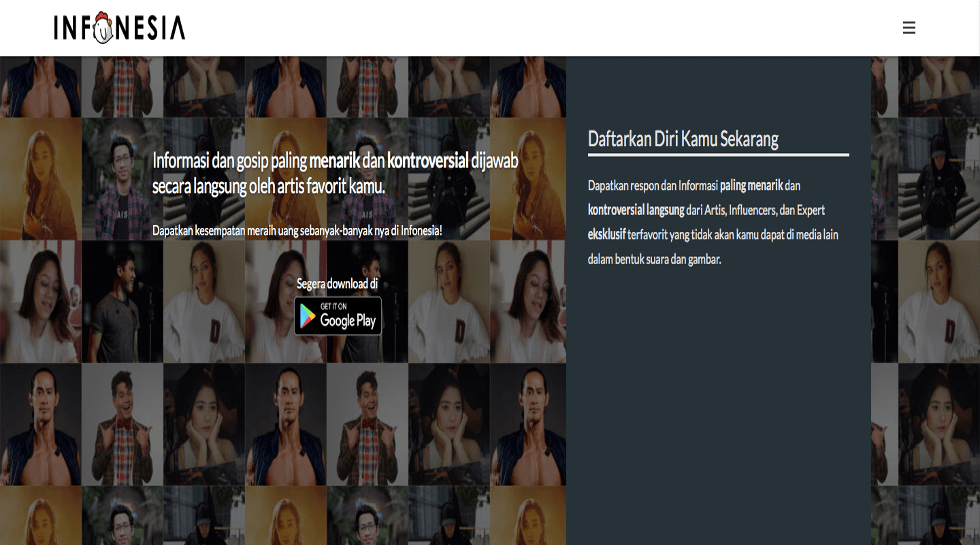

Indonesian Q&A platform Infonesia has raised seed funding from international venture capital major 500 Startups, the company announced. The startup offers a social network product that performs Q&A with the difference being that it samples sites like Quora and live streaming apps.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com