Fresh after raising its $100-million Series D round last month, Singapore-headquartered artificial intelligence (AI) startup Near is on the hunt for acquisitions in the US.

Founded in 2012, Near collects, manages and analyses location, enterprise and consumer data to provide actionable insights to its customers that include News Corp, MetLife, MasterCard and WeWork. It claims to process data from over 1.6 billion monthly users across 44 countries. Its key markets are in the Asia Pacific across Japan, Southeast Asia, Australia and New Zealand, with Australia being its largest market by revenue.

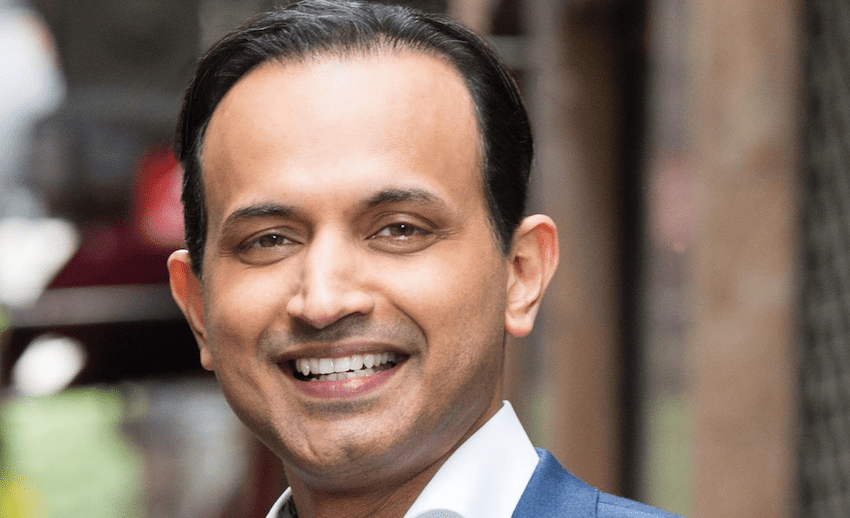

Near CEO and founder Anil Mathews believes the company is ready for a larger international play. In an interview with DealStreetAsia, he said the firm is actively scouting for suitable targets to penetrate the US market, one of the largest and most competitive SaaS markets in the world.

Mathews listed US-based company Factual as one of its competitors, but said that he is not seeking to buy it out.

“We are looking at US companies to acquire as we speak…We are looking at someone who can complement and sell our current product. It could be a competitor. But we haven’t zeroed in on anyone on the list that are competitors as well,” said Mathews.

Mathews added that Near was already EBITDA positive before closing its $100 million Series D round by London-based private equity firm Greater Pacific Capital. A “small portion” will be used to finance its overseas acquisitions, while the rest will be dedicated to acquiring, storing and analysing data in its existing markets.

Near declined to disclose revenue or valuation figures. However, it is growing by 100 per cent year-on-year. Mathews also expects an exit within the next two to three years but did not share whether he foresees this exit being in the form of an IPO or a trade sale.

While Greater Pacific Capital is Near’s largest shareholder, it does not hold a majority stake in the company. Other investors on its cap table are Cisco Investments, Telstra Ventures, Sequoia Capital India, JP Morgan Partners, Global Brain Corporation, Canaan Partners and OurCrowd.

Edited excerpts of an interview with Near founder and CEO Anil Mathews: