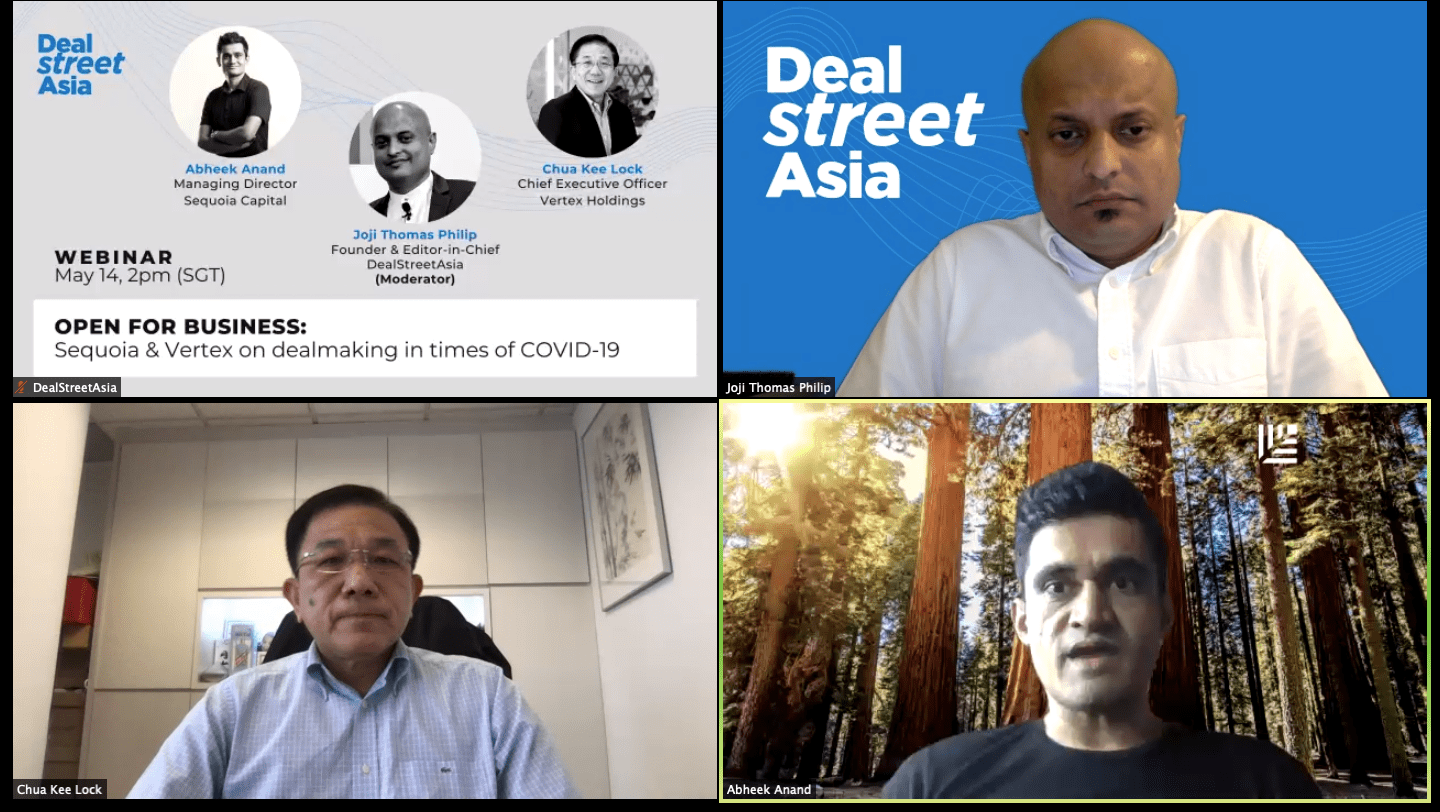

In DealStreetAsia’s second webinar on May 14, 2020 – Open for Business: Sequoia and Vertex on deal-making in times of COVID-19 – Sequoia Capital India managing director Abheek Anand and Vertex Holdings CEO Chua Kee Lock talked about how the disruption caused by the pandemic has dramatically altered the way fund managers go about pursuing deals.

Both Sequoia and Vertex were involved in large deals that got announced earlier this month. Live streaming platform M17 recently announced a $26.5-million round led by the Vertex Growth Fund while Sequoia Capital led the $109-million mega-round in Indonesian coffee chain Kopi Kenangan.

Based in Singapore, Anand focuses on a range of sectors including fintech, education and consumer internet across Southeast Asia. Chua is CEO of Vertex Holdings, a Singapore-headquartered VC investment holding company, and is concurrently the managing partner of Vertex Ventures Southeast Asia and India, as well as the chairman of Vertex Growth Fund.

In conversation with DealStreetAsia’s editor-in-chief and founder Joji Thomas Philip, Anand and Chua talked about the challenges fund managers face with respect to due diligence, valuations and down rounds, and the investment outlook over the next 24 months.