China Deals Barometer Report: Investors wrap up 220 deals in Nov, up 23.6% MoM, ahead of lean season

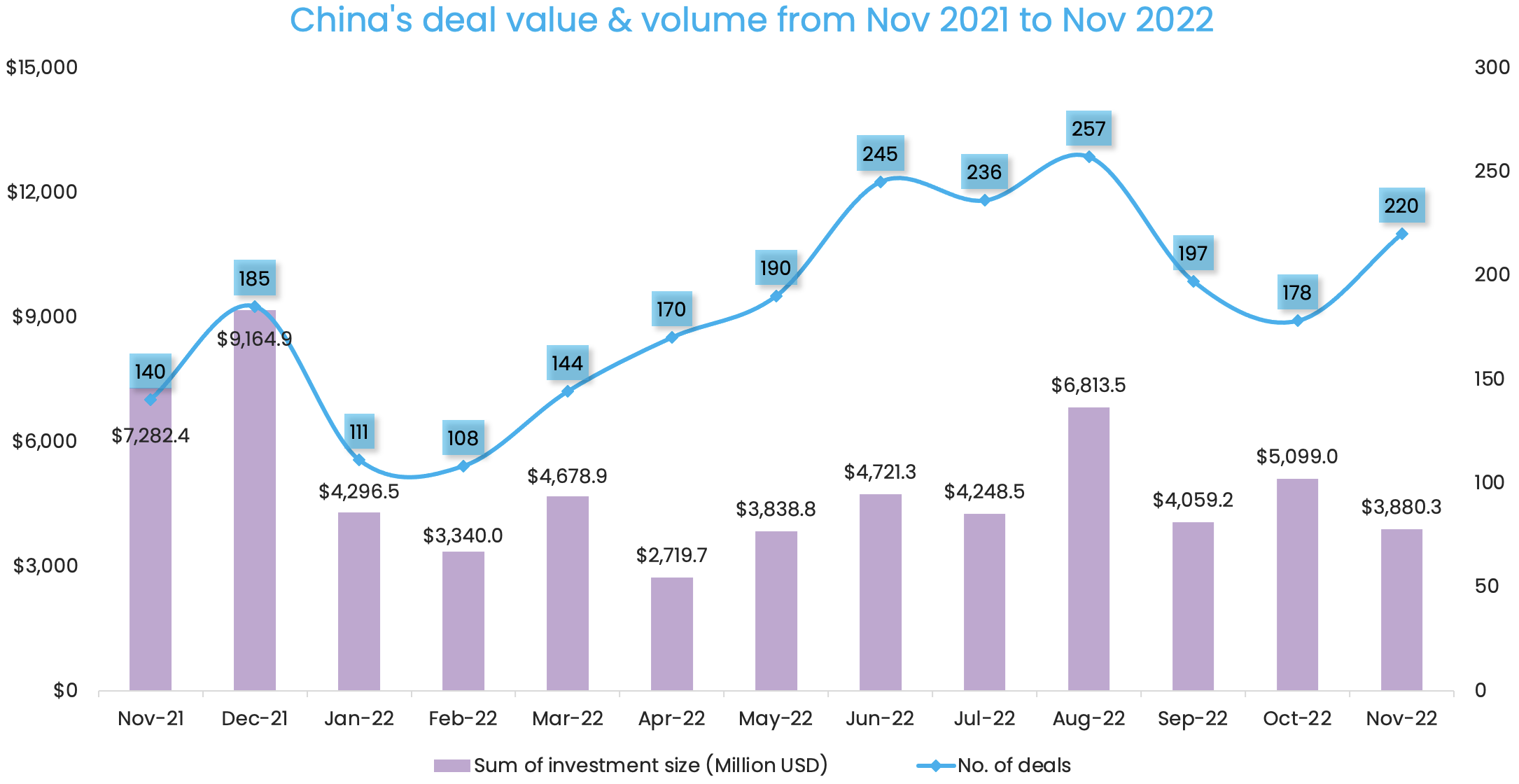

November saw a dealmaking sprint as venture investors in the Greater China market completed a total of 220 investments, up 23.6% from October, before moving into the lean season of December.

Dealmaking in November was not only more active compared to the previous month, but also exceeded the deal count logged in the corresponding month last year at 140, according to proprietary data compiled by DealStreetAsia.

With almost $3.9 billion being raised, the monthly deal value, however, remained at a low point due to a continued shortage of big-sized, growth-stage transactions. The month’s deal value was 23.9% less than that of the previous month and 46.7% less than that of November 2021.

Venture investors are wrapping up this year with more signed term sheets. Yet, their total committed capital is likely to be lower compared to 2021 following a shift to conservative asset classes amid the global market slowdown.

The first 11 months of 2022 saw startups already complete 2,056 deals – 1.2 times more than the same period last year. But their total capital raised at $47.7 billion represents only three-fifths of the $78.3 billion raised from January-November 2021.

EV, NEV space grab mega deals

Enthusiasm for investments in electric vehicles (EVs), new energy vehicles (NEVs), and cleantech made them some of the best-funded industries in Greater China, as the political agenda remains a major factor in decision-making across the country’s entrepreneurial and investor circle.

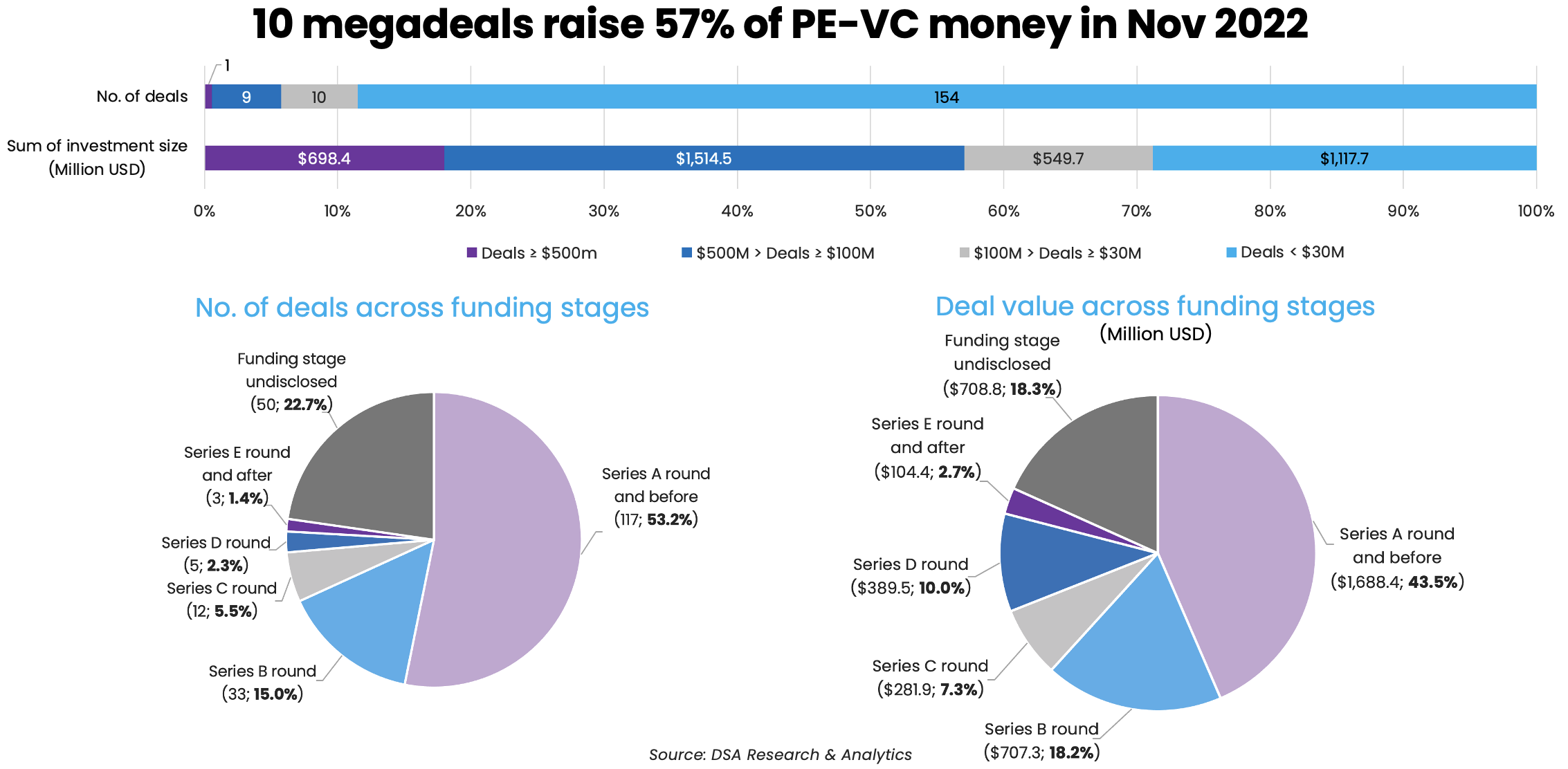

In November, EV and battery technology startups contributed to four of the month’s 10 mega deals, or transactions at a size of $100 million or more. Voyah, an EV brand affiliated with the Chinese state-owned traditional carmaker Dongfeng Motor, secured $698.4 million in a Series A round to lead the pack. Its Series A round was led by the Bank of China (BOC) Financial Asset Investment and Mixed Ownership Reform Fund, a 200-billion-yuan ($28.7 billion) Chinese national fund that supports mixed-ownership reforms of state-owned enterprises (SOEs).

Letin, a NEV manufacturer that started with electric bicycles, motorcycles, and low-speed EVs, came second with the completion of its Series A round at $447.2 million. The new round was expected to help the firm invest in product R&D and expand its business in China and overseas markets including Japan, Indonesia, and some European countries.

Mixed Ownership Reform Fund, the lead investor of the Voyah deal, also led a $206.1-million Series D round for solid-state lithium battery developer Welion in a move to support the development of the country’s upstream EV supply chain. Welion, which makes EV batteries for Nio and Geely from four manufacturing bases in China, is poised to serve a surging market demand amid Beijing’s goal to boost the market share of newly-produced, eco-friendly vehicles in 2030 to up to 40%.

Including the remaining seven mega deals, the 10 largest investments collectively raised more than $2.2 billion, approximately 57% of the total financing in November.

That compares to October when mega deals garnered nearly $3.6 billion and accounted for 69.7% of the capital raised in the month. GAC AION, the five-year-old EV subsidiary of Chinese state-owned automaker Guangzhou Automobile Group (GAC), was the largest fundraiser with the completion of a $2.5-billion Series A round.

Series A and earlier funding stages continued to be investors’ favorites, while the stock market drops weighed heavy on their appetite for late-stage deals.

As a reflection of the market sentiment, the 117 Series A and earlier deals took up more than half of the deal count in November. In terms of deal value, the earliest funding stage amassed $1.7 billion, or 43.5% of the month’s total financing.

Despite the dominance of early-stage deals, the pre-IPO stage saw the completion of a mega deal last month. Trinomab Biotech, a clinical-stage biopharma firm with global operations, closed its pre-IPO round at $104.4 million although the firm has yet to introduce any of its drug candidates to the market.

List of mega deals (Nov 2022)

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| Voyah | Wuhan | $698.4 | A | Mixed Ownership Reform Fund, Bank of China (BOC) Financial Asset Investment | Industrial and Commercial Bank of China (ICBC), Jingkai Investment Fund, ABC Investment, Ganfeng Lithium, Changjiang River Industrial Investment Group, BOCOM International, Sunwoda, Hongtai Aplus | Auto & Parts | Electric/Hybrid Vehicles |

| Levdeo | Weifang | $447.2 | A | Weicheng West Investment & Development Group | Auto & Parts | Electric/Hybrid Vehicles | |

| Welion | Beijing | $206.1 | D | Mixed Ownership Reform Fund | CSC Financial, SDIC Chuangyi Industry Fund Management, China Merchants Capital, Hermitage Capital, DYEE Capital, Hidden Hill Capital, Yunhe Partners, Huzhou Jingkai Investment Development Group, Zibo Jingneng | Energy Storage | CleanTech |

| eRoad | Shanghai | $139.9 | D | Software | SaaS | ||

| Dongfang Jingyuan Electron Limited | Beijing | $139.6 | Equity Financing | XingCheng Capital, Yizhuang Venture Capital/ E-town Capital, Shenzhen Capital Group, Nuo Capital, CGII Private Fund, Sailing Capital, Beijing Industrial Investment, among others | Semiconductor | N/A | |

| SemiDrive Technology | Nanjing | $138.9 | B+ | Wuxi SAIC Jinshi Innovation Industry Fund (affiliated with SAIC Motor) | Guozhong Capital, Huatai Insurance Group, Shanghai STVC Group, Shanghai Zhangjiang Hi-Tech Park Development, V Fund, among others | Semiconductor | Electric/Hybrid Vehicles |

| Xiaoice | Beijing | $138.4 | Business Support Services | AI and Machine Learning | |||

| Trinomab | Zhuhai | $104.4 | Pre-IPO | Kingray Capital, Gree Financial Investment (affiliated with Zhuhai Gree Group) | Efung Capital, Shenyin & Wanguo Investment, China Medical System, Wuxi Guolian Development, Jinhang Group | Pharmaceutical | Biotech |

| Freetech | Jiaxing | $100 | B | Chaos Investment | SAIC Hengxu Capital, BAIC Capital, Shaanxi Automobile Group, Sun Life Everbright Asset Management, Ao Peng Investment, TCL Technology, Tongxiangjintong (桐乡金桐) | Auto & Parts | Autonomous Driving |

| Plum | Beijing | $100 | C | Zhuanzhuan | Internet | E-Commerce |

Auto & parts top deal count followed by semiconductor

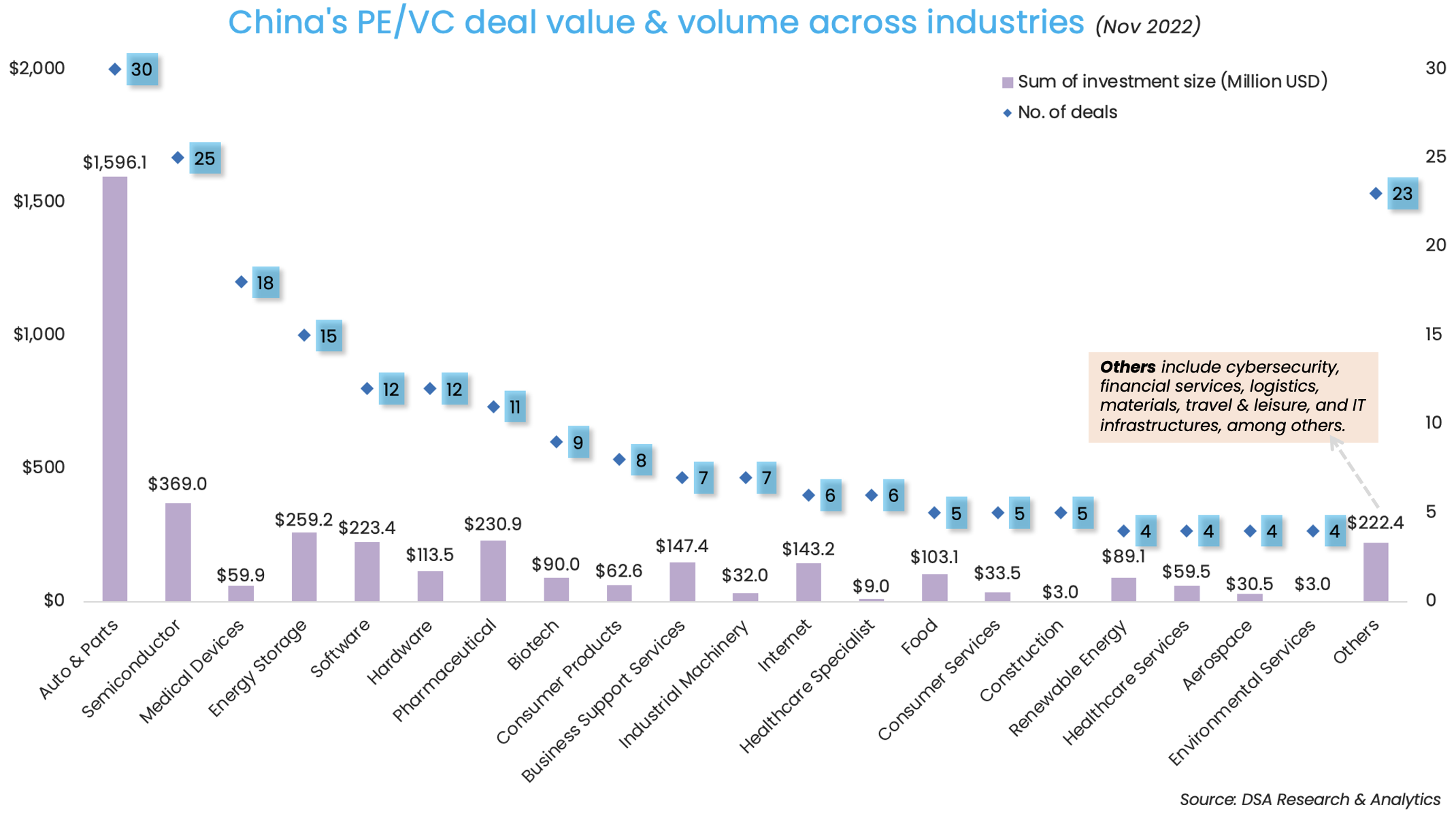

Increased interest in EVs, NEVs, requisite auto components, and smart vehicle technologies propelled the dealmaking activity in the auto & parts industry. It emerged as the most popular industry among venture investors last month, with 30 startups raising a combined $1.6 billion.

DealStreetAsia’s data shows that the bulk of fundraisers in the auto & parts space – or 22 – to be precise, are involved in the R&D, manufacturing, and sales of EVs and/or hybrid vehicle-related products and services. The remaining eight companies are developers of autonomous driving vehicles, or self-driving enablers providing supporting hardware, software, and technologies.

Prominent EV fundraisers include the aforementioned Voyah and Letin, in addition to a group of smaller venture-backed companies such as Kasco, which offers air suspension systems for passenger vehicles developed by Voyah and publicly-listed EV brand Li Auto. In November, Kasco raised $72.4 million in a Series B round from lead investors including Source Code Capital and Shenzhen Capital Group.

The rise of eco-friendly vehicles not only calls for the development of electrified cars, but also intelligent connected vehicles powered by the Internet of Things (IoT), autonomous driving, and such.

Intelligent driving enabler Freetech, whose products range from radars and front-view cameras to its proprietary advanced driver assistance system (ADAS), was the latest to benefit from this industry growth. It completed a Series B round at close to $100 million from lead investor Chaos Investment and participating investors like Hengxu Capital, an investment firm affiliated with state-owned carmaker SAIC Motor. Its list of shareholders also includes Geely, Dongfeng Motor, BAIC Group – another state-owned car business – and bus and truck manufacturer Shaanxi Automobile Group.

The semiconductor industry, whose accelerated growth in recent years was aided by the Chinese government’s strong policy and capital support, continued to be a favourite with venture investors.

Some chip developers may outsmart their counterparts by operating at the intersection of the country’s two hottest industries right now. SemiDrive Technology, which recently raised $138.9 million in a Series B+ round, focuses on the R&D of automotive chips and the promotion of intelligent connected vehicles. A SAIC Motor-backed investment fund led its new round, adding to the firm’s existing investors like Sequoia Capital China and Temasek-backed Vertex Ventures China.

Dongfang Jingyuan Electron Limited (DJEL), which offers solutions to enable chip manufacturing, secured $139.6 million in another mega deal in the semiconductor industry. The round attracted a range of high-profile domestic investment firms including An Xin Capital, a government-backed investment firm tasked with promoting China’s compound semiconductor development.

SAIC Motor, Sequoia China tie for first place

State-owned carmaker SAIC Motor emerged as the top investor in November, on par with venture capital powerhouse Sequoia Capital China.

The Shanghai-headquartered automotive group backed seven venture deals worth a total of $267.9 million, as it further rose the stakes in private-market dealmaking in the face of revenue declines during the COVID-19 pandemic.

As one of China’s earliest traditional carmakers to foray into private equity (PE), SAIC Motor focuses heavily on automotive chips, EV/NEV technologies, automotive software, artificial intelligence (AI), big data, IoT, and other sectors that can potentially complement and enhance its matrix of existing automotive offerings. It primarily invests through three affiliated investment companies, namely SAIC Capital, Hengxu Capital, and Shang Qi Capital.

The firm’s heightened dealmaking efforts came as the automotive industry took a heavy hit from the supply chain crunch across automotive chips, EV batteries, and beyond. On top of that, China’s zero-COVID policy also continues to weigh on its sales performance.

Its latest financial results show that the group’s revenue declined by 14.5% year-over-year to 305 billion yuan ($43.6 billion) in the first half of 2022, while its net profit dropped by 48.1% to 6.9 billion yuan ($986.9 million).

Top investors (Nov 2022)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| SAIC Motor and affiliates | 7 | 267.9 | 3 | 4 |

| Sequoia Capital China | 7 | 88.5 | 2 | 5 |

| State Development & Investment Corporation (SDIC) | 6 | 341.6 | 2 | 4 |

| Addor Capital | 6 | 16 | 4 | 2 |

| Shenzhen Capital Group | 5 | 229.5 | 3 | 2 |

| Lenovo Capital and Incubator Group | 5 | 72.9 | 2 | 3 |

| CAS Star | 5 | 32 | 2 | 3 |

| YuanBio Venture Capital | 5 | 16 | 3 | 2 |

| CoStone Capital | 4 | 168.6 | 1 | 3 |

| CICC Capital and affiliates | 4 | 112.4 | 4 | 0 |

| * If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Stephanie Li contributed to this story.

Note: In our monthly analysis for November 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls below $1b for the first time this year in Nov

November was the worst month so far this year for Southeast Asia’s startups in terms of both fundraising value and volume...

India Deals Barometer Report: Indian startup fundraising dips a tad to $1.3b in Nov

Venture funding in Indian startups dipped marginally to touch nearly $1.3 billion in November...