China Deals Barometer Report: Startup financing halves to $4.3b in Jan in run-up to Lunar New Year

Startup financing in Greater China more than halved in January 2022, in the run-up to the week-long Lunar New Year holiday, as big-ticket transactions and dealmaking activity by top-tier investors declined.

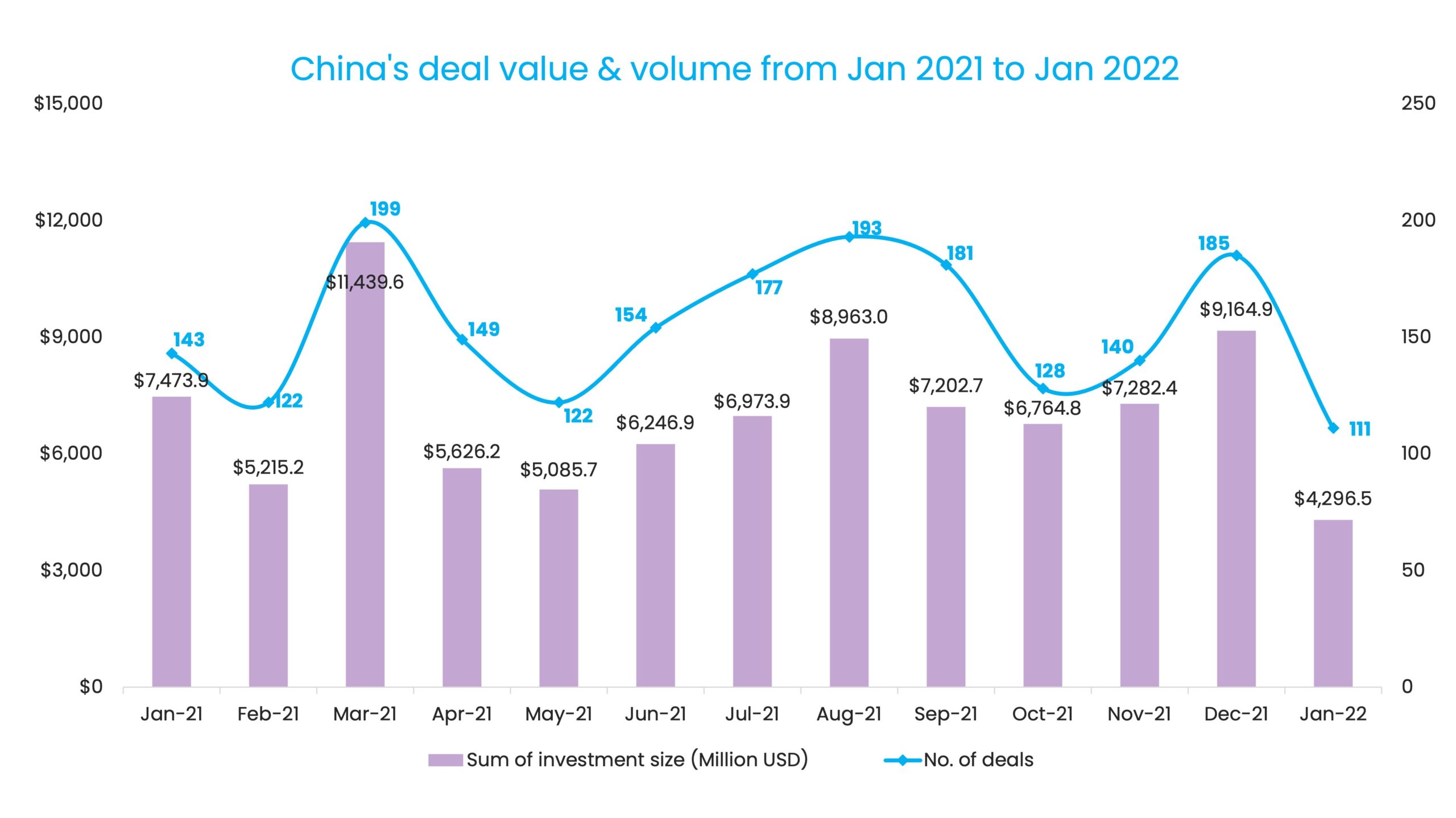

January saw the completion of 111 deals, from which startups collectively raised about $4.3 billion, according to proprietary data compiled by DealStreetAsia.

Compared with a total fundraising size of almost $9.2 billion, from 185 deals, in December, the deal value in January slumped by 53.1%, while the number of transactions reduced by 40%.

Investment of $4.3 billion in the first month of 2022 was below the average of the previous 12 months. Startups in Greater China collected a total of $87.4 billion across 1,893 private equity and venture capital deals for the entire 2021, with a 55.6% increase in annual deal value from 2020. On average, startups garnered close to $7.3 billion each month.

Megadeals dip in market slowdown

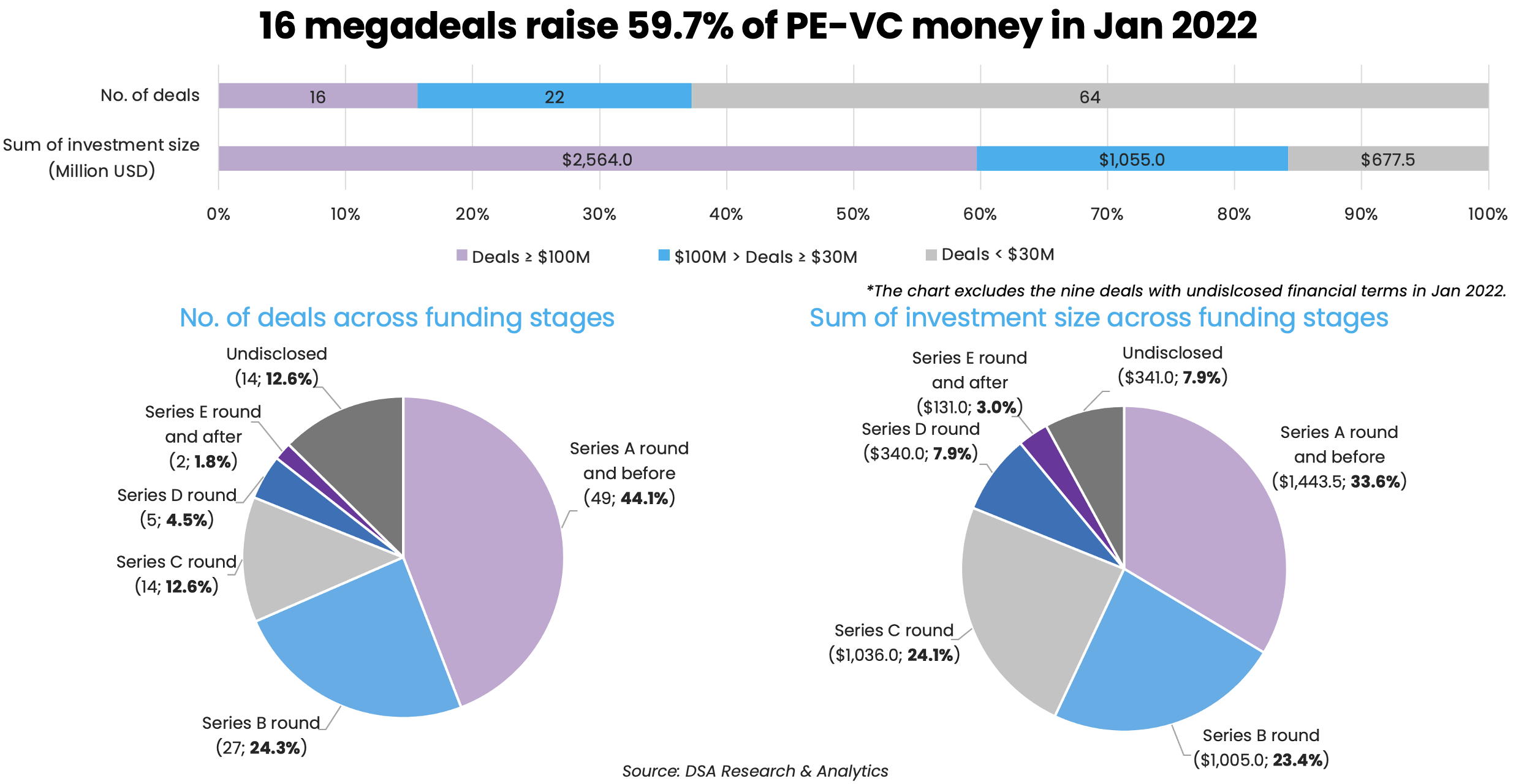

Investors’ appetite for writing large cheques was also dampened in January.

The number of megadeals, or investments worth at least $100 million, reduced to 16 in January from 24 in the month earlier. In total, these megadeals raised around $2.6 billion, or 59.7% of the month’s aggregate funding, marking a major decrease from December when megadeals amounted to over $6 billion, or 65.8% of the month’s funding.

In the biggest funding round last month, Chinese search engine giant Baidu’s electric vehicle (EV) arm Jidu Auto raised nearly $400 million in a Series A round from the parent and automaker Zhejiang Geely Holding Group. The fresh capital will help Jidu bring to the market its first mass-produced car model in 2023. The startup had closed over $300 million in a funding round at its inception in March 2021.

While fundraisers in the aerospace, logistics, and retail space completed some of the biggest deals, the semiconductor and healthcare services sectors saw slightly more megadeal transactions.

In the semiconductor industry, ChemSemi and Eigencomm each raised about 1 billion yuan ($157.8 million) to advance the development of 5G chips. Axera Tech, a developer of artificial intelligence (AI) chips for computer vision applications, amassed $126 million in a Series A++ round from investors such as Qiming Venture Partners, GGV Capital, and food delivery giant Meituan.

Two megadeals happened in healthcare services, namely in-vitro diagnostics firm Virtue Diagnostics’ $100-million Series B round and a $100-million Series C round in contract development & manufacturing organisation (CDMO) ZhenGe Biotech.

Series A and earlier funding stages emerged as the most popular phase for investors focusing on the Greater China market.

It recorded the completion of 49 deals in January, or 44.1% of the month’s total deal count. The funding stage came first in terms of deal value, with over $1.4 billion in financing that accounted for 33.6% of the aggregate funding size.

List of 16 megadeals in Jan 2022

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| JiDU | Shanghai | $400 million | A | Baidu, Zhejiang Geely Holding Group | Auto & Parts | AI and Machine Learning | |

| Galactic Energy | Beijing | $201 million | B, B+ | Oriental Fortune Capital, Huaqiang Capital | New Potential Energy Fund (affiliated with Plum Ventures), Essential Capital, JiangNan Construction & Investment Group, Yunding Capital, Shenzhen Zhongtian Fortune Fund Management, Zhonghang Hangrong, China Veterans Investment, Chengdu New Economy Venture Capital Fund, Tianhong Investment, Maiqiu Venture Capital, Hexin Fangce, Jiusong Heze, Tianqiong Xuanji, Zhidao Capital, Taicang Hongli, Haiyang Ruiming, Yangwang Xingkong, Canlan Xingkong | Aerospace | Space Tech |

| DST/DST Car Rental (Shenzhen) | Shenzhen | $200 million | D1, D2 | D1: CICC Shandong Green Development Fund (affiliated with CICC Capital) | Ingka Group | Logistics & Distribution | Electric/Hybrid Vehicles |

| HARMAY (Beijing HARMAY Lexiang Technology) | Beijing | $200 million | C, D | C: General Atlantic; D: QY Capital | GL Ventures, Eastern Bell Capital, BA Capital, N5Capital, Ocean Link | Retail | Beauty & Hygiene |

| Vital Thin Film Materials (VTFM) | Hefei | $188 million | A | CICC Capital, BYD Company Limited | Sinopec Capital, TBEA Co Ltd | Materials | N/A |

| ORVIBO | Shenzhen | $158 million | Huaxing Growth Capital (affiliated with China Renaissance), Suofeiya Home Collection, Chengdu Fusen Noble-house Industrial, State-Owned Assets Supervision and Administration Commission of Pingxiang City | Consumer Products | Internet of Things | ||

| ChemSemi | Changzhou | $158 million | A | China Internet Investment Fund (CIIF), SummitView Capital | Hubei Xiaomi Yangtze River Industrial Fund, CICC Capital, Huaxing Growth Capital (affiliated with China Renaissance), Jintaifu Capital Management, Qitai Capital, Guolian Capital, Quick Intelligent Equipment, TF Capital, Changzhou Hi-Tech Group, Zhihetong, Xinyi Capital, WI Harper Lucion Fund | Semiconductor | 5G |

| Shanghai Eigencomm Technologies | Shanghai | $157 million | C | SoftBank Group Corp’s Vision Fund 2 | Cathay Capital, CoStone Capital, GF Qianhe Investment, Chobe Capital, Qiming Venture Partners, Fenghuo Capital, China Fellow Partners, Xingwang Investment, China Universal Asset Management | Semiconductor | 5G |

| Shoplazza | Shenzhen/Toronto | $150 million | C1 | SoftBank Group Corp’s Vision Fund 2 | Chimera Investments (affiliated with Royal Group), Stepstone Group, Sequoia Capital China, Qianhai FOF, Sky9 Capital, Pantheon Asset | Internet | Saas |

| Axera Tech | Shanghai | $126 million | A++ | Qiming Venture Partners, Shanghai Innochip Investment, Meituan, Dragon Ball Capital (affiliated with Meituan), GGV Capital, Legend Star, Glory Ventures, Heju Investment Management | Semiconductor | AI and Machine Learning | |

| SiBionics | Shenzhen | $126 million | C++, C+, C | C++: CPE, China Life Innovation Fund; C+: Fortune Capital; C: Source Code Capital | Qianhai FOF, Xiamen C&D Emerging Industry Equity Investment, JG Investment, Jingming Capital, Luxin Venture Capital Group, Source Code Capital, Cedarlake Capital, Riverhead Capital | Medical Devices | HealthTech |

| Parametrix.ai | Shenzhen | $100 million | B | Sequoia Capital China | 5Y Capital, Gaorong Capital | Travel & Leisure | AI and Machine Learning |

| Virtue Diagnostics | Suzhou | $100 million | B | Sequoia Capital China, Morningside Ventures | Lilly Asia Ventures (LAV), Oriza Holdings, PerkinElmer Ventures | Healthcare Services | HealthTech |

| STARFIELD | Shenzhen | $100 million | B | Primavera Capital Group | Zeng Ming (Individual investor), Sky9 Capital, Joy Capital, Matrix Partners China, Lightspeed China Partners | Food | Foodtech |

| ZhenGe Biotech | Shanghai | $100 million | C | Goldman Sachs Asset Management, Sofina | Novo Holdings A/S, Qiming Venture Partners, IDG Capital, LYFE Capital, GT Capital, Cowin Capital | Healthcare Services | Biotech |

| NewLink | Beijing | $100 million | E1, E2 | E1: China Merchants Capital | CR Capital Management, China Merchants Capital, CICC Capital, Shandong Hi-Speed Co Ltd, Shandong Green Development Fund | Energy Storage & Batteries | CleanTech |

Sustained popularity of chip investments

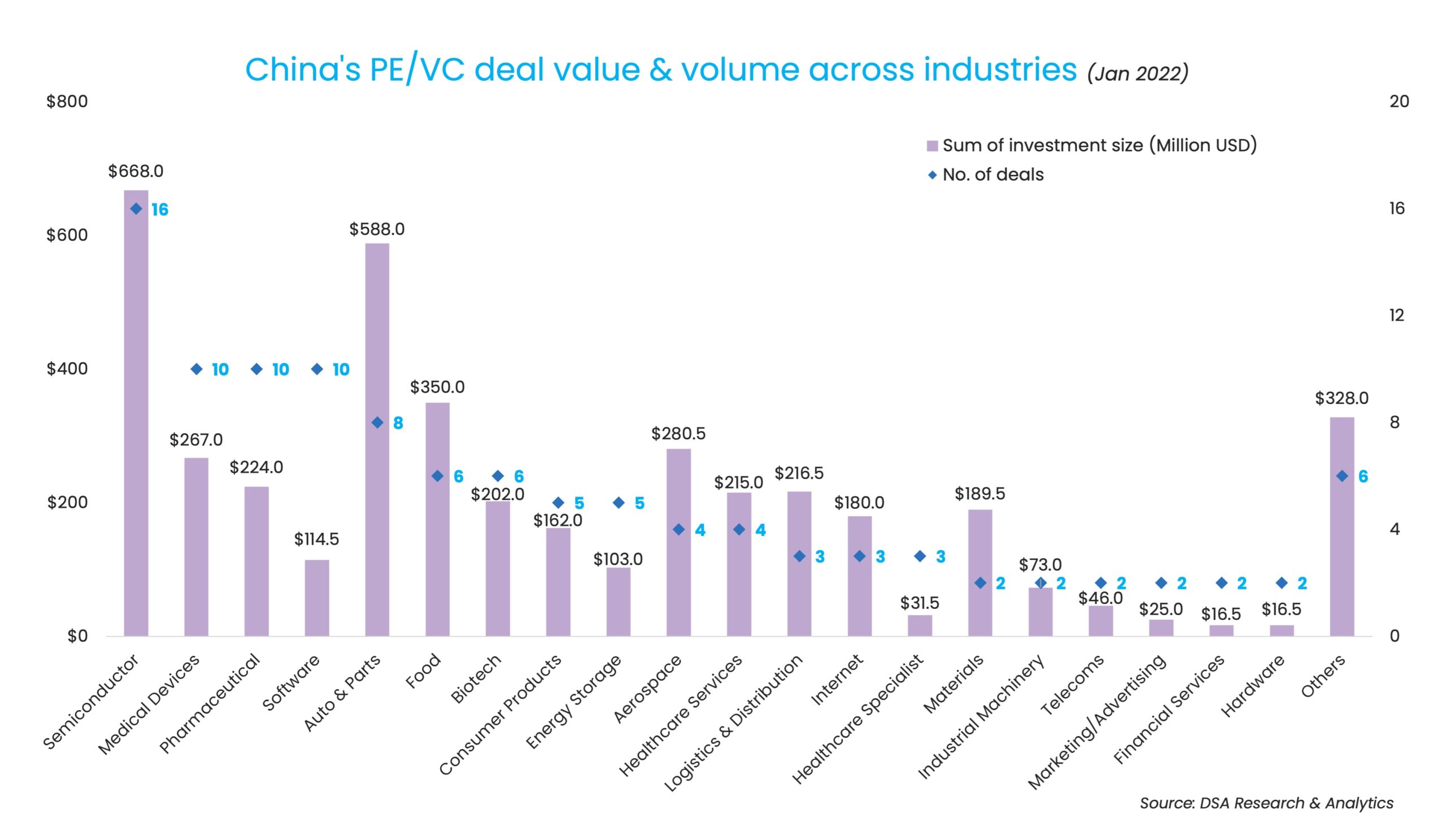

Despite the fall in megadeals and overall startup financing, the popularity of semiconductor investments extended to January.

With three megadeals, the semiconductor industry once again became the most favoured sector — 16 deals totaling $668 million. January had more buzz around chip development for AI, 5G, and Internet of Things (IoT), the verticals on which investors made more bets in the month.

Semiconductor, now the most sought-after portfolio component for investors in Greater China, has gained good traction over the months amid Beijing’s battle with the US for tech supremacy and a continued chip shortage globally.

The industry had overtaken biotech and software to top the industry ranking in December with close to $2.2 billion being raised across 18 deals. In November, semiconductor startups closed $1.4 billion across nine deals, while October witnessed $404.5 million financing flow into six semiconductor players.

Medical devices, pharmaceuticals, and software tied for second place in terms of deal count, each booking the completion of 10 deals in January. The medical devices sector led the pack with $267 million in financing, thanks to a megadeal investment of $126 million in SiBionics, which specialises in the development of active implantable medical devices and medical AI.

Eight deals happened in the auto & parts industry. But the sector raised $588 million, only second to semiconductor in terms of deal value because of EV startup Jidu’s $400-million Series A round.

CICC and affiliates overtake Sequoia China

China International Capital Corporation (CICC) and its affiliated investment platforms beat Sequoia Capital China, the bellwether of tech investments, by a neck to become the most active investment group in the Greater China market in January.

The 27-year-old Chinese investment bank, which has offices across cities like Hong Kong, New York, London, Singapore, and Tokyo, and its range of investment arms backed a total of 11 deals last month. These 11 deals, in which CICC and/or its affiliates acted as lead investors in six deals, raised a combined $792 million.

As the group’s biggest investment in January, CICC Shandong Green Development Fund led the first tranche of a $200-million Series D round in DST, a provider of new energy vehicles and related services. The CICC-backed fund was officially registered in August 2021 as a joint investment vehicle between CICC Capital and China’s state capital investor Shandong Development & Investment Holding Group to invest in carbon-neutral businesses. Its initial closing gathered about 1.5 billion yuan ($235.8 million) in capital commitments.

Besides its joint venture with the state capital investor, CICC also partnered with Chinese carmaker SAIC Motor last year to establish a 10-billion-yuan ($1.6 billion) fund for investments in auto-related tech across verticals including advanced manufacturing, Internet of Things (IoT), semiconductor, and artificial intelligence (AI). The fund, dubbed CICC SAIC Emerging Industry Fund, last month led an investment of nearly 300 million yuan ($47.1 million) in Waytous, which offers autonomous solutions for the mining industry in China.

Other investment firms associated with CICC, such as CICC Capital, biomedicine-focused CICC Qide Innovation Biopharmaceutical Equity Investment Fund, and CICC Qichen (Suzhou) Emerging Industry Equity Investment, which specialises in growth-stage deals across the healthcare, tech, and consumer sectors, also made new investments.

Most active investors in China (Jan 2022)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| CICC and affiliates | 11 | $792 million | 6 | 5 |

| Sequoia Capital China | 10 | $439 million | 3 | 7 |

| Qiming Venture Partners | 8 | $491 million | 2 | 6 |

| Matrix Partners China | 5 | $155 million | 2 | 3 |

| 5Y Capital | 5 | $150 million | 2 | 3 |

| Shunwei Capital | 5 | $36 million | 2 | 3 |

| Baidu and affiliates | 4 | $446.5 million | 2 | 2 |

| Sky9 Capital | 4 | $307 million | 0 | 4 |

| GL Ventures | 4 | $244.5 million | 2 | 2 |

| Plum Ventures | 4 | $219 million | 2 | 2 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Liya Su contributed to the story.

Note: In our monthly analysis for January 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

- Caocao Mobility

- CICC Capital

- FerroTec

- semiconductor

- Sequoia Capital China

- software

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Indian startups kickstart 2022 with $4.43b funding in January

Making a good start into the new year, Indian startups raised over $4.43 billion in Jan 2022 across 199 PE and VC transactions...

Venture Capital

SE Asia Deals Barometer Report: Startup funding in SE Asia off to a slow start with $1.7b raised in Jan, down 41% YoY

Startups garnered just over $1.7 billion in January across 126 venture capital and private equity deals...