India Deals Barometer Report: Startup funding slips in Dec as deal activity slows

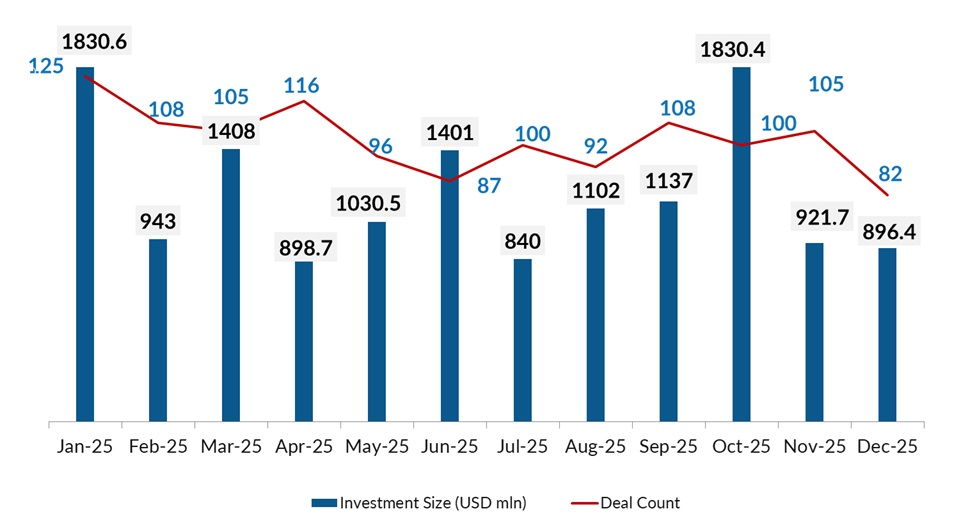

Private equity and venture capital investments in Indian startups declined further to $896 million in December, down from $922 million in November, according to proprietary data compiled by DealStreetAsia.

The decline in November had already been steep, with funding nearly halving to $922 million from $1.83 billion in October.

Deal activity also weakened in December, with the number of transactions falling to 82 from 105 in the previous month. Of the total deals recorded in the month, the value of five transactions was not disclosed, the data showed.

Both deal value and volume were lower than a year earlier, when startups raised $1.38 billion across 98 transactions.

Only two megadeals—transactions valued at $100 million or more—were announced in December, reflecting investors’ continued caution toward large bets. In comparison, one megadeal was announced in November.

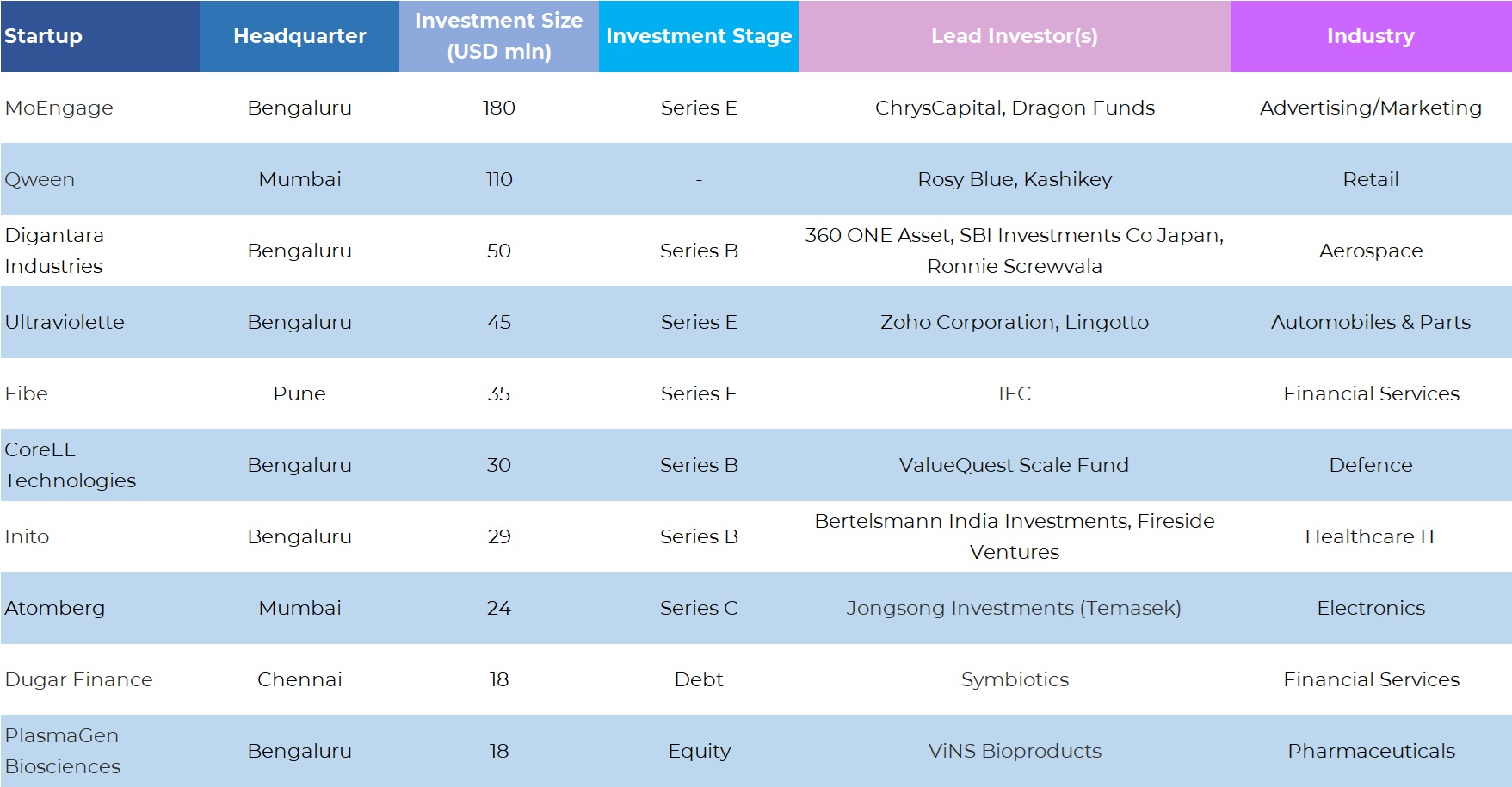

The largest transaction of the month was MoEngage’s $180 million Series F funding round. The San Francisco- and Bengaluru-based customer analytics and cross-channel engagement platform raised the capital from new investors ChrysCapital and Dragon Fund, along with Schroders Capital, while existing backers TR Capital and B Capital also participated in the round.

The latest infusion followed the $100 million raised in November 2025, bringing MoEngage’s total Series F funding to $280 million.

Top 10 deals in December 2025

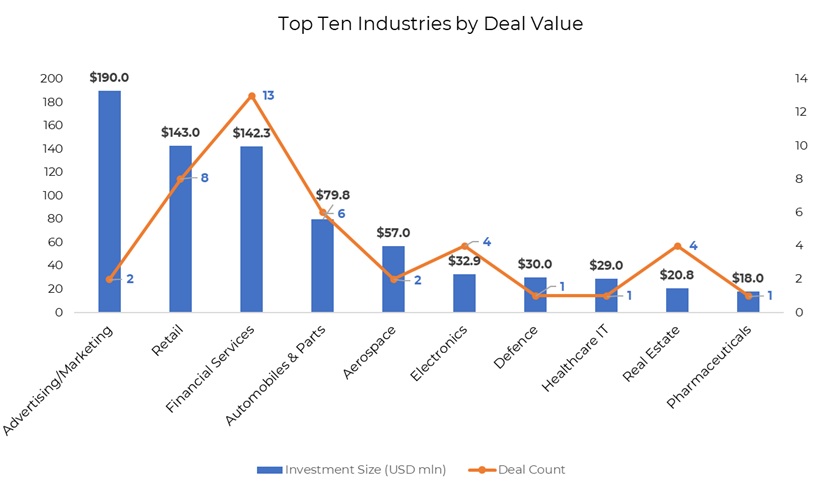

Advertising/marketing industry takes top spot

Boosted by MoEngage’s $180-million funding round, advertising and marketing emerged as the most funded sector in December, raising $190 million across just two transactions. The only other deal in the segment was Tagbin’s $10-million fundraise.

Retail ranked second with startups collectively raising $143 million across eight deals. Jewellery brand Qween led the segment after securing $110 million from global diamond major Rosy Blue and Japanese jeweller Kashikey to accelerate its nationwide expansion.

Other retail deals included furniture rental startup Furlenco, which raised $13.9 million, along with Underneat ($6 million), KNOT ($5 million), Neeman ($3.94 million), Rotoris ($3 million), among others.

Financial services startups occupied the third spot, cumulatively garnering $142.3 million from 13 transactions. Consumer lending startup Fibe, formerly known as EarlySalary, led the industry with a $35 million Series F round anchored by the International Finance Corporation. The infusion was part of Fibe’s broader equity fundraising journey, taking its total equity capital raised since inception to more than $266 million.

Other notable deals in the financial services space during the month included StockGro’s $29.7 million raise, followed by Dugar Finance ($18 million), Finvu ($15 million), PowerUp Money ($12 million), Skydo ($10 million), and Ambak ($7.84 million).

Together, the top three industries raised a total of $475.3 million, accounting for about 53% of the total deal value in the month.

Later-stage deals drive Dec surge

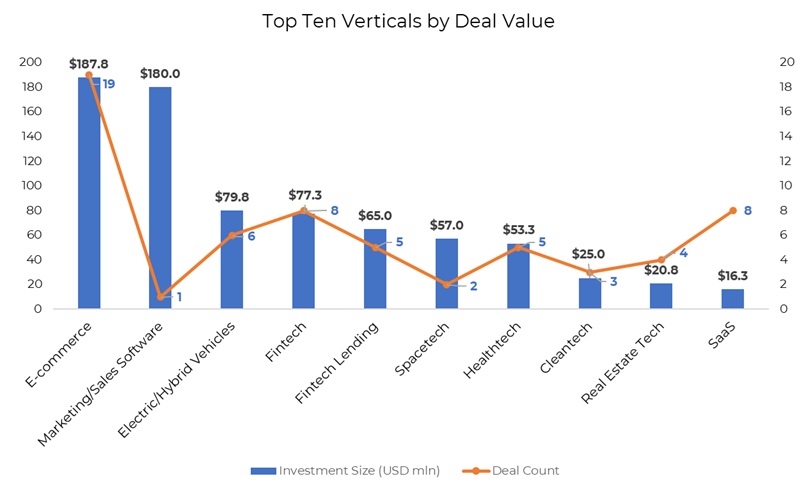

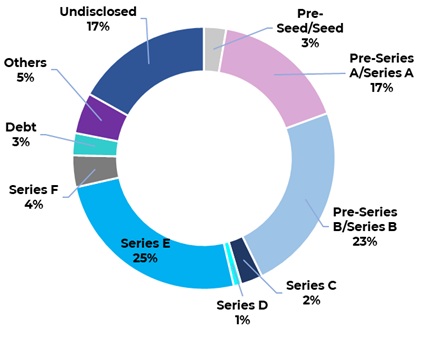

Growth-stage funding surged in December, with Series B and later-stage rounds—including private equity and pre-IPO deals—raising a total of $473.3 million across 15 transactions. The segment accounted for 53% of the month’s total deal value and more than doubled compared with $211.8 million raised in November.

Key growth-stage deals during the month included MoEngage, Ultraviolette ($45-million Series E), Fibe ($35-million Series F), Atomberg ($24-million Series C), StockGro ($13-million Series B1), and Wow! Momo ($8.4-million Series D).

Amid a muted investment climate, however, funding for pre-seed and seed-stage startups dropped sharply in December, falling 59% to $24.5 million from $60 million in November. Deal activity also slowed, with the number of transactions declining to 20 from 36.

Tax management startup Prosperr.io closed the largest seed round of the month, raising $4 million led by Jungle Ventures, with participation from Yatra Angel Network, Sadev Ventures (formerly Eternal Capital), and other investors.

Other seed rounds during the month were sealed by Rotoris ($3 million), Mannjal ($2.1 million), NeoSapien ($2 million), Lumov ($1.2 million), and ReplyAll ($750,000).

Funding in pre-Series A and Series A startups witnessed a minor jump to $149.8 million across 23 deals in December, compared with $148.2 million raised through 24 transactions in November.

The month’s biggest Series A rounds were secured by haircare brand Moxie Beauty and account aggregator Finvu, with each company raising $15 million.

Other notable Series A deals in the month were PowerUp Money ($12 million), Soleos Solar Energy ($12 million), Skydo ($10 million), Magma ($8 million), Ambak ($7.84 million), Modulus Housing ($7.83 million), Sisir Radar ($7 million), and Truva ($6.32 million).

Top investors

Venture capital firms Fireside Ventures and Peak XV Partners emerged as top investors in December with four investments each. Fireside’s investments include at-home diagnostics startup Inito, shapewear and innerwear brand Underneat, nutrition brand Earthful, and haircare brand Moxie Beauty.

Meanwhile, Peak XV Partners’ investments included wealthtech platform PowerUp Money, fintech marketplace Ambak, space-tech firm Digantara Industries, and cookware and home appliances brand EDT.

360 ONE Asset, Inflection Point Ventures, Kalaari Capital, Singularity AMC, Venture Catalysts/100 Unicorns made it to the second place with three investments each.

3i Partners, Bertelsmann India Investments, Jungle Ventures, Blume Ventures, Aavishkaar Capital, Kae Capital, Orios Venture Partners, and Stellaris Venture Partners were among other prominent investors in the month.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Bring stories like this into your inbox every day.

Sign up for our newsletter - The Daily Brief

Related Stories

Venture Capital

Greater China Deals Barometer Report: Market rebound drives startup funding to $5.5b in Dec

After a slow November, December ended on a stronger note with almost $5.5 billion being raised across 231 private-market deals in Greater China. The overall deal value grew significantly by 75.1%, while the number of investments increased by 26.2% from the previous month, according to DealStreetAsia’s proprietary data.

Venture Capital

SE Asia Deals Barometer Report: Funding slips 23% in Dec as deal count drops to record low Edit

Startup funding in Southeast Asia fell 23.3% month-on-month in December 2025, as deal count sank to its lowest level in 12 months, according to proprietary data compiled by DealStreetAsia.