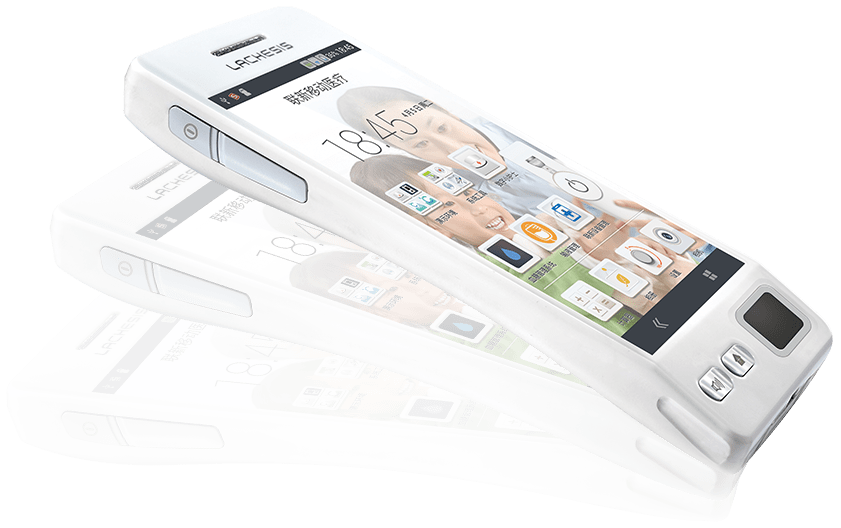

Online insurance service company Nanyan Information Technology has raised 100 million yuan ($14 million) in a Series B2 round of funding led by BOC International Holdings Limited. In a separate development, China’s top medical technology company Lachesis has raised 150 million yuan ($22 million) in a Series B+ round of funding from Shenzhen Municipal Government-backed Shenzhen Capital Group Co., Ltd.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com