China Deals Barometer Report: At $5.5b, startup fundraising strikes 4-month high in Dec

Dealmaking continued to warm up in December, as the Greater China market completed a total of 234 investments, up 6.4% from November.

Deal count in December 2022 showed a significant jump compared to the corresponding month of 2021, which recorded 185 transactions, according to proprietary data compiled by DealStreetAsia.

With almost $5.5 billion raised, December’s deal value hit a four-month high, recording a 41% growth over the previous month. However, it was nearly 40.3% lower when compared to December 2021.

In total, 2022 saw startups conclude a total of 2,290 deals, up 21% from 2021. But the total capital raise of $53.2 billion was 39.2% less than the $87.4 billion recorded in 2021.

Investors expect PE-VC deal activity to pick up in 2023 after China dismantled its stringent zero-COVID policy on December 7.

Megadeals as the major contributor to funding

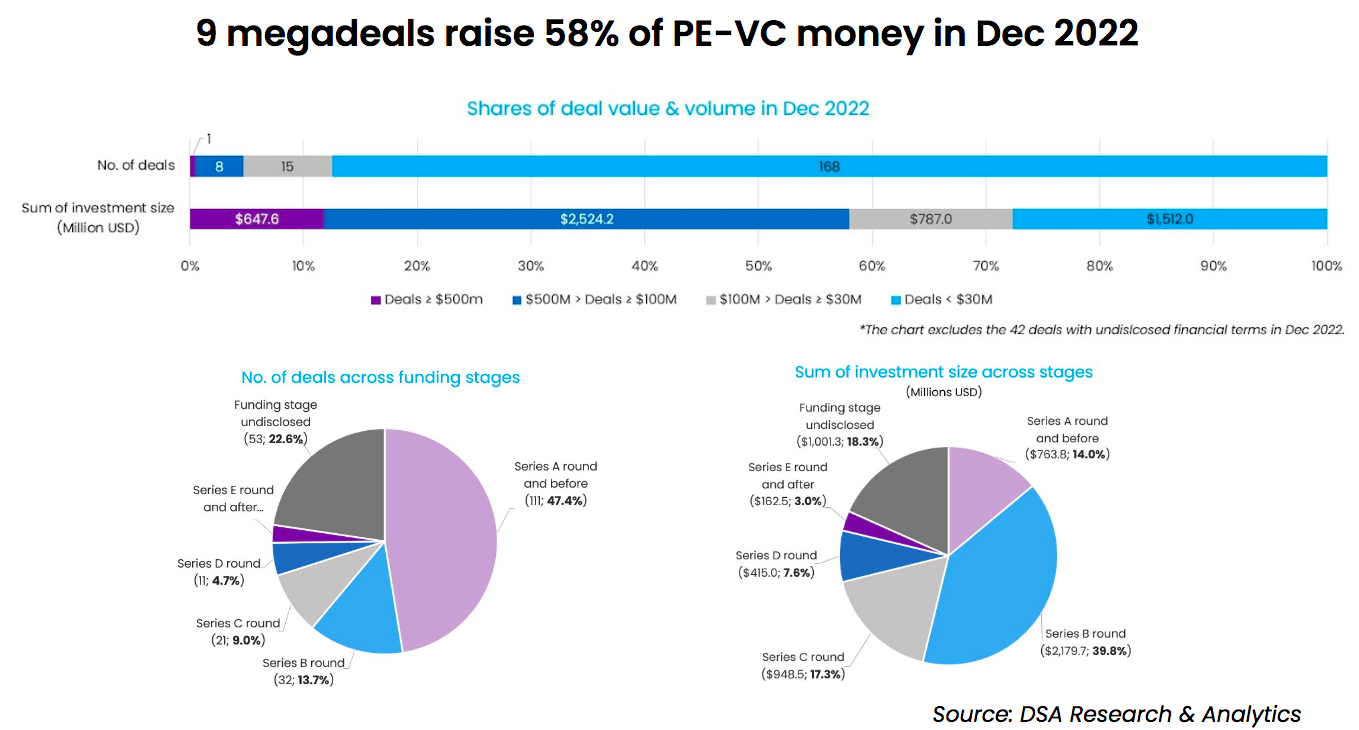

Megadeals, referred to as investments worth at least $100 million, were one of the major contributors to the December deal value. The month logged a total of nine megadeals raising nearly $3.2 billion, accounting for 58% of the total financing.

In spite of the 10 megadeals in November, the total mega deal value in December surged 43.3% over the $2.2 billion clocked in the previous month. State Fuel Cell Technology Corporation (SFCC), a Chinese developer of hydrogen fuel cell vehicles, topped the list raising 4.5 billion yuan ($647.6 million) in a Series B round.

There were eight other deals in the range of $100-500 million that collectively gathered over $2.5 billion, up 66.7% from $1.5 billion one month earlier. Xi’an ESWIN Material Technology, the integrated circuit (IC) and solutions unit of Beijing ESWIN Technology Group, secured the second-largest deal in December. The firm raised 4 billion yuan ($575.7 million) in its Series C round led by CNBM New Materials Fund, making it the largest-ever venture round raised by a semiconductor firm in China.

The third-largest deal was made into Chint Group‘s affiliate Zhejiang Chint Anneng Power System Engineering Co Ltd, a digital energy firm providing rooftop photovoltaic (PV) systems for households in rural China. The firm gathered nearly 4 billion yuan ($574.8 million) across two funding rounds. Parent firm Chint Group is a Chinese conglomerate with businesses across new energy and electrical equipment in over 140 countries and regions worldwide.

As investments continue to flow into sectors including new energy vehicles (NEVs), semiconductors, and renewable energy, Aerospace Times Feihong Technology Co (ATFTC) emerged as the only electronic warfare drone maker on the list. ATFTC, a subsidiary of the state-owned China Aerospace Science and Technology Corp, secured 3.8 billion yuan ($552.1 million) from a slew of investors such as Guokai Manufacturing Transformation and Upgrading Fund, CITIC Securities, and Yuexiu Industrial Fund.

The Series B stage accounted for the lion’s share of deal value in the month with startups garnering $2.2 billion in total, or 39.8% of the overall financing in December.

Series A and earlier funding stages led in terms of deal count. At 111, early-stage deals accounted for 47.4% of the total deal count. As the largest Series A fundraiser, Sany Heavy Truck, a truck manufacturer affiliated with China’s Sany Heavy Industry, raised almost 1 billion yuan ($145 million) to invest in the R&D of its new-energy heavy-duty trucks.

Only three pre-IPO transactions took place in December amid the stock market volatility.

List of megadeals (Dec 2022)

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| State Fuel Cell Technology Corporation (SFCC) | Shenzhen | 647.6 | B | State Power Investment Corporation Limited (SPIC), China State-Owned Enterprises Mixed Ownership Reform Fund, Sichuan Provincial Investment Group, National Green Development Fund, Guokai Manufacturing Transformation and Upgrading Fund | Automobiles & Parts | Electric/Hybrid Vehicles | |

| Eswin Material Technology | Xi’an | 575.7 | C | CNBM New Materials Fund (affiliated with China National Building Material) | Source Code Capital, Yufu Holding Group, Financial Street Capital Operation Group, Chang An Hui Tong, Shang Qi Capital (affiliated with SAIC Group), SDIC Venture Capital, Hudson Capital, Guangtou Capital Management Group, Shanghai Mixed Ownership Reform Fund (上海综改基金), China Life Private Equity Investment, China Zongji Investment, Puyao Capital (普耀资本) | Semiconductor | N/A |

| Chint Anneng Power System Engineering | Hangzhou | 574.8 | B, B+ | B: Cloudview Capital | National Green Development Fund (NGDF), China-Russia Energy Fund, Hangzhou Industrial Investment Group (HIIG), China Southern Power Grid Company Limited | Renewable Energy | CleanTech |

| Aerospace Times Feihong Technology | Beijing | 552.1 | Equity Financing | Guokai Manufacturing Transformation and Upgrading Fund (国开制造业转型升级基金), CITIC Securities, Jinshi Feihong Equity Investment (金石飞鸿(嘉兴)股权投资合伙企业), SAIC Motor Corp-Goldstone Investment (无锡上汽金石创新产业基金), Gongrong Jintou (affiliated with ICBC Financial Asset Investment) (工融金投(北京)新兴产业股权投资基金), Xingejuju Haihe Binhai Equity Investment Fund (affiliated with China Poly Group) (新格局海河滨海股权投资基金), AECC Investment Management, Yuexiu Industrial Fund | Defense | Robotics & Drones | |

| Chint Solar/Astronergy | Haining | 216.3 | B | Cloudview Capital | Hillhouse Capital Group, CICC Capital, Ori-mind Capital, Haining Jianshan Xinqu Guozi (海宁尖山新区国资), Yue Qing State Investment (温州乐清国资) | Energy Storage & Batteries | CleanTech |

| Moore Threads | Beijing | 215.2 | B | China Mobile Digital New Economy Industry Fund (affiliated with China Mobile), Hexie Health Insurance | Dianshi Capital | Semiconductor | AI and Machine Learning |

| Sinopont | Hangzhou | 145 | D | Guodiao Zhanxin Fund (affiliated with China Chengtong Holding Group), GGV Capital, Source Code Capital, CICC Capital, CITIC Goldstone Fund Management, SPIC Industrial Fund Management [affiliated with State Power Investment Corporation Limited (SPIC)] | Materials | CleanTech | |

| Sany Heavy Truck | Changsha | 145 | A | Hidden Hill Capital, China Merchants Capital, CMG-SDIC Capital (affiliated with China Merchants Capital, SDIC Fund Management) | Rosefinch Investment, Huaxu Fund | Automobiles & Parts | Electric/Hybrid Vehicles |

| Qitan Tech | Chengdu | 100.1 | C | Meituan | BioTrack Capital, Huagai Capital | Biotech | Biotech |

Semiconductor remains an investor favourite

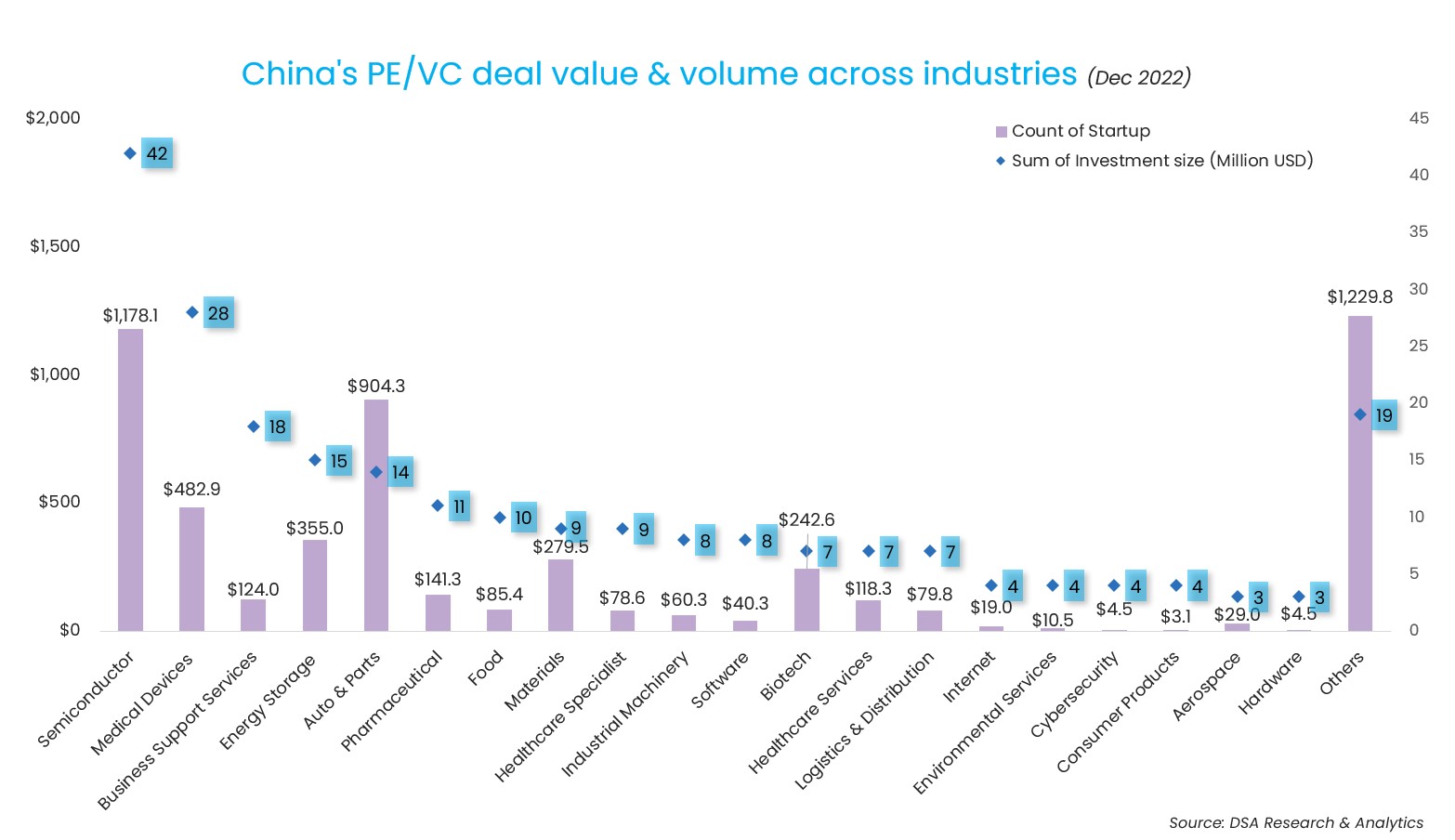

Semiconductor firms collectively raised nearly $1.2 billion in December, up 219.3% from $369 million in the previous month; while the 42 deal count signified a major month-over-month (MoM) growth of 68%.

China remains the world’s largest semiconductor market, as monthly sales of chips in the country stood at $13.4 billion in November 2022, or 29.4% of the global sales, according to the World Semiconductor Trade Statistics (WSTS) The US was the second largest market, with a monthly sales of $12.1 billion, or 26.7% of the global sales.

Moore Threads, a Chinese semiconductor player that develops graphics processing units (GPUs), raised 1.5 billion yuan ($215.2 million) in a Series B round led by China Mobile Digital New Economy Industry Fund and China’s domestic insurer Hexie Health Insurance, making it one of the megadeals of the month.

The medical devices industry logged a total of 28 deals but it only raised a combined $482.9 million.

State-linked investors top list

CICC Capital, the global private equity (PE) platform of China International Capital Corporation Limited (CICC), and its affiliates emerged as the top investor in December, landing a total of eight deals worth $536.5 million.

In spite of investing in only six companies, China’s state-owned carmaker SAIC Motor and its affiliates continued to back a slew of hard tech and deep tech sectors. The Shanghai-based automotive group, which primarily invests through three affiliated investment companies, namely SAIC Capital, Hengxu Capital, and Shang Qi Capital, collectively invested about $1.2 billion in December.

State Development & Investment Corporation (SDIC), one of China’s largest state-owned investment holding companies, notched the third spot as it invested in six venture deals worth $857.5 million.

Top investors (Dec 2022)

Investment company No. of deals Total value of participated deals (Million USD) Lead Non-lead

CICC Capital and affiliates 8 536.5 3 5

SAIC Motor and affiliates 6 1156.8 2 4

State Development & Investment Corporation (SDIC) 6 857.5 5 1

Addor Capital 6 46.5 2 4

Sequoia Capital China 6 140 1 5

Jinding Capital 6 20.5 4 2

Source Code Capital 5 751.2 1 4

Leaguer Capital 5 40.5 0 5

Green Pine Capital Partners 4 101.1 3 1

Meridian Capital 3 36.3 3 0

Note: In our monthly analysis for December 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup funding rebounds to $1.2b in Dec despite fewer deals

After falling below the psychologically important $1 billion mark in November...

India Deals Barometer Report: Fundraising by startups slackens to touch $1.25b in Dec

As Indian startups continue to experience funding winter, capital raised...