Private equity fund managers expect limited partners (LPs) to increase allocations to the Asia Pacific as the global pandemic has increased the participation of several investors that previously did not have full access to the market.

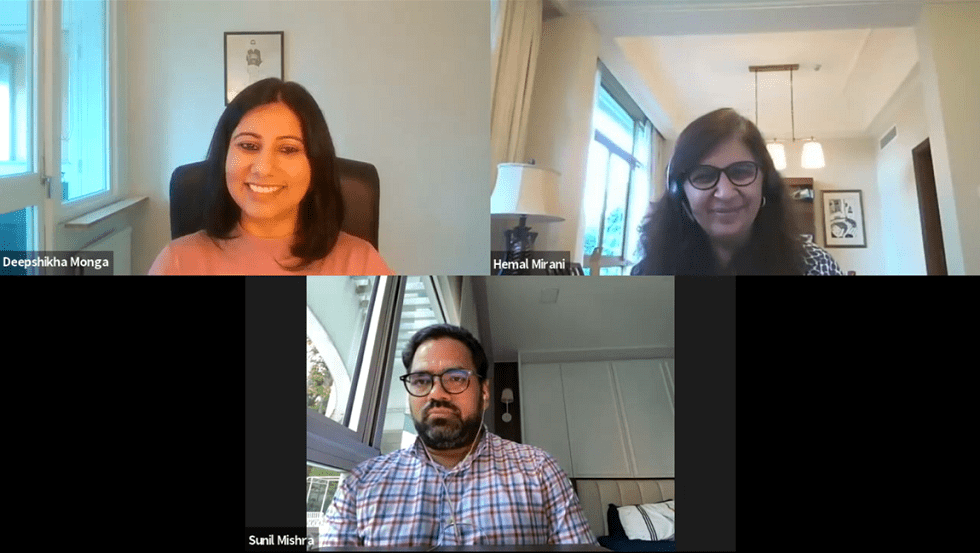

“Asia is reaching, in terms of size, skill, depth, and maturity, a stage where it probably will attract more capital as it has more experienced managers, more exit avenues, and mature private markets to take such capital,” said Sunil Mishra, a partner responsible for primary investments at Adams Street Partners, at DealStreetAsia’s Asia PE-VC Summit 2021.

Hemal Mirani, managing director at HarbourVest Partners, noted that the global coronavirus pandemic has broadened participation for many investors who may not have had budgets to travel to the region.