India Deals Barometer Report: Fundraising by startups slackens to touch $1.25b in Dec

As Indian startups continue to experience funding winter, capital raised by them dipped marginally to touch $1.25 billion in December, according to proprietary data compiled by DealStreetAsia. The drop is of about 4% in value over November when startups had collectively scooped up $1.3 billion from risk capital investors.

Deal volume also dropped 22% to 102 transactions in the month from 131 in November as a result of lesser early-stage bets, the data showed.

On a year-on-year basis, Indian startup fundraising fell by more than one-third from $4.86 billion in the corresponding period last year. The number of transactions also halved from the year-ago period.

Of the total deals in December, the value of as many as 10 deals was not disclosed, the data showed.

In terms of mega deals, only two transactions worth $100 million and above were sealed during the month as against one in November. These include Tredence’s $175-million Series B funding round led by Advent International and HealthKart’s $135-million funding round led by Singapore’s state investment firm Temasek.

Top ten deals in December 2022

Source: DealStreetAsia

Source: DealStreetAsia

Other bigger deals closed in the month include myTVS ($83 million), KreditBee ($80 million), Money View ($75 million), WeWork India ($66.4 million), and Dehaat ($60 million).

The top ten transactions were worth $788 million and accounted for about 63% of the total deal value in December.

The pace at which startups were turning unicorns in 2021 dipped considerably in 2022. For the third consecutive month, no startup made it to the unicorn club in December. Unicorns are privately-held companies valued at $1 billion and above.

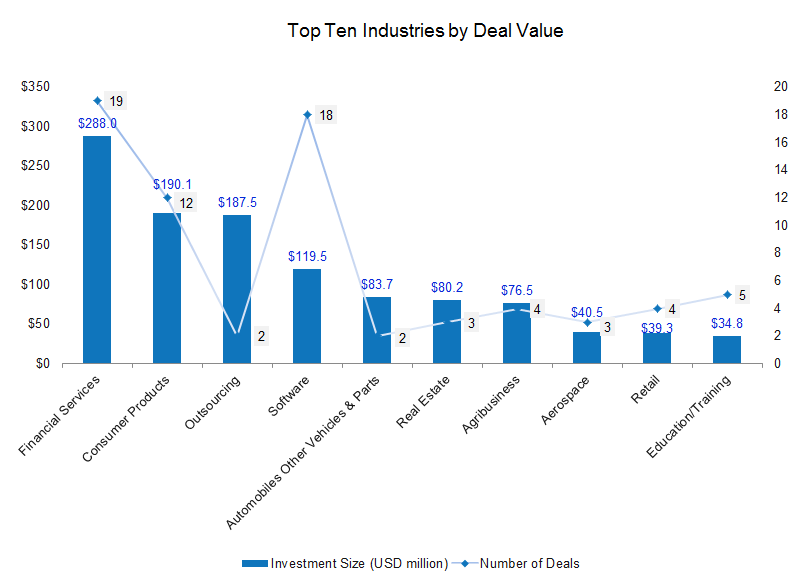

Investors bet big on financial services

Financial services pipped software to emerge as the most funded industry with a total of $288 million across 19 deals in its kitty. Last month, financial services startups raised a mere $70 million across 12 deals in November. Fintech startup KreditBee led the industry by mopping up $80 million in its Series D investment round from new investor MUFG Bank, and existing investors such as Azim Premji’s Premji Invest, Motilal Oswal Alternates, NewQuest Capital, and Mirae Asset Ventures.

Source: DealStreetAsia

Source: DealStreetAsia

The consumer products industry followed with a total of $190 million across 12 deals. Several factors including COVID-induced digitalisation, growth of digital infrastructure, rise in disposable income, and ease of online payments, among others, shored up the demand for direct-to-consumer (D2C) brands during the year in the country.

Prominent deals within the consumer industry include HealthKart ($135 million), Renee Cosmetics ($25 million), Wellbeing Nutrition ($10 million), 82°E ($7.5 million) and The Ayurveda Experience ($6 million).

Two deals worth $187.5 million were closed within the outsourcing industry – Tredence ($175 million) and Uniqus Consultech Inc ($12.5 million).

Together, the top three industries – financial services, consumer products and outsourcing – raised a total of $665 million, accounting for about 53% of the total funding raised in December.

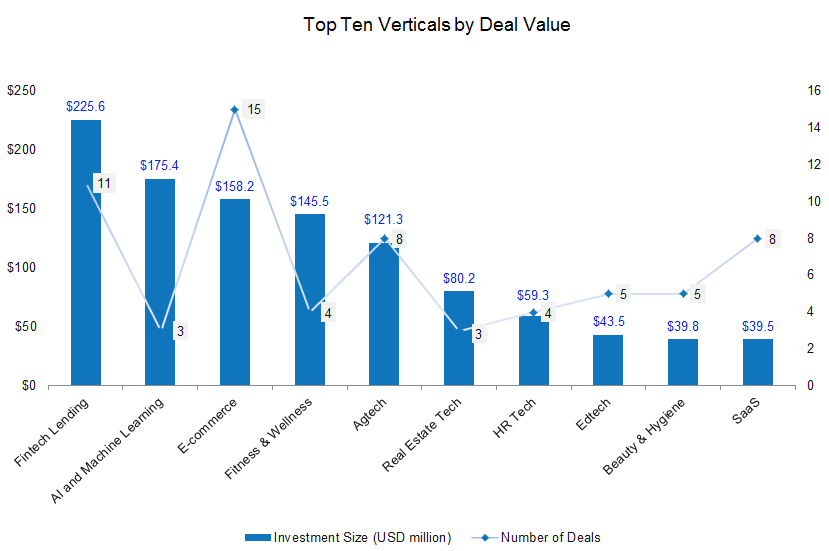

Within verticals, fintech lending ($225 million), artificial intelligence (AI) and machine learning ($175 million), and e-commerce ($158 million) were among the top scorers.

Growth-stage deals see revival

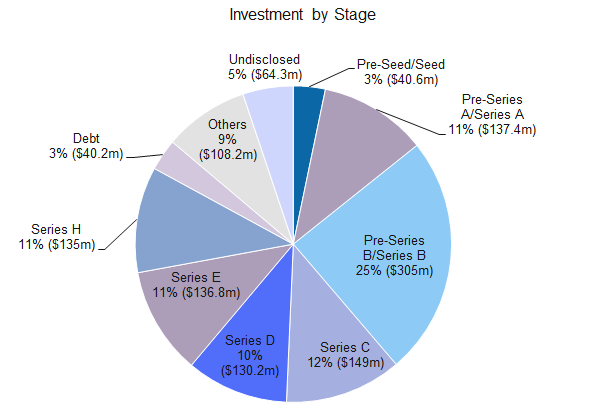

Growth-stage deals, defined as Series B or post-Series B rounds, accumulated $853 million across 22 deals as against $701 million across 17 transactions in November. Late-stage deals have been gradually making a comeback after being subdued for the most part of 2022.

Some of the growth-stage deals sealed during the month include HealthKart (Series H), Tredence (Series B), MYtvs (Series C), KreditBee (Series C), Money View (Series E), DeHaat (Series E), BetterPlace (Series C), NeoGrowth (Series D), Novo (Series B), CropIn (Series D), Awfis (Series E), among others.

Source: DealStreetAsia

Fundraising by startups at pre-seed and seed stages dropped to $40 million in December from $56 million in the previous month. Deal volume also dropped 22% to 35 in December from 45 in November. Pre-Series A and Series A deals were also down 34% at $137 million in the month.

Meanwhile, debt deals were also comparatively low at $40 million in December as against $186 million in November.

Most active investors

Venture capital firm Anicut Capital emerged as the most active investor by closing at least five deals. These include The Ayurveda Experience, HairOriginals, Swageazy, GalaxyEye Space, and Bigyellowfish.

Founded in 2015 by financial services veterans Ashvin Chadha and IAS Balamurugan, Anicut Capital invests through its Grand Anicut Fund. The firm operates debt and equity schemes with about Rs 1,600 crore of assets under management. So far, it has made 39 debt deals, as per its website. Anicut Capital is expected to mark the first close of its Rs 1,500 crore third debt fund by April 2023.

Meanwhile, Artha India Ventures, BlackSoil, and LetsVenture made four deals each. In October, Artha Group launched a Rs 450 crore winners-only microVC fund – Artha Select Fund (ASF) with investment from multiple investors including Kirloskar Family Office, Abhinav Sinha (MD, British International Investment), Narendra Karnavat of CA firm Karnavat and Co, Jashvant Raval of JCR and Co, SAT Industries, among others.

Rebright Partners, Alteria Capital, Blume Ventures, Inflection Point Ventures, Sequoia Capital, and Venture Catalysts, along with its accelerator fund 9Unicorns, invested in three startups each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: At $5.5b, startup fundraising strikes 4-month high in Dec

Dealmaking continued to warm up in December, as the Greater China market completed a total of 234 investments, up 6.4% from November...

Venture Capital

SE Asia Deals Barometer Report: Startup funding rebounds to $1.2b in Dec despite fewer deals

After falling below the psychologically important $1 billion mark in November, startup fundraising in Southeast Asia rebounded in December...