Greater China Deals Barometer Report: Startup funding slows down in Nov as mega deals dwindle

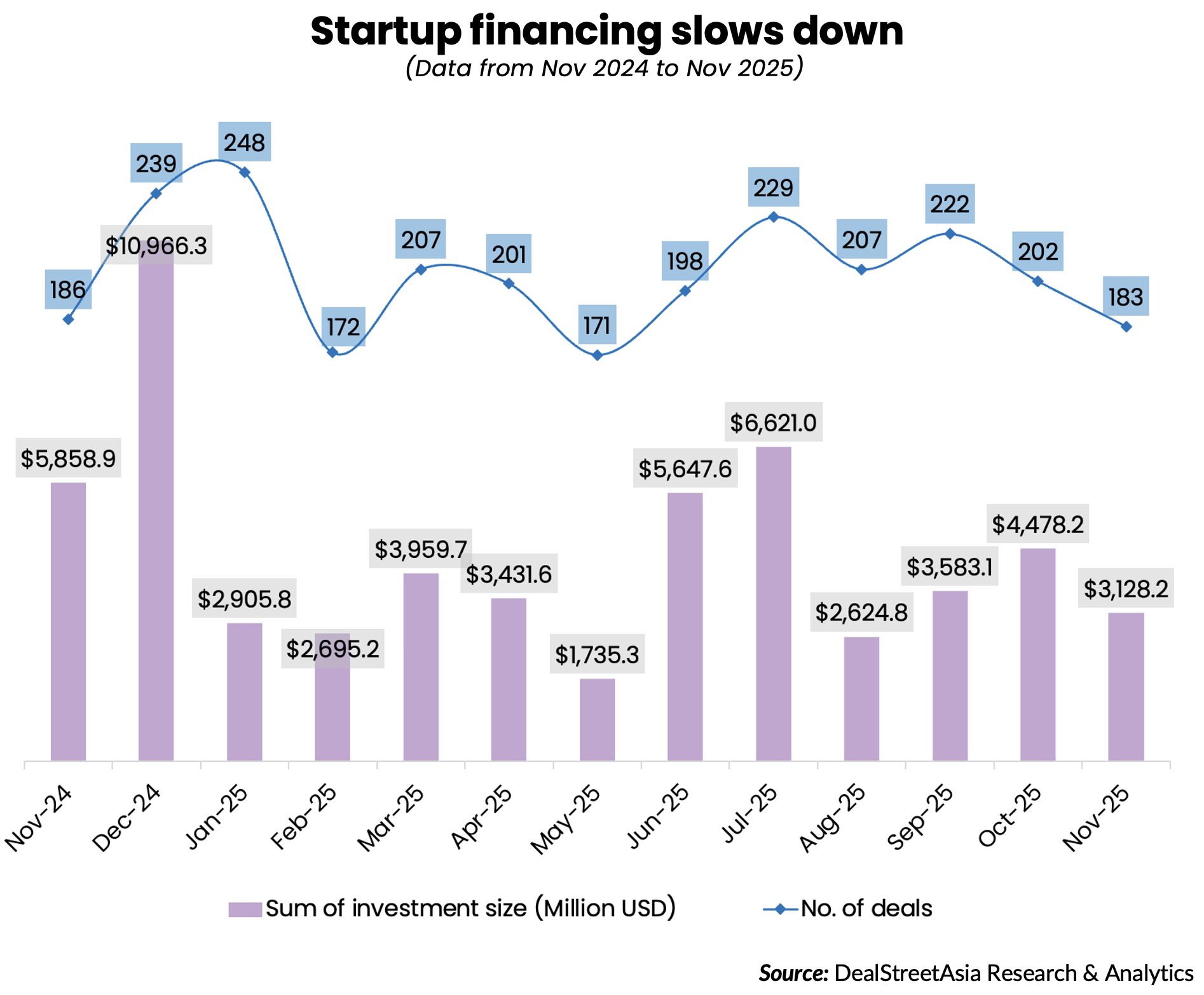

Startup funding in Greater China slowed down in November amid a sudden drop in big-ticket investments.

The month saw the completion of 183 startup investments, down 9.4% from the previous month. Startups collectively raised a total of over $3.1 billion, representing a 30.1% decrease from October, due to a lack of hundred-million-dollar financing, according to DealStreetAsia’s proprietary data.

On a year-over-year (YoY) comparison, the month’s funding total was down by a significant 46.6% from the near $5.9 billion raised in November 2024. The number of investments also dipped by 1.6% from one year ago.

The year’s startup financing activity showed earlier signs of a slowdown than usual, as investors in the Greater China market typically would pick up their dealmaking pace in the few months ahead of the week-long Chinese New Year holiday. The official Chinese New Year holiday in 2026 falls on February 16-22 for mainland China.

But, to some extent, 2025 is already a better year than 2024: In the first 11 months, startups in Greater China completed a total of 2,240 deals, overtaking the 2,209 deals recorded throughout last year.

The year’s deal value, however, is looking unlikely to beat 2024’s $60.6 billion. Startups in the market raised just $40.8 billion in the first 11 months of 2025, still falling short of last year by almost $19.8 billion.

Business support services sector sees 2 megadeals

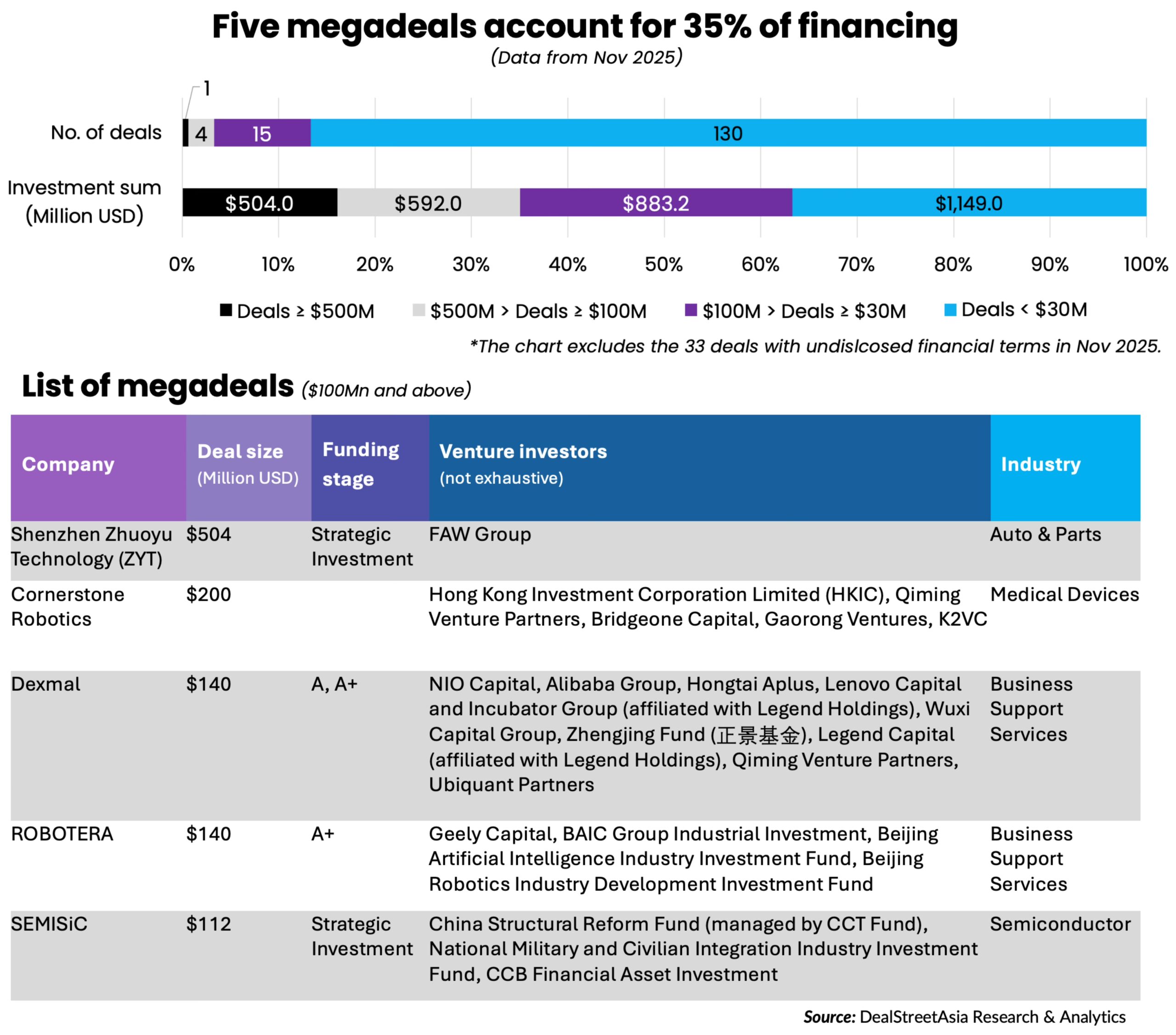

The premature dealmaking slowdown, alongside a sudden drop in megadeals (defined as investments of at least $100 million) were the two main reasons behind the sluggish funding in November.

Five megadeals collectively raised just under $1.1 billion in November, accounting for 35% of the monthly funding total. That compared to October, when the near-$2.8 billion across 12 megadeals represented 62.5% of last month’s financing.

Shenzhen Zhuoyu Technology (ZYT), an advanced assisted driving solutions (ADAS) developer spun out of Chinese drone giant DJI, raised a strategic investment of about $504 million from the state-owned automaker FAW Group to become November’s top deal.

It was followed by surgical robotics developer Cornerstone Robotics, whose oversubscribed $200-million round made it the second-biggest fundraiser of the month. The Hong Kong government-owned Hong Kong Investment Corporation Limited (HKIC) led the deal, with participation from investors like Qiming Venture Partners, Bridgeone Capital, Gaorong Ventures, and K2VC.

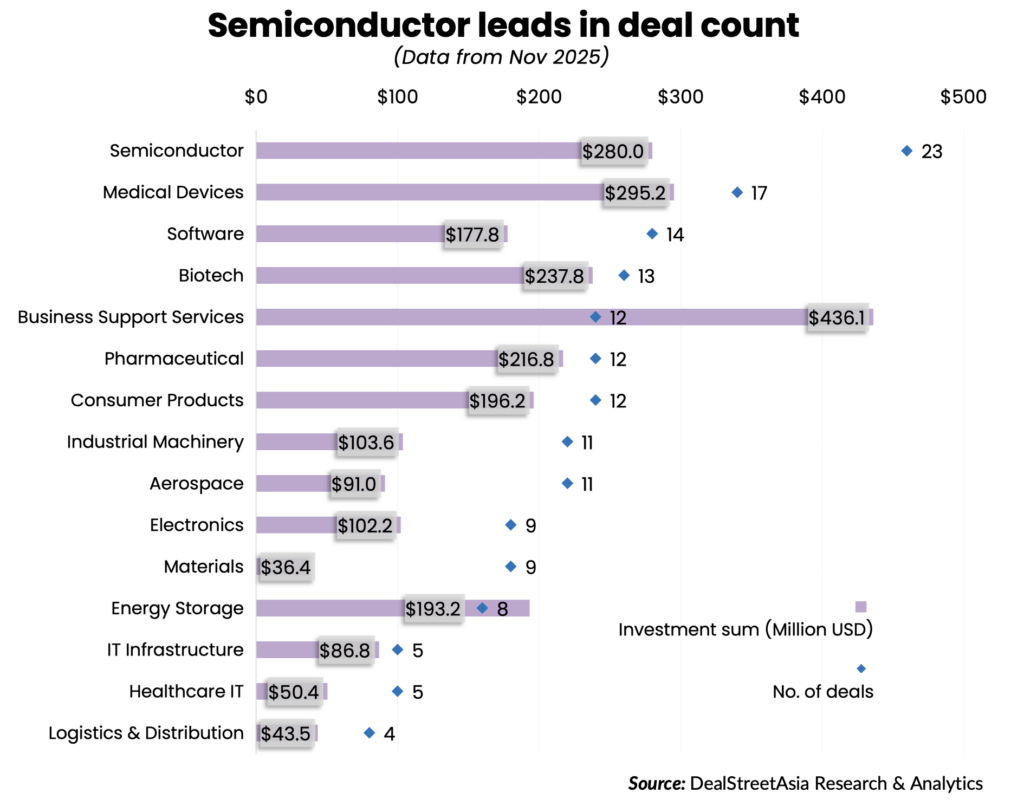

Across industries, business support services emerged as the month’s best-funded industry – with $436.1 million raised across 12 investments – thanks to the completion of two megadeals, namely Dexmal’s $140-million Series A+ round and ROBOTERA’s Series A, A+ financing that totalled $140 million.

The two startups are both developers of embodied intelligence products for commercial use in areas such as logistics and warehousing automation. This is one of the most sought-after, artificial intelligence (AI)-powered sectors where investors expect commercialisation and mass adoption to accelerate in the months to come.

In terms of deal volume, semiconductors ranked first with the completion of 23 deals amid sustained investor interest, as the advancement of homegrown chips remains central to the national tech agenda.

Top investors

Early-stage investments, Series A or earlier, continued to dominate the dealmaking scene with 118 investments, or 64.5% of November’s deal count.

The deal tally tapered in the later funding stages, with Series B, C, and D to pre-IPOs recording 22, nine, and two investments in the month, respectively.

With China still a venture- and growth-oriented market, the funding situation across stages remained the same as in prior months: The later the funding stage, the fewer the number of deals. But an increase in mergers and acquisitions (M&A) talks over recent months indicates that its transition into a mature market featuring more control-focused investments is underway.

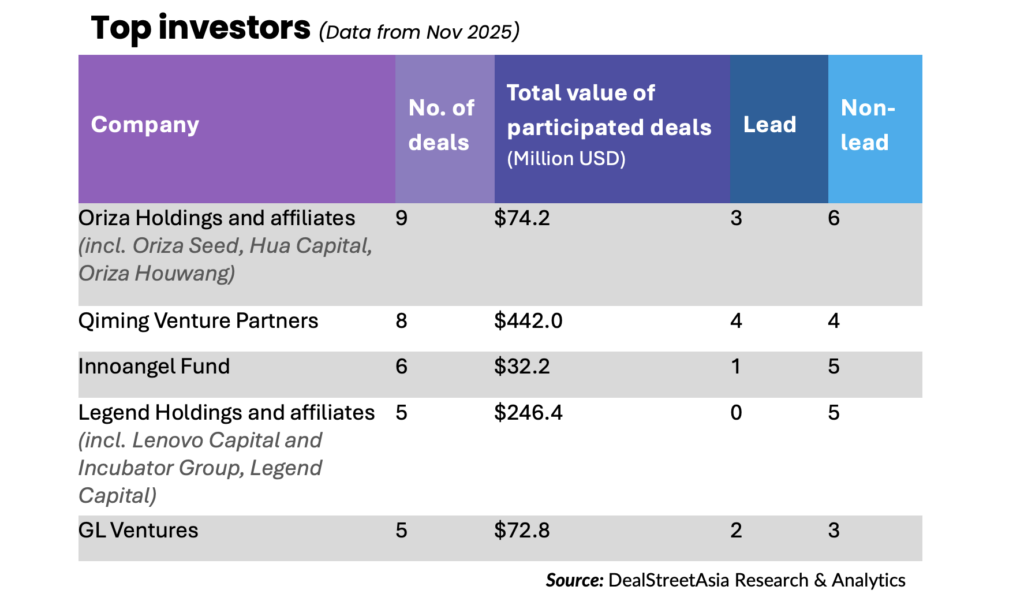

The month featured a diverse list of five top investment institutions, including state capital-backed funds known for dealmaking in Chinese yuan, and funds historically known for managing US dollars for venture investments in China. Among them were also corporate investment platforms and fund managers specialised in angel financing into university startups.

Oriza Holdings led the pack with the group and its affiliated fund platforms investing in a total of nine deals worth a combined $74.2 million in November.

One of China’s largest equity investment groups, Oriza Holdings, has a cumulative fund management scale of over 120 billion yuan ($17 billion) with strategies spanning direct equity investments, debt financing, and primary fund investments – under which it had exposure to nearly 100 general partners (GPs) as of February this year.

Note: In our monthly analysis for November 2025, we have put together detailed charts of prominent deals, deal stages, and the most attractive sectors in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup funding rebounds in Nov sans megadeals

Startup funding in Southeast Asia rebounded in November, supported by a cluster of mid- and late-stage cheques, even as the market again went without a $100 million-plus megadeal.

Venture Capital

India Deals Barometer Report: Startup funding halves to $922m in Nov, megadeals dry up

Startup funding in India nearly halved month-on-month to $922 million across 105 venture capital and private equity transactions in November, according to proprietary data compiled by DealStreetAsia.