In DealStreetAsia’s third webinar on July 16, 2020 – Alternative financing & dealmaking: How investors are overcoming pandemic’s fundraising hurdles – we looked at the overall opportunities set for various private capital strategies when the COVID-19 pandemic continues to batter businesses around the world.

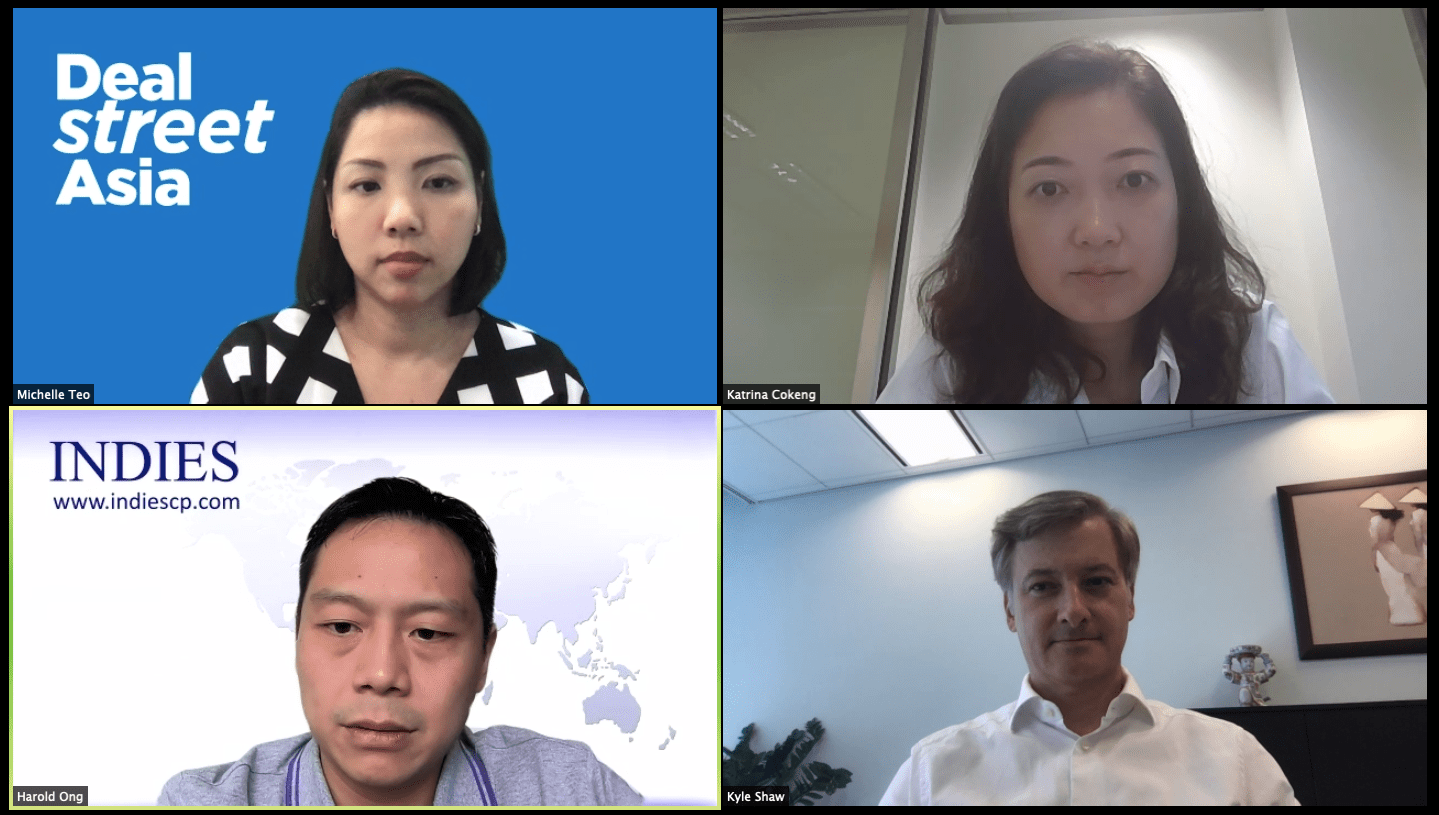

The panellists at DealStreetAsia’s fourth webinar were Harold Ong, managing director at Indies Capital Partners; Katrina Cokeng, co-founder and group CEO of Xen Capital; and, Kyle Shaw, the founder and managing partner of ShawKwei Partners.

Alternative financing providers believe there is still time before opportunities in this crisis start to become evident as central banks globally have been quick with relaxed lending norms to support businesses.

In conversation with DealStreetAsia’s managing editor Michelle Teo, our panelists talked about their investment approaches in the pandemic times, the changing alternative financing landscape, attractive asset classes and shift in strategies with the geopolitical environment.

Watch the video of the webinar or read the transcript below, which has been edited for brevity and clarity.