India Deals Barometer Report: Startup funding halves to $922m in Nov, megadeals dry up

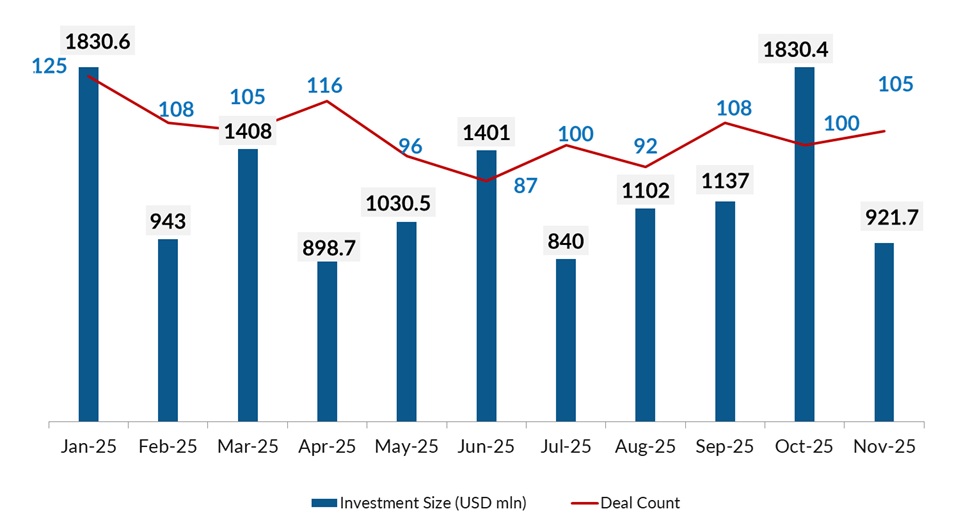

Startup funding in India nearly halved month-on-month to $922 million across 105 venture capital and private equity transactions in November, according to proprietary data compiled by DealStreetAsia.

In October 2025, Indian startups collectively secured $1.83 billion across 100 deals, the data showed.

On a year-on-year basis, the funding value fell 44.4% in November 2025 from $1.65 billion across 91 deals in November 2024.

Big-ticket funding, or megadeals (deals valued at $100 million and above), floundered in the month with just one transaction. In comparison, there were four megadeals worth $955 million in October 2025.

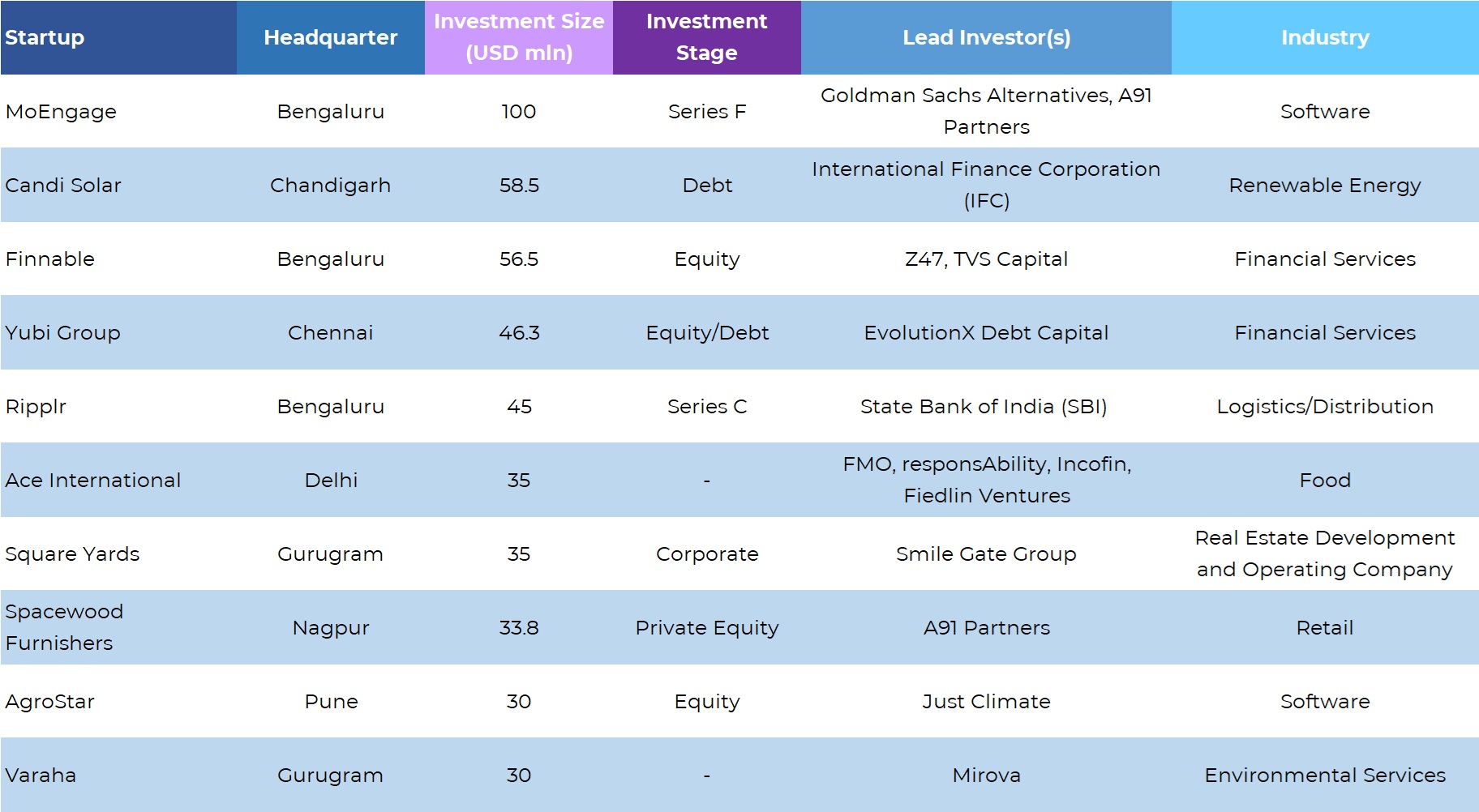

In the largest deal in the month, MoEngage, a customer analytics and cross-channel engagement platform based in San Francisco and Bengaluru, secured $100 million in a Series F funding round led by existing investor Goldman Sachs Alternatives and new investor A91 Partners. The latest fundraise brought MoEngage’s total funding to more than $250 million.

Top 10 deals in November 2025

Other notable deals in the month included Candi Solar, a solar power solution provider for commercial and industrial clients, that secured $58.5 million in debt funding; digital lending platform Finnable that raised nearly $56.5 million in equity funding; fintech platform Yubi Group raised around $46.3 million; and Ripplr, a technology driven distribution and supply chain platform, which raised $45 million in its Series C funding round.

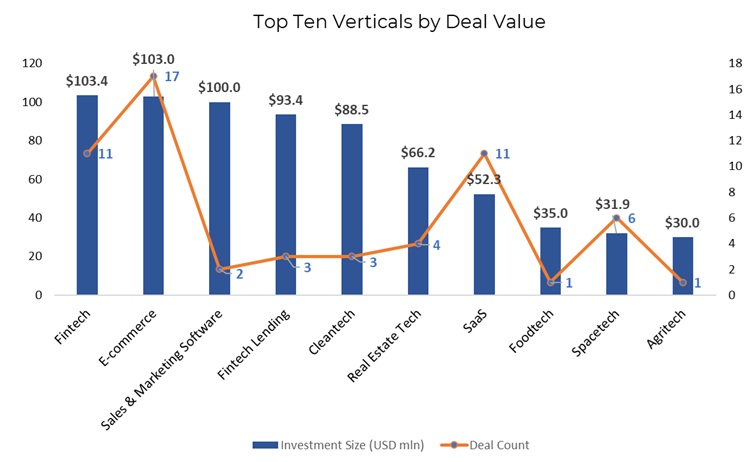

Financial services tops funding charts

Financial services emerged as the most funded industry in November. These startups collectively garnered $190.9 million across 12 deals in the month, down 57.5% from $449.6 million across 15 deals in the previous month.

Within financial services, digital lending platform Finnable raised the largest round of nearly $56.5 million in equity funding from Z47 and TVS Capital. Finnable uses data-driven insights and a credit approach to provide quick loans for working professionals.

Loan distribution and management platform Yubi followed with a $46.3-million funding in November through a mix of long-term structured debt and equity from EvolutionX Debt Capital and founder Gaurav Kumar.

Other prominent deals within the industry were education-focused NBFC Auxilo ($25.5 million), wealth and asset management firm Neo ($25 million), wealth management startup Wealthy ($14.5 million), and consumer lending platform Moneyview ($11.4 million).

Software ranked second with $189.6 million in total funding proceeds from 24 deals. In comparison, software startups raised $409.4 million in funding from 23 deals.

Within software, MoEngage led the pack with a $100-million funding followed by agritech startup AgroStar, which raised $30 million in a round led by environment-focused investment firm Just Climate.

Other notable deals within software in the month included AI research startup Redrob ($10 million), AI driven procurement platform Zinit ($8 million), insurtech startup Pibit.AI ($7 million), voice AI startup Synthio Labs ($5 million), financial infrastructure startup Zynk ($5 million), and workspace aggregator Stylework ($3.39 million).

Logistics and distribution industry made it to the third place with $74.6 million in funding across four deals, including Ripplr ($45 million), Pidge ($13.6 million), Agraga ($12 million), and Stackbox ($4 million).

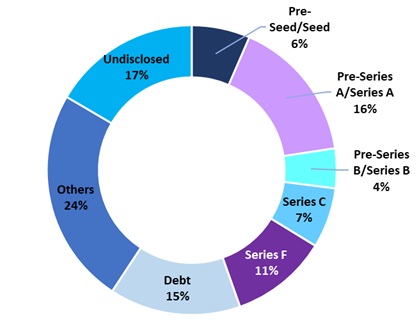

Growth-stage funding lose momentum

Companies in the Series B or post-Series B rounds (including private equity) collected an aggregate of $211.8 million—about 23% of the total deal value—through six investments. In comparison, these rounds raised a total of $957 million in October, accounting for 52.3% of the overall funding.

Key growth-stage deals during the month included MoEngage ($100-million Series F), Ripplr ($45-million Series C), Agnikul ($17-million Series C), Wealthy ($14.5-million Series B), and The Policy Exchange ($1.5-million Series B).

The value of pre-seed and seed deals too fell to $60 million in November from $83.2 million in October. Their number also fell to 36 in the month from 38 in October.

Zinit, an AI-powered procurement platform, raised the largest seed round of $8 million, led by AltaIR Capital, with participation from DVC and other investors. Other seed rounds during the month were closed by Synthio Labs ($5 million), Zynk ($5 million), Axirium Aerospace ($3.5 million), Tribe Stays ($2.8 million), AxiTrust ($2.63 million), and CtrlB ($2.5 million), among others.

Meanwhile, about 24 pre-Series A and Series A transactions worth $148.2 million were closed in the month, marginally down from $158.8 million across 20 transactions in October. The largest Series A round of $22.6 million was raised by rural vehicle and mobility solutions platform Tractor Junction. The round was led by Astanor, a Europe-based impact fund, with participation from existing investors Info Edge and Omnivore.

Other Series A rounds in the month included Pidge ($13.6 million), 3ev Industries ($13.4 million), Whizzo ($11 million), Brandworks Technologies ($11 million), STAN ($10.5 million), Redrob ($10 million), and Pibit.AI ($7 million), among others.

Top investors

Inflection Point Ventures emerged as the top investor in November with five investments each, including tech-driven fashion supply-chain platform Thimblerr, home decor brand The Artment, EV battery-as-a-service company BatteryPool, music licensing platform Hoopr, and EV charging ACS Energy, per the data.

GVFL occupied the second spot with four investments including HRS Navigation, Protouch, DOCO, Brandworks Technologies. Venture capital firms 3one4 Capital, 8X Ventures, Info Edge, Riverwalk Holdings, Sauce VC, and Titan Capital made three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Bring stories like this into your inbox every day.

Sign up for our newsletter - The Daily Brief

Related Stories

Venture Capital

Greater China Deals Barometer Report: Startup funding slows down in Nov as mega deals dwindle

Startup funding in Greater China slowed down in November amid a sudden drop in big-ticket investments.

Venture Capital

SE Asia Deals Barometer Report: Startup funding rebounds in Nov sans megadeals

Startup funding in Southeast Asia rebounded in November, supported by a cluster of mid- and late-stage cheques, even as the market again went without a $100 million-plus megadeal.