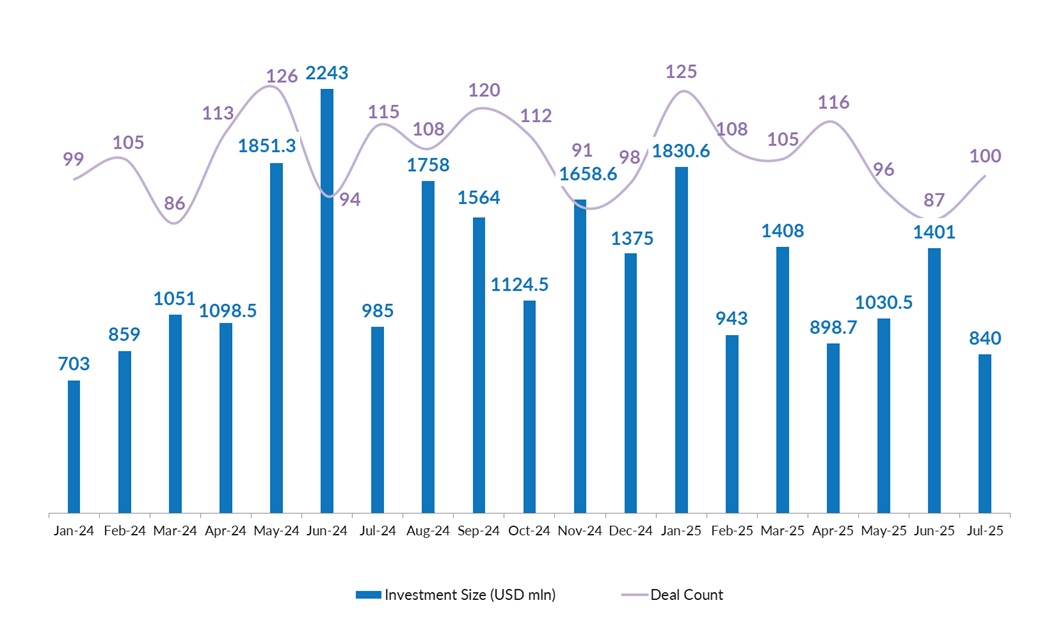

India Deals Barometer Report: Startup funding hits 18-month low of $840m in July

Startup funding in July dropped to its lowest level in the past 18 months, signalling cooling investor activity amid uncertainties in the global economy, tighter capital flows, and increased scrutiny of startups.

According to proprietary data compiled by DealStreetAsia, the $840 million that Indian startups raised in July represents a steep 67% decline from the $1.4 billion raised in the previous month.

However, deal activity remained resilient, driven by a surge in early-stage investments. The number of deals rose to 100 in July, compared with 87 in the previous month, the data showed.

On a year-on-year basis, too, the decline in deal value was significant. Funding in July 2025 fell nearly 15% from the $985 million recorded in July 2024, while overall deal volume slipped 13% compared to the same period last year.

Startup fundraising in India

After starting the year on a strong note with $1.83 billion raised in January, funding levels fluctuated month to month, reflecting market uncertainty. Despite brief rebounds in March and June, the overall trend in 2025 showed a gradual decline, pointing to changing market conditions.

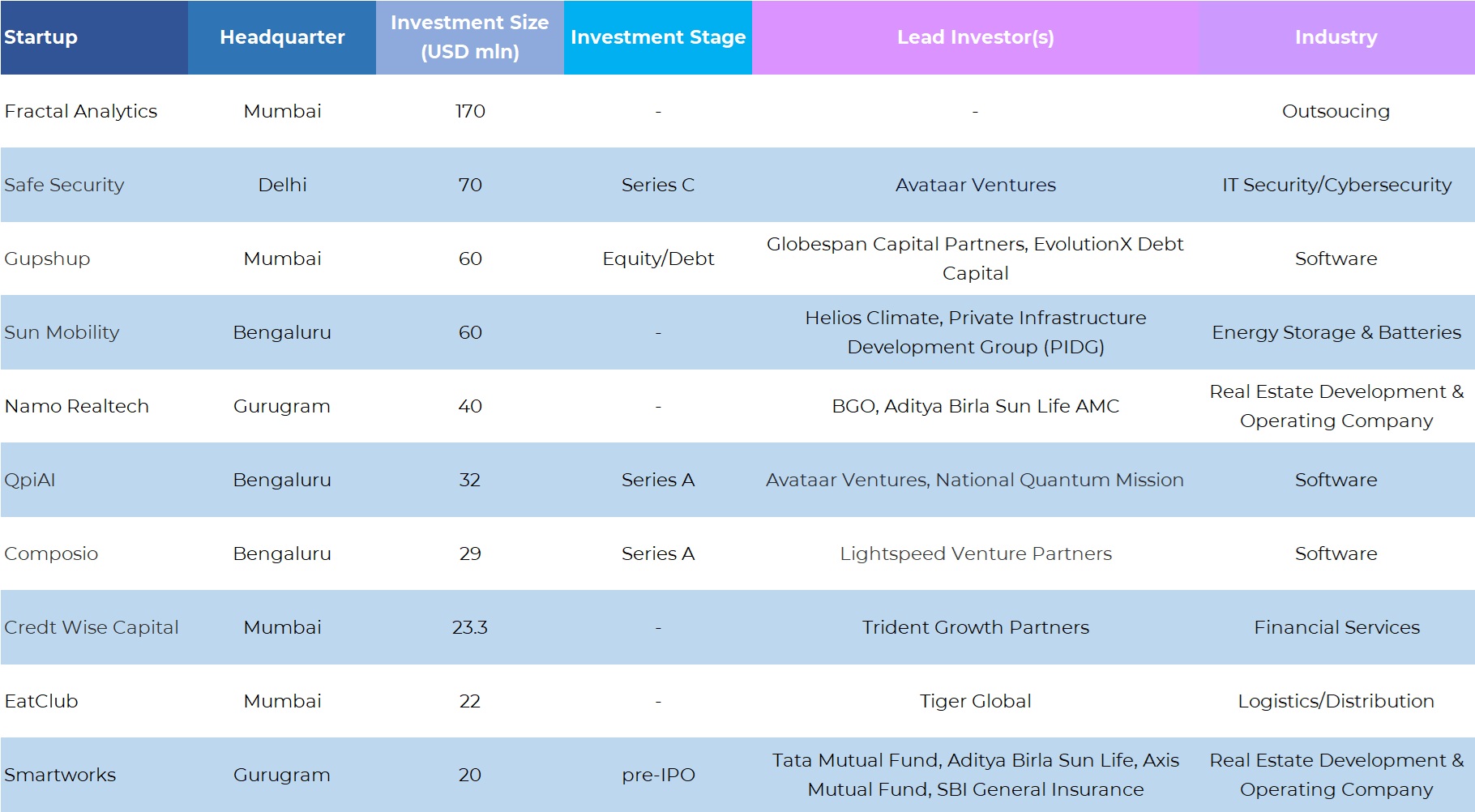

Top 10 deals in July 2025

Mega deals—defined as funding rounds valued at $100 million or more— remained scarce in July. The only notable transaction in this category was a $170-million funding round by artificial intelligence (AI) analytics firm Fractal Analytics. The fresh capital came in the wake of Apax Partners, an existing investor, exiting its 6% stake in the company.

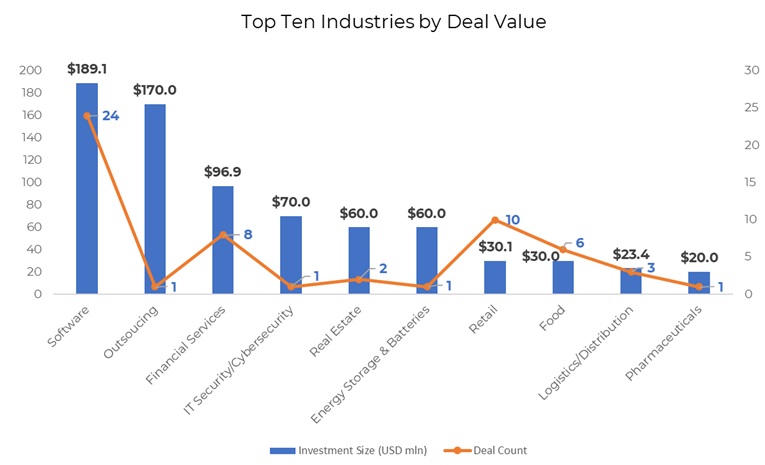

Software industry shines

The software industry emerged as the top fundraiser in July, with total proceeds of $189.1 million from 24 deals. Software startups had raised $56.2 million in June from seven deals. Within software, AI-driven B2B messaging platform Gupshup raised the largest round, a $60 million equity and debt funding from Globespan Capital Partners and EvolutionX Debt Capital.

Other prominent deals within software were quantum computing startup QpiAI ($32 million), agentic AI startup Composio ($29 million), deeptech startup Kluisz.ai ($9.6 million), Metaforms ($9 million) and STAN ($8.5 million).

Fractal Analytics’ $170-million deal pushed up outsourcing industry to the second place. Fractal Analytics raised the aforementioned funding through a secondary share sale, valuing the company at $2.44 billion.

The financial services industry, which has been an investor favourite, occupied the third spot with a total of $96.9 million in funding from eight transactions. Credit Wise Capital, a Mumbai-based NBFC focused on two-wheeler and MSME loans, was the industry’s largest fundraiser in July, with $23.3 million in funding from Trident Growth Partners.

Among other dealmakers within financial services were fintech unicorn Navi ($20 million), education-focused NBFC Varthana ($18.6 million), FincFriends ($11.5 million), Mufin Green Finance ($6.5 million) and InPrime Finserv ($6 million).

The top three industries—software, outsourcing and financial services—cumulatively raked in about $456 million, or 54% of the total proceeds, in July.

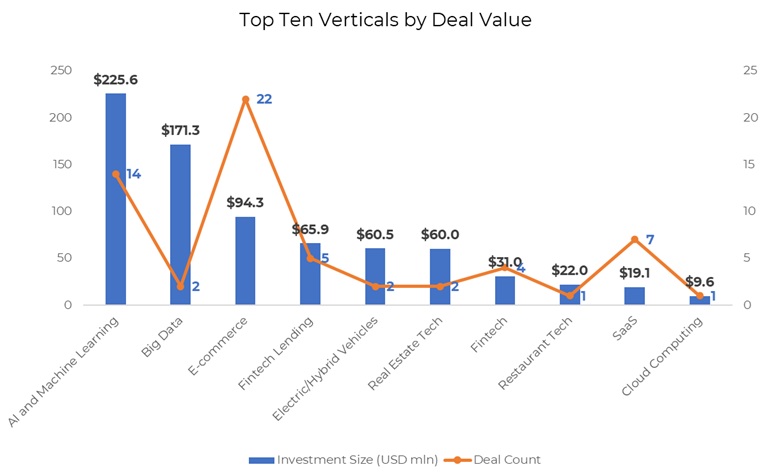

Early-stage deals drive July activity

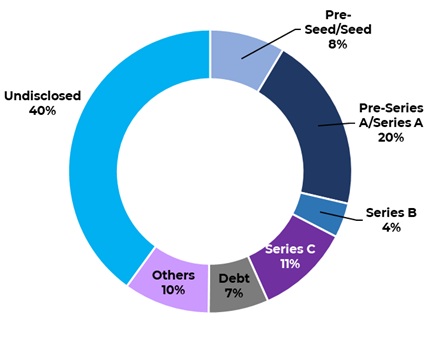

Despite an overall dip in total startup funding, early-stage investment activity surged in July 2025, signalling sustained investor interest in emerging ventures. Pre-Series A and Series A rounds collectively attracted $168.7 million—nearly double the $89.6 million recorded in June. Deal volume in this segment also doubled, rising to 31 from just 16 in the previous month, indicating a strong appetite for backing young startups.

Deals by funding stage in July 2025

The month’s largest Series A round was raised by quantum computing startup QpiAI, which secured $32 million in a round led by Avataar Ventures and India’s National Quantum Mission.

Other notable Series A deals included Composio ($29 million), Netrasemi ($12.5 million), Metaforms ($9 million), STAN ($8.5 million), EduFund ($6 million), and EVeez ($5.4 million).

Pre-seed and seed-stage funding also saw a robust uptick, climbing to $72.1 million in July from $46.4 million in June. The standout in this category was deeptech startup Kluisz.ai, which raised a $9.6 million seed round led by RTP Global. The round drew participation from prominent investors such as Unicorn India Ventures, Blume Founders Fund, Climber Capital, and several high-profile angels, including Ritesh Agarwal (OYO), Dr. Ritesh Malik (Innov8), and Aditya Virwani (Embassy Group).

Meanwhile, growth-stage investments—comprising Series B and later rounds, including private equity and pre-IPO deals—saw a sharp decline in their share of total funding. In July, these rounds accounted for just 17% of overall funding, down significantly from 67.5% in June. Growth-stage startups raised a total of $143.2 million across six deals in July, a steep drop from the $947 million raised through 21 transactions in June.

During the month, growth-stage deals were inked by Safe Security ($70 million Series C), Truemeds ($20 million Series C), Smartworks ($20 million pre-IPO), Khetika ($18 million Series B), SuperK ($11.7 million Series B), and Lo! Foods ($3.5 million).

Top investors

Inflection Point Ventures (IPV) and Peak XV Partners emerged as the top investors in July with four investments each. IPV led funding in startups including home services marketplace Clean Fanatics, insuretech platform Bharatsure, protein-focused food startup FitFeast, and IoT-enabled parking platform Parkobot.

Meanwhile, Peak XV Partners invested in e-pharmacy and telehealth platform Truemeds, AI startup Metaforms, fertility-tech startup Luma Fertility, and home décor startup Vaaree.

Blume Founders Fund, GVFL, InfoEdge Ventures, Together Fund, and Unicorn India Ventures made it to the second place with three investments each.

Other prominent investors in the month were Antler, Atrium Venture, Avataar Ventures, Elevation Capital, General Catalyst, IAN Group, and Kae Capital.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Bring stories like this into your inbox every day.

Sign up for our newsletter - The Daily Brief

Related Stories

Venture Capital

Greater China Deals Barometer Report: July dealmaking holds up amid signs of market recovery

Fundraising in Greater China continued its upward trajectory in July as startups in the region collectively raised over $6.6 billion, the highest-ever monthly deal value recorded this year.

Venture Capital

SE Asia Deals Barometer Report: Startup funding surges in July on a billion-dollar data centre deal

Southeast Asia’s startup funding activity rebounded sharply in July, with total investment value more than quadrupling from the previous month, driven by a single billion-dollar transaction in Singapore.