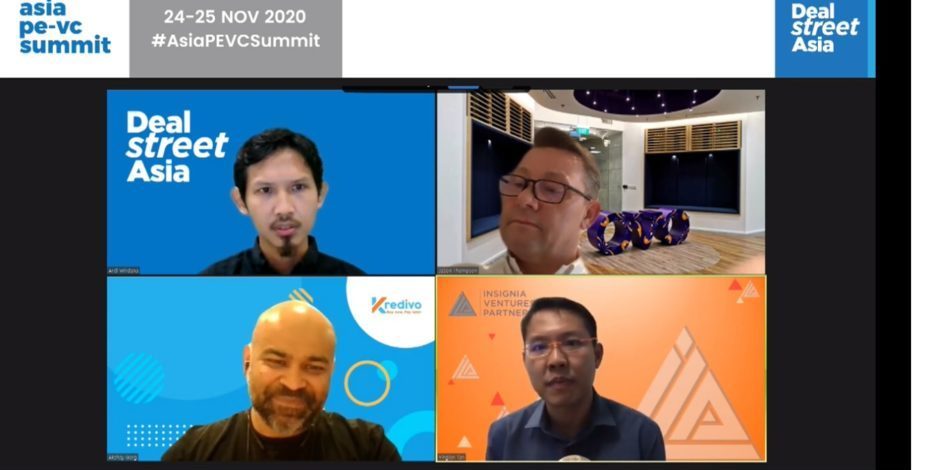

Indonesians are an optimistic lot and that attitude will help the country rebound quickly from the technical recession it is currently in, predicts Jason Thompson, the CEO of payments platform OVO. He was speaking at the Asia PE-VC Summit 2020 organised by DealStreetAsia last week.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com