Greater China Deals Barometer Report: Market rebound drives startup funding to $5.5b in Dec

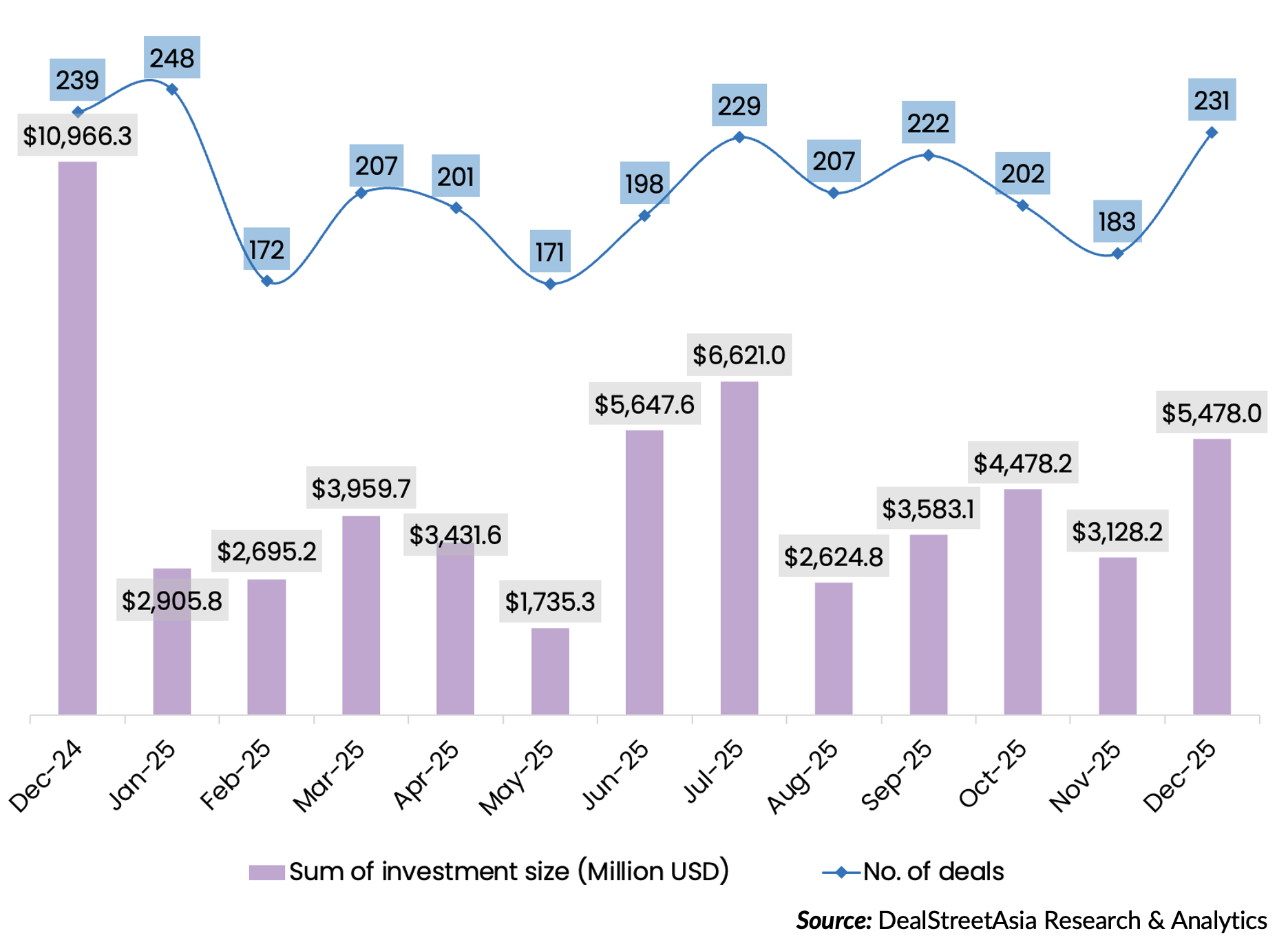

After a slow November, December ended on a stronger note with almost $5.5 billion being raised across 231 private-market deals in Greater China. The overall deal value grew significantly by 75.1%, while the number of investments increased by 26.2% from the previous month, according to DealStreetAsia’s proprietary data.

But a year-over-year (YoY) comparison suggests private-market dealmaking has yet to fully recover. December’s funding total was only half of the near-$11 billion raised during the same time in 2024. The number of investments was still down 3.3% from one year ago.

Startup financing in Greater China

Startups in Greater China completed 2,471 deals in 2025, 11.9% more than the 2,209 deals recorded in 2024. Their fundraising total of about $46.3 billion was 23.6% less than that of the prior year amid a prolonged market downcycle that has driven investors to stay disciplined in asset selection and writing big cheques.

Megadeal volume triples

The December rebound was likely cyclical, as investors wrapped up transactions ahead of a new year. This led to a surge in deal volume, including megadeals or investments of $100 million and above.

Compared to November, when just five megadeals were completed, the number of megadeals in December tripled, with 15 such transactions collectively raising over $3.2 billion.

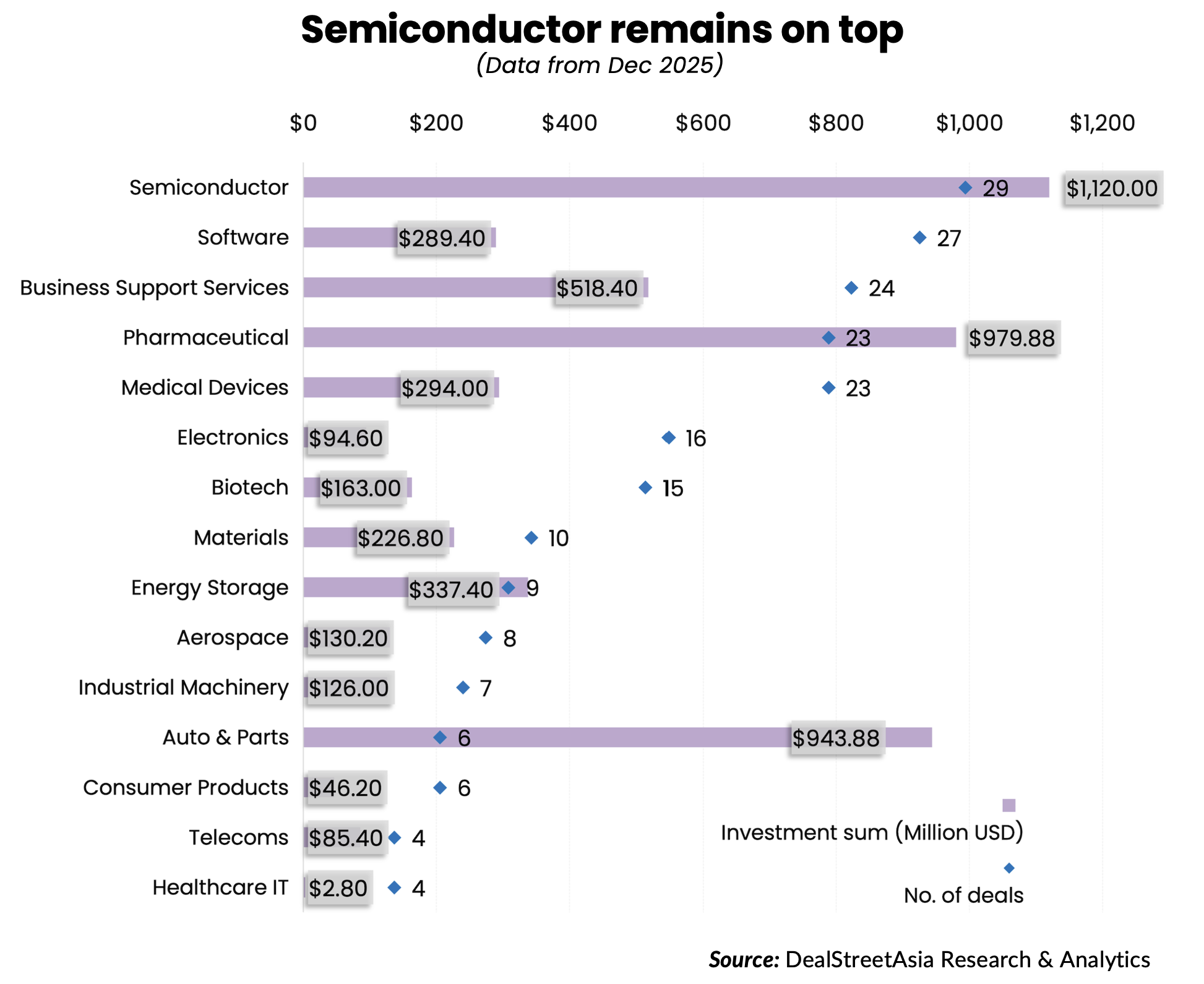

The three biggest investments in December happened in the auto & parts, semiconductor, and business support services, which are considered among the top investment themes in China nowadays.

The month’s largest investment was a $857.1-million Series C round raised by Deepal Automobile Technology, a smart electric vehicle (EV) manufacturer majority-owned by Chinese state automaker Changan Automobile. The company was one of the first two EV makers to receive a Level 3 autonomous driving licence in China for operations on designated public roads.

The second-largest financing went to Shanghai New Micro Technology Group, or SIMIC Holdings, which pocketed $359.8 million from a string of investors, including multiple state-level funds and local government investment platforms amid China’s continued efforts in achieving self-sufficiency in chips.

Humanoid robot startup Galbot’s new funding round at over $300 million ranked third, making it arguably the biggest financing in China’s embodied intelligence industry to date. The startup plans to accelerate the adoption of its human-like robots across commercial, industrial, and household use cases following the deal.

The pharmaceutical sector sprung a surprise, contributing to five megadeals, raised by Green Valley Pharmaceutical, Sanegene Bio, D3 Bio, OTR Therapeutics, and Syneron Bio, respectively – underscoring increased investor recognition in the market potential of homegrown innovative drugs from Greater China.

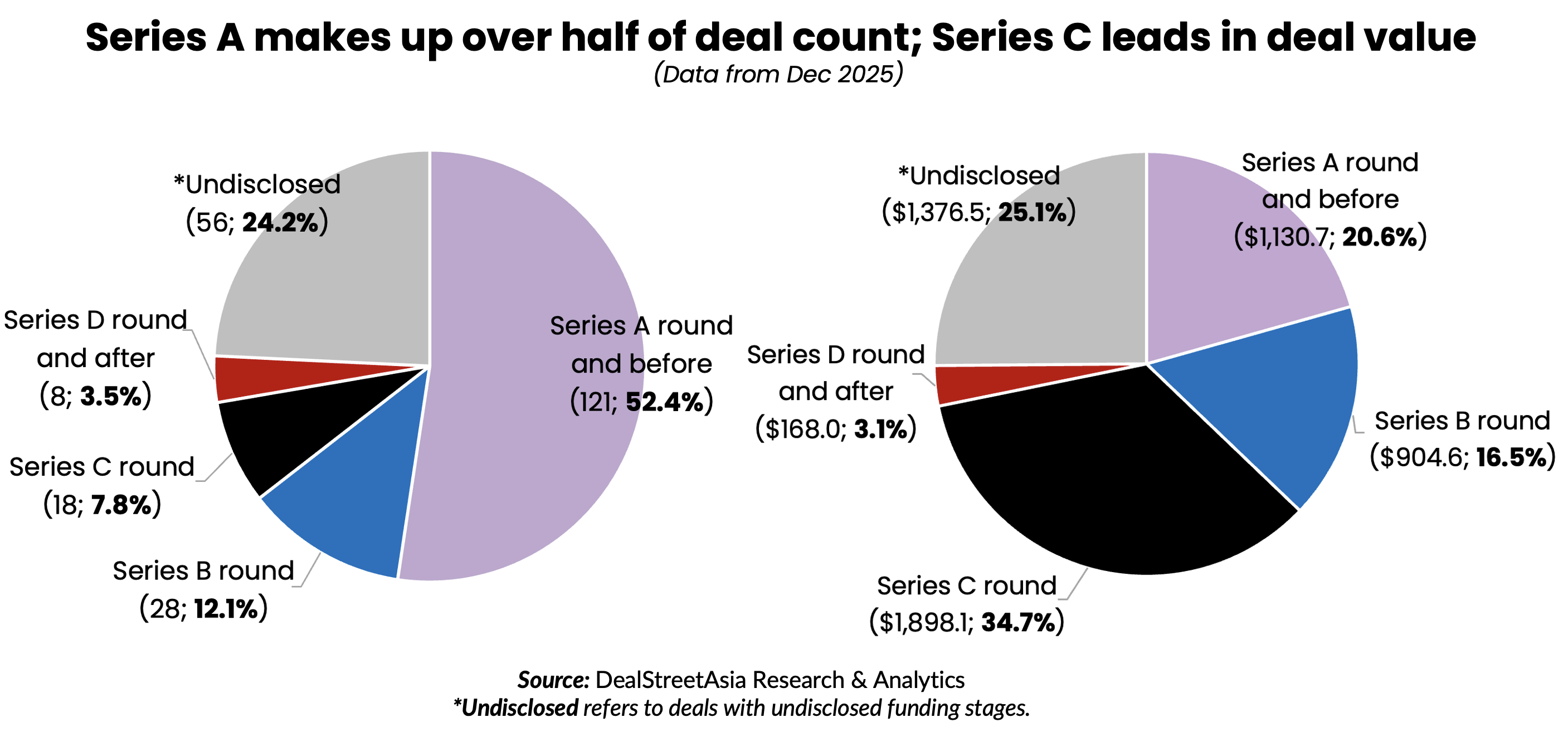

Spike in Series C financing

Across funding stages, dealmaking at pre-Series A to Series A again dominated with the completion of 121 deals, representing 52.4% of December’s total deal volume.

In terms of deal value, however, the month saw a spike in Series C financing driven by five megadeals at this funding stage. Collectively, the five megadeals in Deepal, artificial intelligence (AI) chipmaker Tsing Micro, lithium battery manufacturer Ganfeng Lithium, NIO-backed battery asset operator WN Power, and AI solutions provider DP Technology pocketed over $1.5 billion, accounting for the bulk of the near-$1.9 billion Series C financing raised in the month.

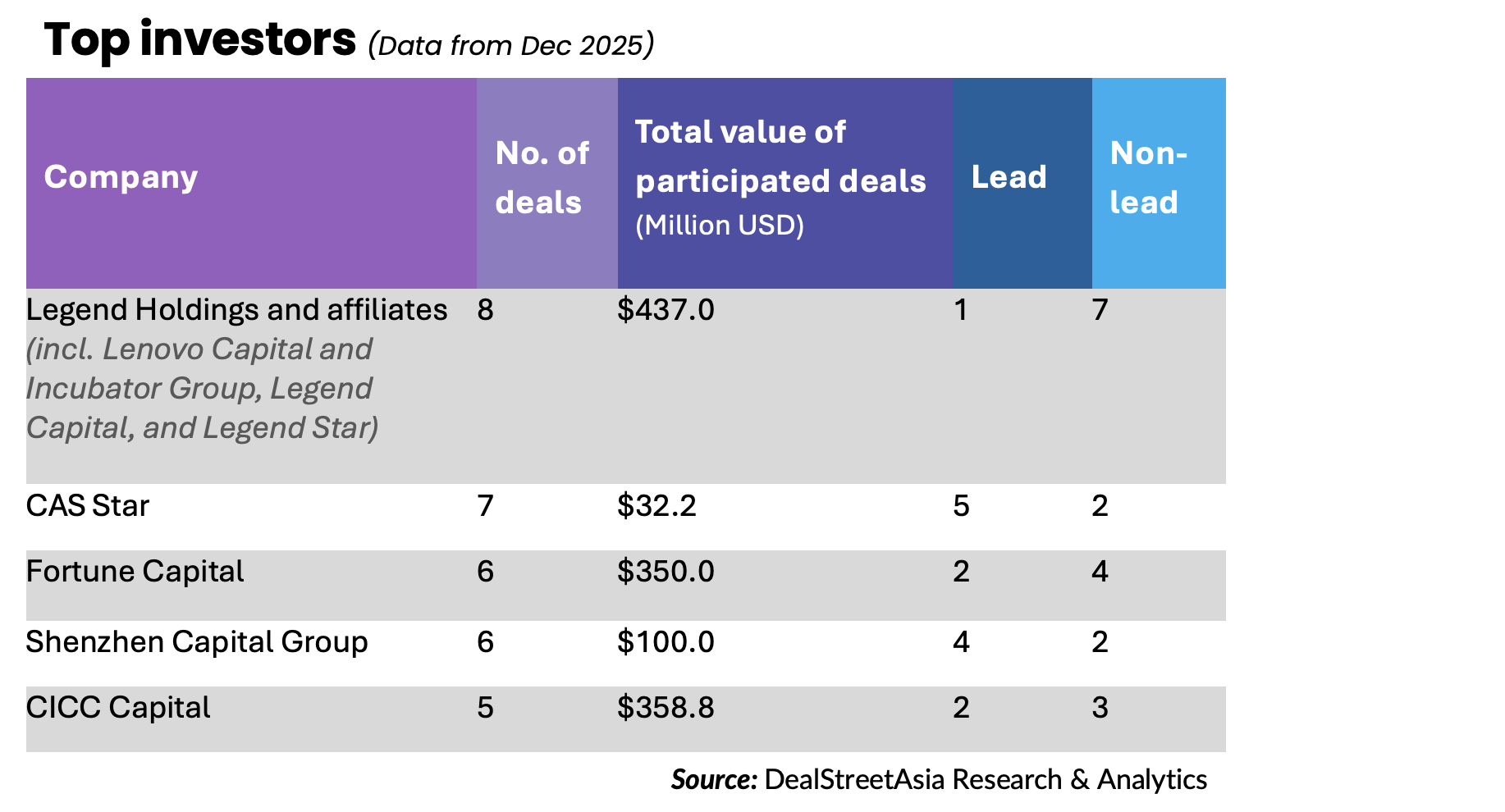

Legend Holdings, a Chinese conglomerate with a wide scope of businesses spanning financial services, consumer electronics, advanced materials, and agribusiness, emerged as the most active investment group of the month. Through multiple investment platforms, the conglomerate poured money into eight deals worth a combined $437 million.

The top investor list also featured four other investment firms with significant state backing, including CAS Star, a hardtech-focused venture capital (VC) firm backed by the state-owned Chinese Academy of Sciences, the government-funded Fortune Capital and Shenzhen Capital Group, as well as the partially state-owned financial institution CICC Capital.

Note: In our monthly analysis for December 2025, we have put together detailed charts of prominent deals, deal stages, and the most attractive sectors in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

Lynn Huang contributed to this story.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Funding slips 23% in Dec as deal count drops to record low

Startup funding in Southeast Asia fell 23.3% month-on-month in December 2025, as deal count sank to its lowest level in 12 months, according to proprietary data compiled by DealStreetAsia.

Venture Capital

India Deals Barometer Report: Startup funding slips in Dec as deal activity slows

Private equity and venture capital investments in Indian startups declined further to $896 million in December, down from $922 million in November, according to proprietary data compiled by DealStreetAsia.