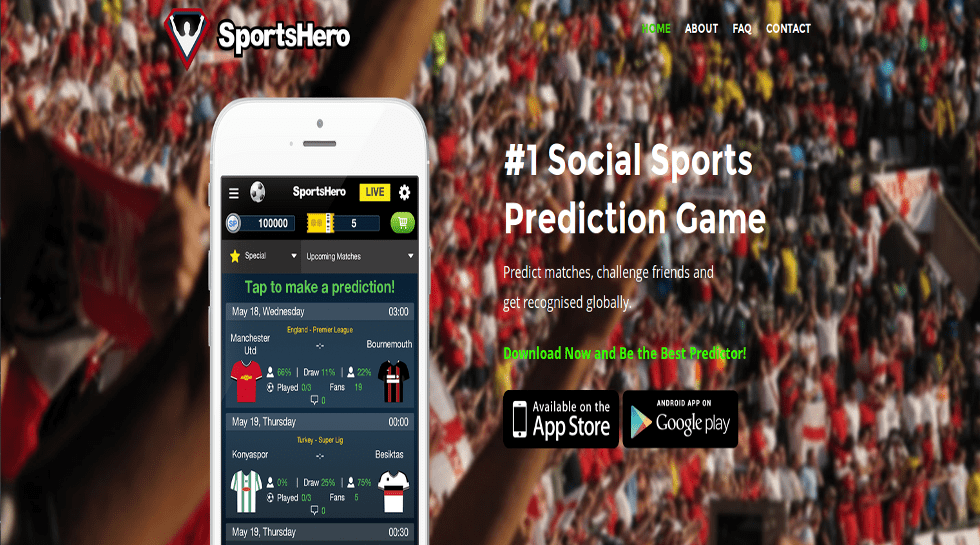

SportsHero (SportsHero.mobi), the world’s first social network dedicated to sports prediction, is heading for a listing on the Australian Securities Exchange (ASX) through a reverse takeover (RTO) of Nevada Iron Ltd (ASX: NVI). As part of the transaction, a placement of 60 million shares of common stock at AU$0.05 per share are being issued, raising A$3 million ($2.24 million).

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com