India Deals Barometer Report: Startups rake in $1b in April, down 24% from March

As investors continue to deploy their cash selectively, and more judiciously, funding for Indian startups fell to $1 billion in April from $1.4 billion in March, show proprietary data compiled by DealStreetAsia.

At 72 venture capital and private equity transactions, deal volume in the month showed a marginal improvement over March, when 70 transactions were closed, led by smaller deals as early-stage startup investment remains an attractive proposition for investors in the current climate.

There were also nine transactions in April whose deal value was not disclosed.

On a year-on-year basis, the deal value at $1.048 billion was down 66% from April 2022 when $2.9 billion worth of investments were secured by Indian startups across 129 transactions. Fundraising has been a challenge for most startups since the latter part of 2022 driven by multiple factors such as the rate hikes in developed markets, the geopolitical situation in Eastern Europe, and COVID-related supply chain shocks.

The number of megadeals, or transactions worth $100 million and above, dropped to three in April from four in the previous month. In comparison, at least eight megadeals worth $1.82 billion were closed in April 2022.

Experts expect the downturn to last a few more quarters, and the round sizes and valuations to remain conservative in the meantime.

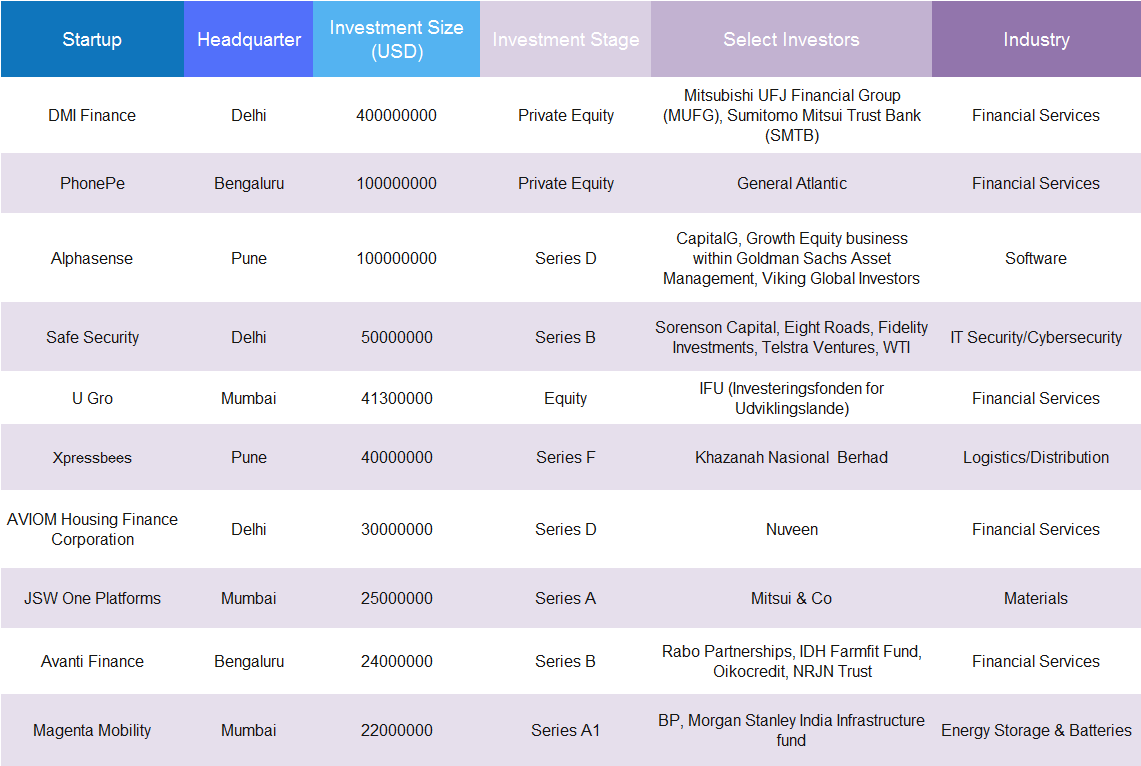

In April 2023, the largest funding round, worth $400 million, was clinched by the non-banking finance company DMI Finance in an equity round led by MUFG Bank of Japan. The fundraising, which involved primary and secondary transactions, also saw participation from existing investor Sumitomo Mitsui Trust Bank.

Top ten deals in April 2023

The other top deals included digital payments startup PhonePe’s $100 million round from existing backer General Atlantic and AlphaSense’s $100 million round led by Alphabet’s CapitalG.

No startup made it to the unicorn club in April. In fact, no startup has entered the unicorn club since Molbio Diagnostics, a Goa-based healthtech startup, attained the coveted $1 billion valuation in September 2022. India had produced 24 unicorns, with a combined valuation of $50 billion, in 2022. There were also 45 unicorns minted in 2021.

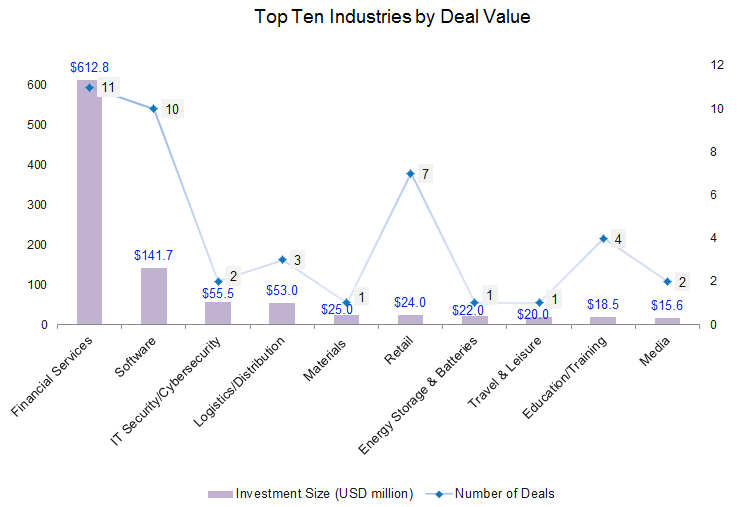

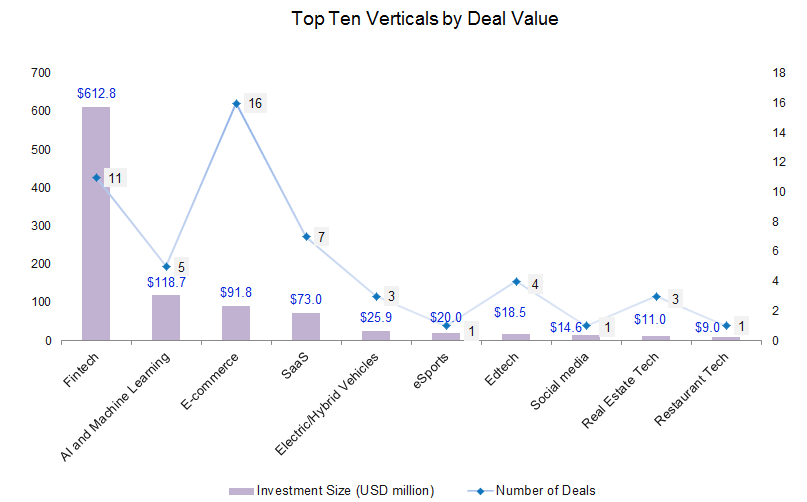

Financial services industry tops the charts

The financial services industry, which comprises banking, mortgages, credit cards, and digital payment startups, led PE-VC funding in April with total investments worth $613 million, or 58.4% of the total funding value in the month. The industry was led by DMI Finance’s $400 million round, followed by PhonePe ($100 million), U Gro ($41.3 million), AVIOM Housing Finance Corporation ($30 million), and Avanti Finance ($24 million).

Software startups followed with a total of $142 million across 10 transactions. Within software, market intelligence and search platform Alphasense scored the highest $100 million financing in its Series D round at a $1.8 billion valuation through new investments by CapitalG, and existing investors, including the Growth Equity business within Goldman Sachs Asset Management (Goldman Sachs) and Viking Global Investors.

Spendflo ($11 million), LightMetrics ($8.5 million), and Officebanao ($6 million) were other top scorers within software.

Led by Safe Security’s $50-million round, IT security and cybersecurity industry made it to the third spot with a total of $55.5 million funding across a mere two transactions. The top three industries—financial services, software, and IT security/cybersecurity—collectively garnered $810 million, accounting for 77% of the total deal value in the month.

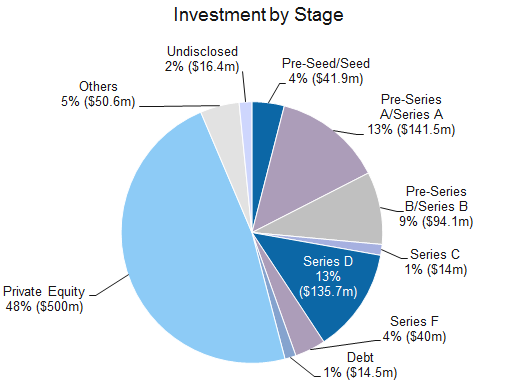

Early-stage deals drive volumes

Funding has not been bad for early- and seed-stage startups. Early-stage startups, comprising companies in their pre-seed to Series A stages, had a share of 61% in the total deal volume in April.

There were a total of 44 such deals worth $183 million in the month as against 42 deals worth $252 million in March.

Only deals with disclosed funding stages were included in the above computation.

Workspace interiors startup Officebanao, edtech startup Mesa School of Business, biotechnology startup Zero Cow Factory, women-focused career engagement platform HerKey, and GenWise were among the startups that raised seed rounds during the month.

Breaking it up further, startups in pre-Series A and Series A stages alone mopped up about $141 million across 22 transactions as against $234 million across 25 transactions in the previous month.

Companies in Series B or post-Series B rounds collected an aggregate of $278 million across eight transactions in April as against $771 million through eight investments in March. The growth transactions during the month were closed by startups including Safe Security, Avanti Finance, Lokal, Purple Style Labs, Alphasense, AVIOM Housing Finance Corporation, Servify, and Xpressbees.

The month saw a total of two private equity deals worth $500 million. There were three debt deals worth $14.5 million in April as against five deals worth $62.4 million in March.

Most active investors

Klub, a Sebi-registered Category II Alternative Investment Fund, emerged as the top investor in April with a total of four investments: Beyoung, Polka Pop, Papacream, and Artinci. The platform announced the close of its Rs 200 crore maiden fund in September last year. Till September, the fund had made more than 33 investments in growth-stage businesses.

Inflection Point Ventures, Mumbai Angels, and Sequoia Capital occupied the second spot with three investments each. Founded in 2018, Inflection Point Ventures (IPV) is a 7,700+ strong member angel investing firm that supports new-age entrepreneurs. The platform has assisted 175 startups to raise capital worth a combined $5.9 billion, according to its website.

Other prominent investors in the month include Pi Ventures, Green Frontier Capital, Kalaari Capital, Lightspeed Venture Partners, Speciale Invest, and Panthera Peak Capital.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: After historic lows in March, startup funding revives in April

After recording a historic low in March this year, dealmaking bounced back in China in April, as investors pumped in $3.4 billion in the startup ecosystem across 207 deals...

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls 66% YoY to $751m in April

Fundraising in Southeast Asia stayed below the psychologically-important $1 billion mark for the fourth straight month in April...