China Deals Barometer Report: Startup funding plunges almost 40% YoY in Jan as investors brace for tough 2024

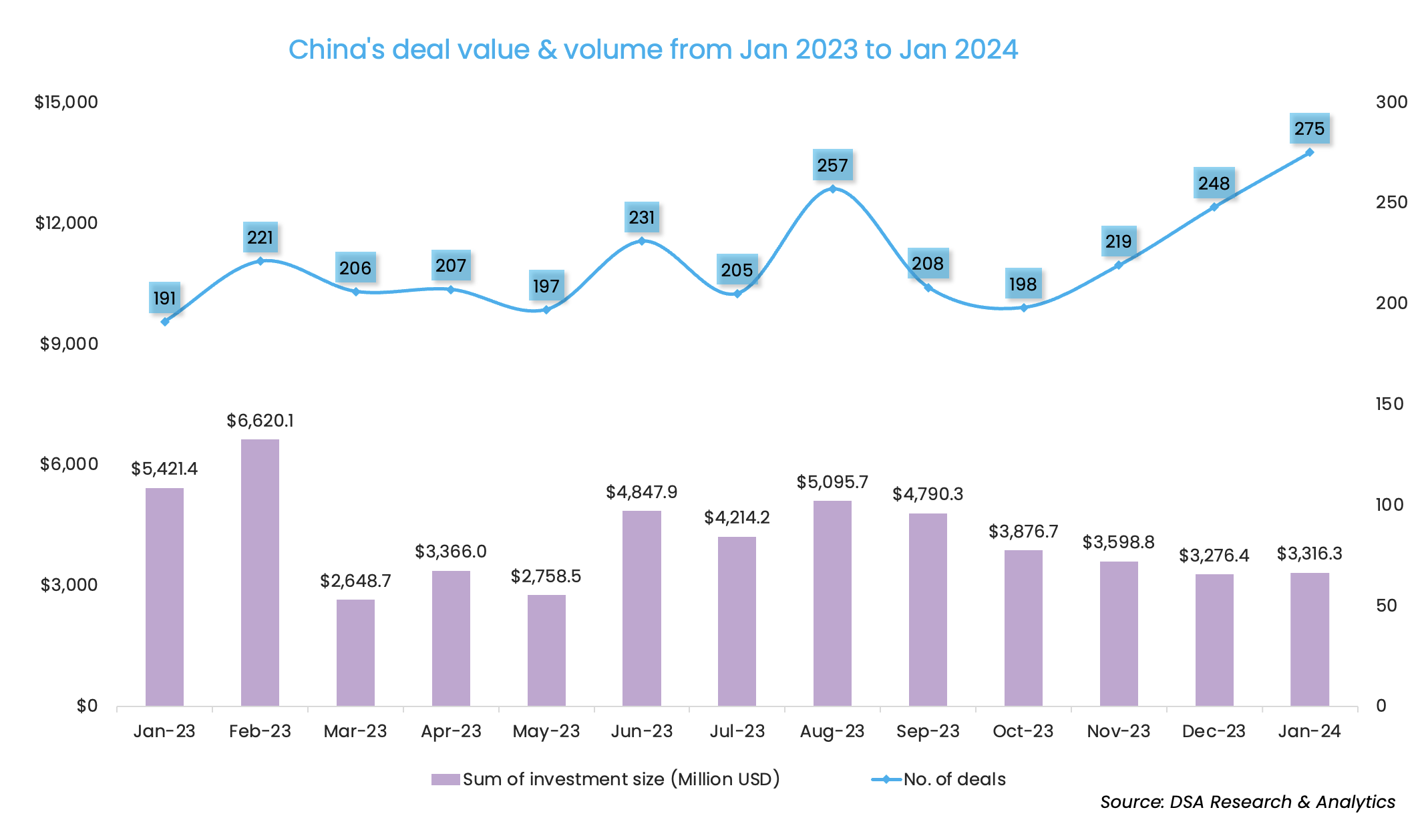

Startup financing in Greater China marked a 38.8% year-over-year (YoY) decline in January as geopolitical risks and macro risks continue to stifle the venture capital market.

In the first month of 2024, privately held companies headquartered in mainland China, Hong Kong, Macau, and Taiwan raised $3.3 billion through the completion of 275 deals, according to proprietary data compiled by DealStreetAsia.

Investors started 2024 with a pinch of caution that steered them away from big-ticket transactions amid a tepid exit landscape. The month saw a 44% uptick in deal volume, largely contributed by early-stage transactions, compared to January 2023.

Megadeals drop amid market slowdown

Investors that once splurged on the up-and-rising tech firms in the Greater China region took slower and smaller steps as the market remained bound with uncertainties.

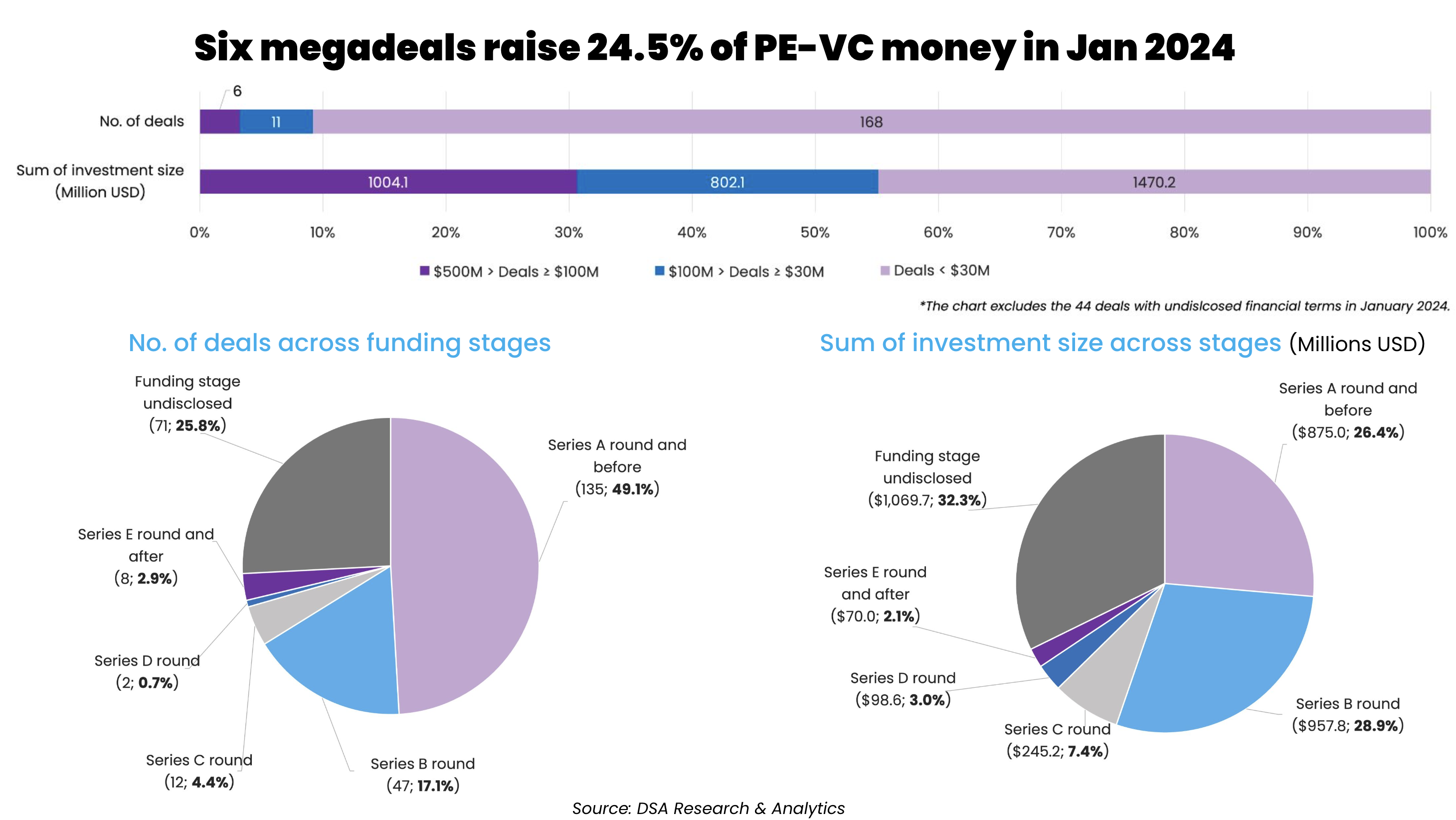

There were only six megadeals — transactions worth at least $100 million — in January that secured a combined $812.6 million in investments or 24.5% of the total deal value. January sustained the momentum of December 2023 when six megadeals gathered over $1 billion, or 30.6% of the month’s total financing.

In comparison, January 2022 and January 2023 saw 16 and 13 megadeals respectively. Both months saw the megadeals contributing to at least 60% of the total monthly fundraising corpus.

In the biggest funding round last month, Qiyuan Green Power, a green energy solutions provider affiliated with China’s state-owned electricity supplier State Power Investment Corporation (SPIC), sealed its Series B funding round at 1.5 billion yuan ($211.2 million) to reach the unicorn valuation of over $1 billion.

The second largest deal was that of Jixing Pharmaceutical, which was incubated by New York-based life science-focused investment firm RTW Investments in 2019, to develop novel therapeutics to treat unmet medical needs in cardiovascular and ophthalmic diseases. The biopharmaceutical firm pocketed a combined $162 million from German multinational pharmaceutical Bayer and RTW.

In another megadeal last month, medical device firm Lanfan Bosheng, a wholly-owned subsidiary of Shenzhen-listed medical equipment maker Blue Sail Medical, raised its registered capital by 900 million yuan ($126.7 million) at a pre-money valuation of 4 billion yuan ($563.1 million).

The rest of the megadeals are scattered across the sectors of semiconductors, digital assets, and automobiles.

Investments in Series A and earlier stages accounted for nearly half (49.1%) of January’s total deal count, amassing a total of $875 million or 26.4% of the total deal value. In comparison, Series E and later funding stages only recorded eight deals in January worth an aggregate of $70 million or 2.1% of the total deal value, indicating the cautious approach adopted by investors towards big bets.

List of megadeals (January 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Qiyuan Green Power | Shanghai | 211.2 | B | State Power Investment Corporation (SPIC), National Green Development Fund, BOC Financial Asset Investment (affiliated with Bank of China), Gree Electric, and others | Energy Storage & Batteries | CleanTech | ||

| Jixing Pharmaceuticals | Shanghai | 162 | Bayer, RTW Investments | Pharmaceutical | Biotech | |||

| Lanfan Bosheng | Beijing | 126.7 | Huagai Capital, Linkong Private Equity Fund Management (affiliated with Hebei Linkong Group), Linqu County Advaned Technology Industry Investment | Medical Devices & Equipment | N/A | |||

| Zhongning Silicon Industry | Quzhou | 112.7 | Phoenix Tree Capital Partners | Quzhou State-owned Capital Operation, Hengxu Capital (affiliated with SAIC Motor Corp), China Cinda Asset Management | Semiconductor | N/A | ||

| HashKey Group | Hong Kong | 100 | A | Financial Services | Blockchain | |||

| Chunqing Technology | Tianjin | 100 | Initial | Automobiles & Parts | Electric/Hybrid Vehicles |

Rise of HK as a crypto hub

January saw a rare megadeal in the digital asset sector even as crypto firms across the globe were facing one of the chilliest fundraising winters in 2023 when only one-third of VC investments were logged.

Hong Kong-headquartered digital asset management firm HashKey Group snapped up $100 million in a Series A financing round, entering the unicorn club at a pre-money valuation of $1.2 billion.

As a spinoff of the Chinese multinational conglomerate Wanxiang Group, HashKey Group’s businesses include HashKey Capital, a global asset manager investing in blockchain technology and digital assets. HashKey Capital closed its third fund – HashKey FinTech Investment Fund III – at $500 million in January 2023.

The fundraising came at a time when Hong Kong has emerged as the Asian crypto hub after the city launched a series of new rules to embrace digital assets including approving virtual asset trading platforms to offer services to retail investors and the public offering of virtual asset futures exchange-traded funds (VA ETFs).

Despite China’s ban on cryptocurrency, Hong Kong continues to step up its moves in the space. HK financial watchdog said in a joint circular that it is prepared to accept applications for VA spot ETFs in December 2023. That could potentially make the city the first Asian market to launch such products.

Chip-making firms ride on the fundraising stride

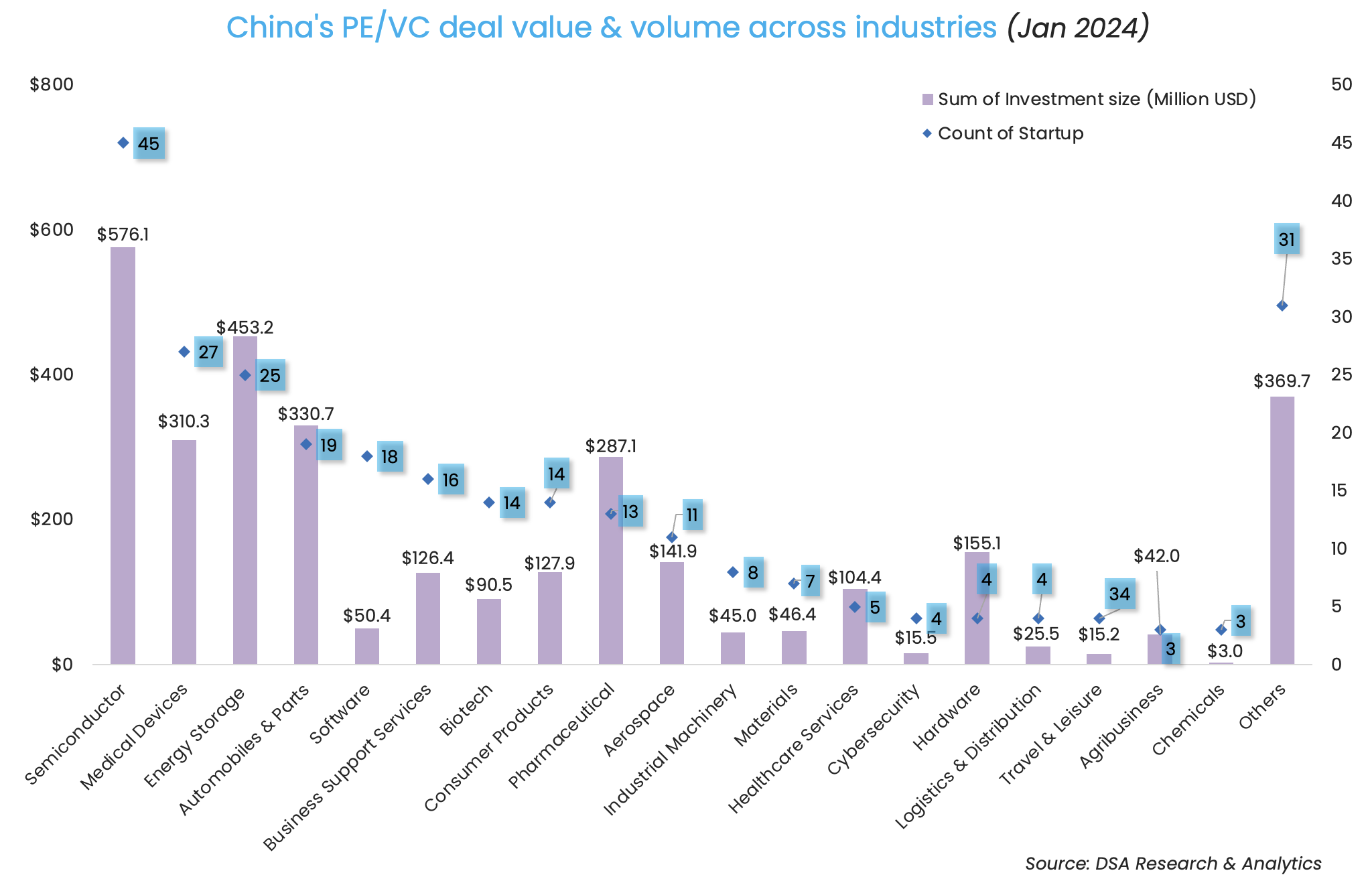

Semiconductor continued to be the most sought-after portfolio component for investors in Greater China, as the sector ranked first in both deal count and deal value.

The pullback of US dollar investors, as well as high interest rates and macro uncertainties, has created a dynamic shift in the 21-trillion-yuan (almost $3 trillion) private fund industry in China that has seen the rising participation of RMB-denominated government capital in tech innovations and startup incubation.

The dynamic shift could lead to RMB-denominated funds taking a more major role in sensitive sectors including semiconductor and artificial intelligence, PitchBook analysts shared in a research note.

Addor Capital tops investor list

Early-stage venture capital firm Addor Capital, backed by state-affiliated Jiangsu High-tech Investment Group participated in eight deals to top the investor list. The eight startups raised a total of $48 million.

Most active investors in China (January 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Addor Capital | 8 | 48 | 5 | 3 |

| Qiming Venture Partners | 5 | 68 | 3 | 2 |

| CICC Capital | 6 | 151.4 | 2 | 4 |

| Wuxi Venture Capital Group | 4 | 18.5 | 0 | 4 |

| Legend Holdings & affiliates | 4 | 29.5 | 1 | 3 |

| Shenzhen Capital Group | 4 | 44.8 | 2 | 2 |

| China Merchants Group & affiliates | 4 | 56 | 2 | 2 |

| Oriza Holdings & affiliates | 4 | 57.6 | 1 | 3 |

| Shandong Luxin High-Tech Industry | 3 | 42 | 3 | 0 |

| Suzhou Capital Group & affiliates | 3 | 17 | 0 | 3 |

| Orinno Capital | 3 | 42.1 | 2 | 1 |

| Summitview Capital | 3 | 29.5 | 2 | 1 |

| SDIC Venture Capital | 3 | 28 | 2 | 1 |

| Shanghai STVC Group | 3 | 29.6 | 1 | 2 |

| Cowin Capital | 3 | 29.5 | 2 | 1 |

| Z&Y Capital | 3 | 42 | 0 | 3 |

| Qingsong Fund | 3 | 4.5 | 2 | 1 |

| Goldport Capital | 3 | 15.5 | 1 | 2 |

| Leaguer Capital | 3 | 42 | 3 | 0 |

| CAS Star | 3 | 17 | 0 | 3 |

| Cathay Capital | 3 | 43 | 2 | 1 |

| SND Financial Holdings | 3 | 42 | 1 | 2 |

| CDH Investments | 3 | 42 | 2 | 1 |

Note: In our monthly analysis for January 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: In ominous start to the year, startup funding plunges 78% in Jan

Southeast Asian startup funding plummeted to a 12-month low in January, marking a cautious start to the new year.

Venture Capital

India Deals Barometer Report: Startup fundraising dips 23% to $853m in Jan but transaction volume rises

The prolonged funding winter continued to cast its shadow over startups in India as they raised a mere $853 million across 100 private equity and venture capital transactions in January, registering a drop of about 23% in value over the previous month, according to proprietary data compiled by DealStreetAsia.