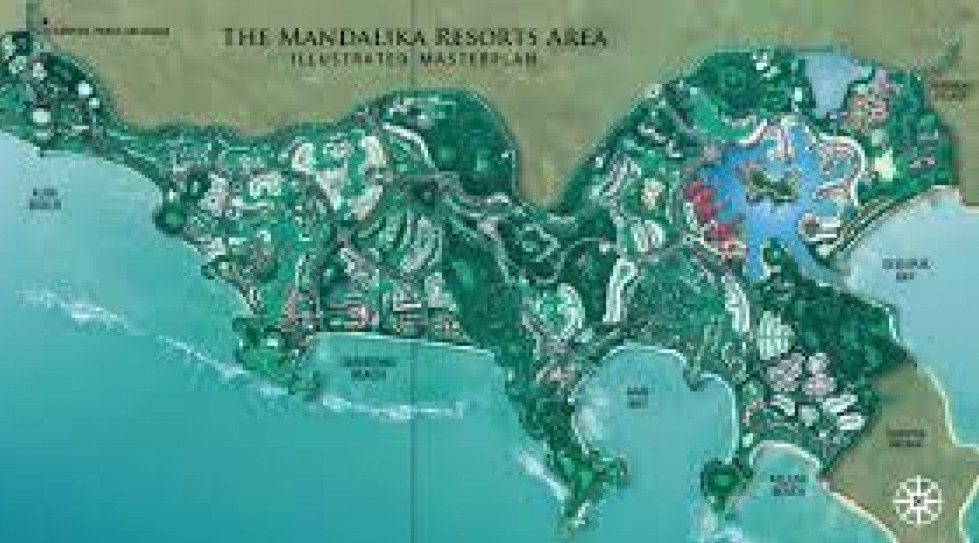

Indonesia real estate has been active with Singapore-listed developer Sinarmas Land Ltd – the holding entity for property companies of Sinar Mas Group– announcing Rp 9 trillion ($644.85 million) plans to develop Nuvasa Bay. Also, the French hotel group AccorHotels held the groundbreaking ceremony for its Pullman hotel in Mandalika Resort, Lombok, West Nusa Tenggara.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com