Greater China Deals Barometer Report: July dealmaking holds up amid signs of market recovery

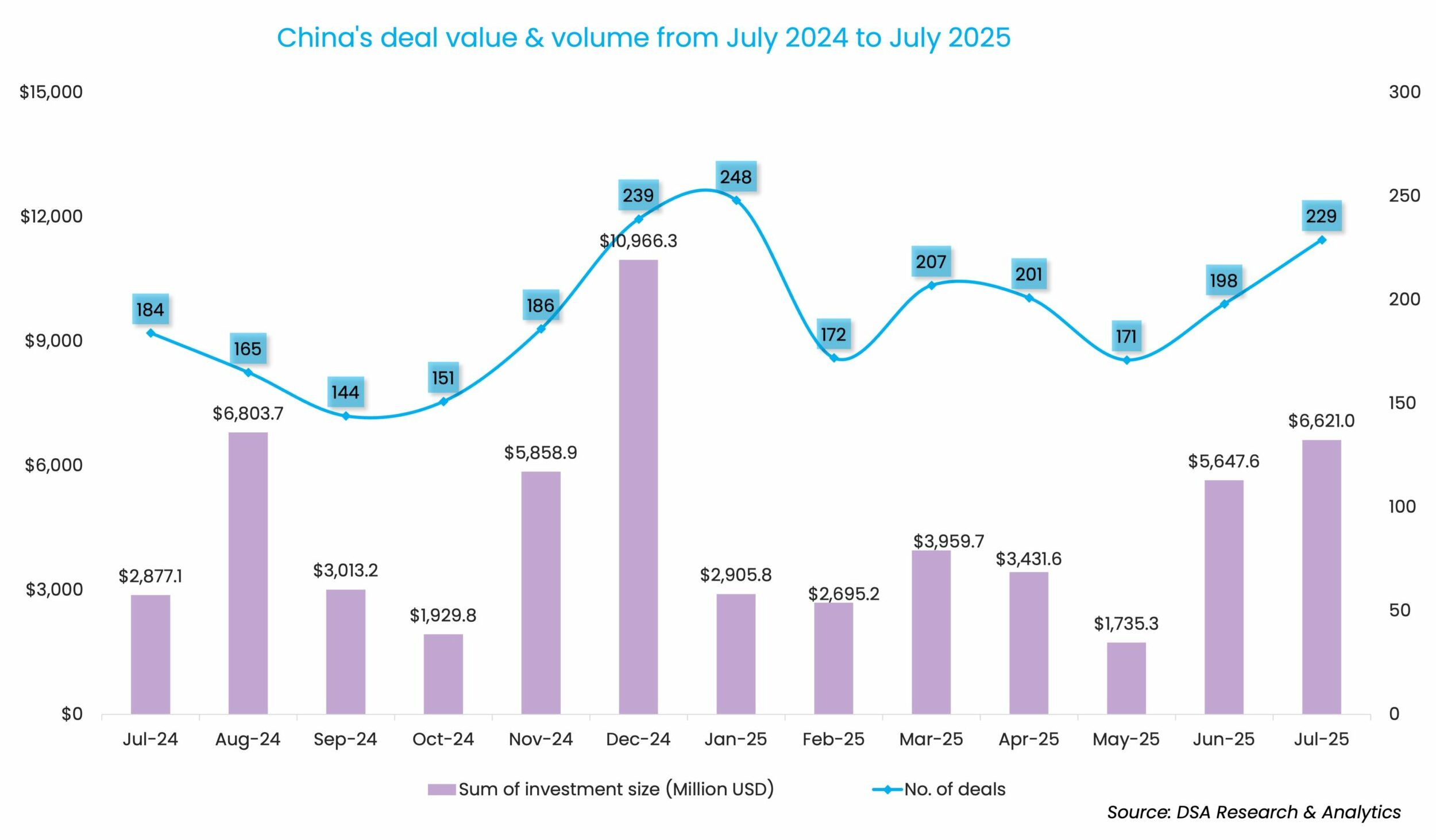

Fundraising in Greater China continued its upward trajectory in July as startups in the region collectively raised over $6.6 billion, the highest-ever monthly deal value recorded this year.

The monthly deal value climbed 17.2% over June 2025, while the deal count grew 15.7% to 229, according to proprietary data compiled by DealStreetAsia.

The rebound was more salient compared to July 2024 when almost $2.9 billion was raised via the completion of 184 deals. That translated to a year-over-year growth of 130% and 24.5%, respectively.

A shift in sentiment towards China has been underway — a recent report published by US-based asset manager Invesco shows that a significant majority of SWFs (59%) are expected to increase their China allocations over the next five years, with APAC- and Africa-based sovereign investors leading the way.

Sovereign investors based in North America, too, show high interest in growing their China allocation, signifying their willingness to look beyond the current geopolitical situation. The SWFs in the survey also cited attractive local returns, diversification benefits, and China’s accelerating leadership in critical technologies as compelling reasons to engage in the market, per the survey.

Yet, it remains to be seen whether the recovery momentum will continue. So far, the first seven months of 2025 have raised almost $27 billion through 1,426 deals. Venture investors pledged 15.7% less capital in H1 2025, although the deal count was 7.7% more than the same period last year.

Megadeals prop up startup fundraising

Part of the dealmaking rebound in July was driven by the record number of megadeals or investments worth at least $100 million — the month saw a total of 13 megadeals raising a combined $4.7 billion, or 70.8% of the month’s total deal value.

The only billion-dollar deal — also the largest deal of the month — went to China Fusion Energy, a newly launched national fusion energy firm backed by several state-owned nuclear and energy firms that snapped 11.5 billion yuan ($1.6 billion) in its latest funding round.

The second-largest deal of the month saw Hong Kong-listed Sino Biopharmaceutical announce its acquisition of the remaining 95.09% stake in Shanghai-based biopharmaceutical firm LaNova Medicines for no more than $950.92 million, according to an exchange filing.

Post-financing, Sino Biopharmaceutical will hold a 100% stake in LaNova, which focuses on the unmet therapeutic needs in the field of tumour immunity and tumour microenvironment.

Embodied intelligence continues to be a major theme, with the likes of EngineAI, TARS, and Galaxea AI sealing megadeals in the month. Zhipu AI, known as one of China’s “Six Tigers” in developing large language models (LLMs), secured yet another big-ticket investment of 1 billion yuan ($139.6 million) from two state capital investors in Shanghai as the company heads towards an initial public offering (IPO).

Early-stage investments dominated the country’s venture scene, accounting for 50.2% of the total deal count, despite contributing around $1.4 billion, or 20.4% of the month’s total proceeds. The month also tracked an uptick in late-stage dealmaking, with a total of two transactions taking place at Series E or later stages.

Public listing, one of the major exit strategies among many of the Chinese general partners (GPs), showed significant recovery in H1 2025.

In the first half of 2025, there were 94 initial public offerings (IPOs) from Greater China across exchanges in mainland China, Hong Kong, and the US, raising nearly $8.7 billion. This represents a 19% increase in the number of IPOs and a 38.3% rise in total funds raised compared to the first half of 2024, as indicated by Dealogic data analysed by DealStreetAsia.

List of megadeals in China (Jul 2025)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Legend Holdings & affiliates | 6 | 103.5 | 0 | 6 |

| Addor Capital | 5 | 17 | 4 | 1 |

| JD.com | 4 | 225.7 | 4 | 0 |

| MiraclePlus | 4 | 15.6 | 2 | 2 |

| Beijing Artificial Intelligence Industry Investment Fund (北京市人工智能产业投资基金) | 3 | 41.8 | 2 | 1 |

| Wuxi Venture Capital Group | 3 | 111.5 | 1 | 2 |

| Guolian Jintou Zhiyuan (国联金投致源) | 3 | 0 | 2 | 1 |

| Chenkun Capital (坤辰资本) | 3 | 3.1 | 2 | 1 |

| Highlight Capital | 3 | 282.9 | 0 | 3 |

| Xiang He Capital | 3 | 291.7 | 0 | 3 |

| Cowin Capital | 3 | 15.5 | 1 | 2 |

| China Cinda Asset Management | 3 | 752.3 | 0 | 3 |

| Panlin Capital | 3 | 27.9 | 2 | 1 |

| Innoangel fund | 3 | 15.5 | 1 | 2 |

| Everest VC | 3 | 97.9 | 0 | 3 |

| CAS Star | 3 | 26.6 | 2 | 1 |

| IDG Capital | 3 | 115.5 | 1 | 2 |

| Xiaomi | 3 | 28 | 1 | 2 |

| 01VC | 3 | 5.8 | 0 | 3 |

| Panlin Capital | 3 | 27.9 | 2 | 1 |

HK-based startups capture investor attention

Hong Kong’s startup ecosystem has regained investor attention. The month saw a total of seven Hong Kong-based startups securing funding from local and regional investors.

Part of the funding momentum can be traced back to Hong Kong’s regulatory regime for stablecoin issuers, which took effect on August 1. KUN, a stablecoin-based payment and financial infrastructure services platform, has secured $6 million in funding from Chinese fintech firm MOG Digitech Holdings Limited, through its indirect wholly owned subsidiary Zhongbao HK.

ZA Global, the international business unit of Hong Kong-listed insurtech firm ZhongAn Online P&C Insurance, too, led a $40-million Series A2 round in stablecoin infrastructure firm RD Technologies.

Hong Kong-listed digital asset platform OSL Group also announced that it had completed a $300-million equity financing, making it the biggest publicly disclosed equity raise in Asia’s digital asset landscape, per a release.

Although this deal was not included as part of DealStreetAsia’s PE/VC deal analysis, the investment signifies the intensifying investor interest in the space, as Hong Kong brings more regulatory certainty to the digital asset space.

Canadian insurer Sun Life’s additional $70-million capital injection in HK-based Bowtie, further enhancing its already significant holding in the virtual insurer, is yet another deal involving HK-based firms.

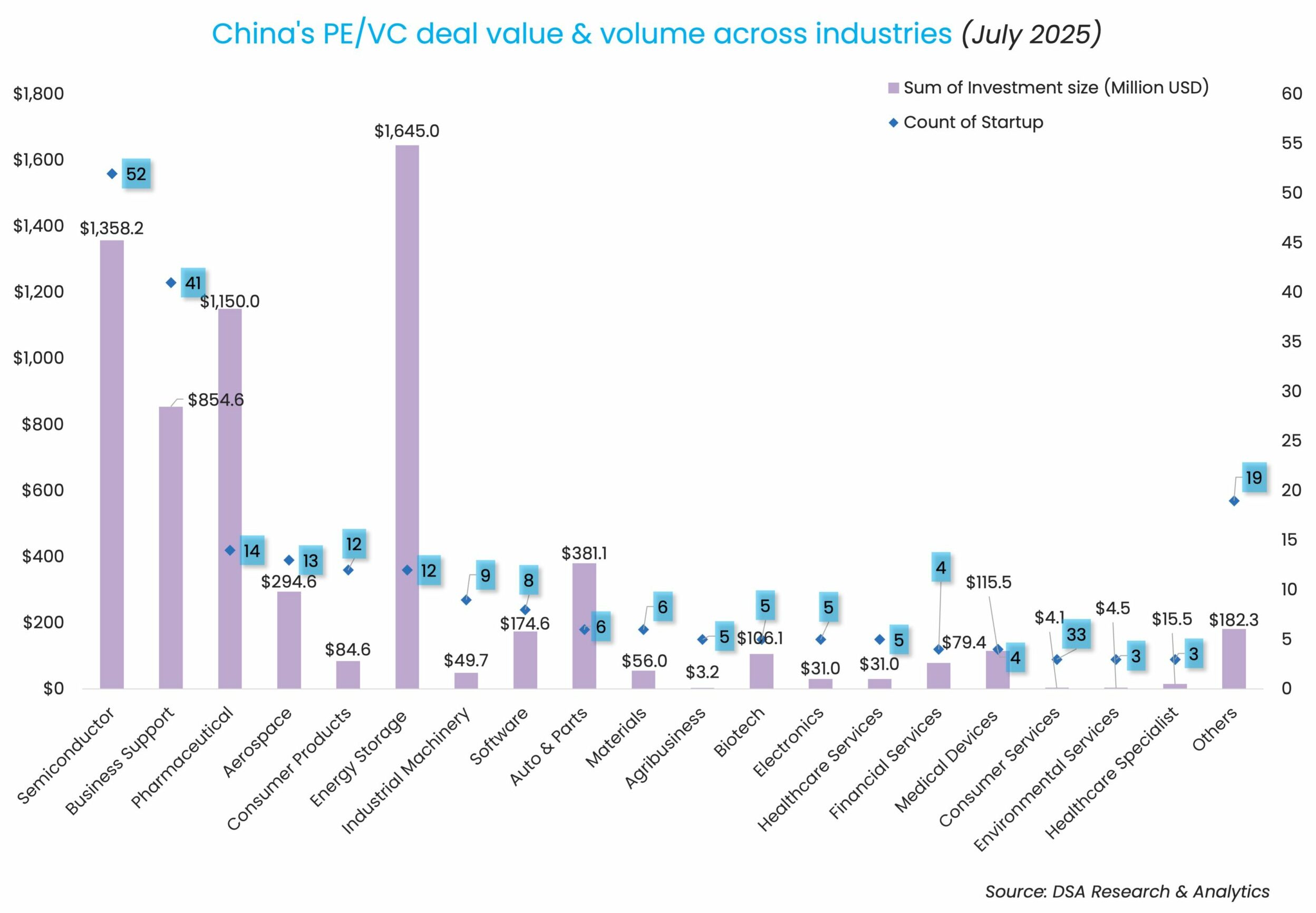

Semiconductors continued to take the lead in deal count, with the completion of 52 transactions. Three megadeals were sealed in the chipmaking space that include Chinese full-stack AI chipmaker Sunrise, which bagged 1 billion yuan ($139.3 million) in its latest funding round to consolidate its market share in the home-grown advanced graphics processing unit (GPU) sector.

JD.com, Xiaomi accelerate embodied AI push

Chinese e-commerce giant JD.com has splurged on four robotics startups in July, including EngineAI Robotics Technology; Spirit AI; RoboScience; and Limx Dynamics, as the online business-to-consumer (B2C) e-commerce platform joined the wave of capital rushing into firms that are pushing the boundaries of integrating AI with physical systems.

Chinese tech giant Xiaomi, whose business spans from consumer electronics to electric vehicles (EVs), was also seen backing three firms in the month, including AI chips developer LuminX; smart dishwasher firm Ongmei; and Jingdongfang Shengshi Technology, the display technologies unit under BOE Technology Group.

Chinese conglomerate Legend Holdings was the most active investor during the month in terms of deal count. The group injected around $103.5 million across six startups through its subsidiaries.

Most active investors in China (January 2025)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Legend Holdings & affiliates | 6 | 47 | 0 | 6 |

| Addor Capital | 5 | 15.5 | 4 | 1 |

| JD.com | 4 | 47.4 | 4 | 0 |

| MiraclePlus | 4 | 15.5 | 2 | 2 |

| Beijing Artificial Intelligence Industry Investment Fund | 3 | 28 | 2 | 1 |

| Wuxi Venture Capital Group | 3 | 25.1 | 1 | 2 |

| Guolian Jintou Zhiyuan | 3 | 0 | 2 | 1 |

| Chenkun Capital | 3 | 1.5 | 2 | 1 |

| Highlight Capital | 3 | 59.9 | 0 | 3 |

| Xiang He Capital | 3 | 65.7 | 0 | 3 |

| Cowin Capital | 3 | 3 | 1 | 2 |

| China Cinda Asset Management | 3 | 69.7 | 0 | 3 |

| Panlin Capital | 3 | 14 | 2 | 1 |

| Innoangel fund | 3 | 8.4 | 1 | 2 |

| Everest VC | 3 | 29.5 | 0 | 3 |

| CAS Star | 3 | 15.5 | 2 | 1 |

| IDG Capital | 3 | 37.6 | 1 | 2 |

| Xiaomi | 3 | 3 | 1 | 2 |

| 01VC | 3 | 3 | 0 | 3 |

Note: In our monthly analysis for July 2025, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup funding surges in July on a billion-dollar data centre deal

Southeast Asia’s startup funding activity rebounded sharply in July, with total investment value more than quadrupling from the previous month, driven by a single billion-dollar transaction in Singapore.

Venture Capital

India Deals Barometer Report: Startup funding hits 18-month low of $840m in July

Startup funding in July dropped to its lowest level in the past 18 months, signalling cooling investor activity amid uncertainties in the global economy, tighter capital flows, and increased scrutiny of startups.