India Deals Barometer Report: Indian startup fundraising dips a tad to $1.3b in Nov

Venture funding in Indian startups dipped marginally to touch nearly $1.3 billion in November, compared with $1.4 billion in the previous month, show proprietary data compiled by DealStreetAsia.

Deal volume in November, though, moved in the opposite direction. There were 131 private equity and venture capital transactions in the month versus 87 transactions in October, which is a jump of 50%, signalling a lift in market sentiment.

Yet, fundraising remains considerably below 2021 levels. On a year-on-year basis, Indian startup fundraising fell 69% last month, from $4.2 billion — across 152 transactions — in November 2021. Investment sentiment has been largely subdued this year owing to the so-called funding winter and volatile global economic and political turmoil.

Of the total 131 transactions in November, the value of 18 deals was not disclosed.

PE-VC fundraising by Indian startups (2022)

Source: DealStreetAsia

The sole $100-million-plus deal was closed by SaaS startup Amagi, which received funding from private equity firm General Atlantic in a mix of primary and secondary infusions. Amagi achieved a valuation of $1.4 billion in the round, up from the $1 billion valuation it garnered in its last funding round in March 2022.

The top ten transactions were worth $668 million and accounted for about 51% of the total deal value last month.

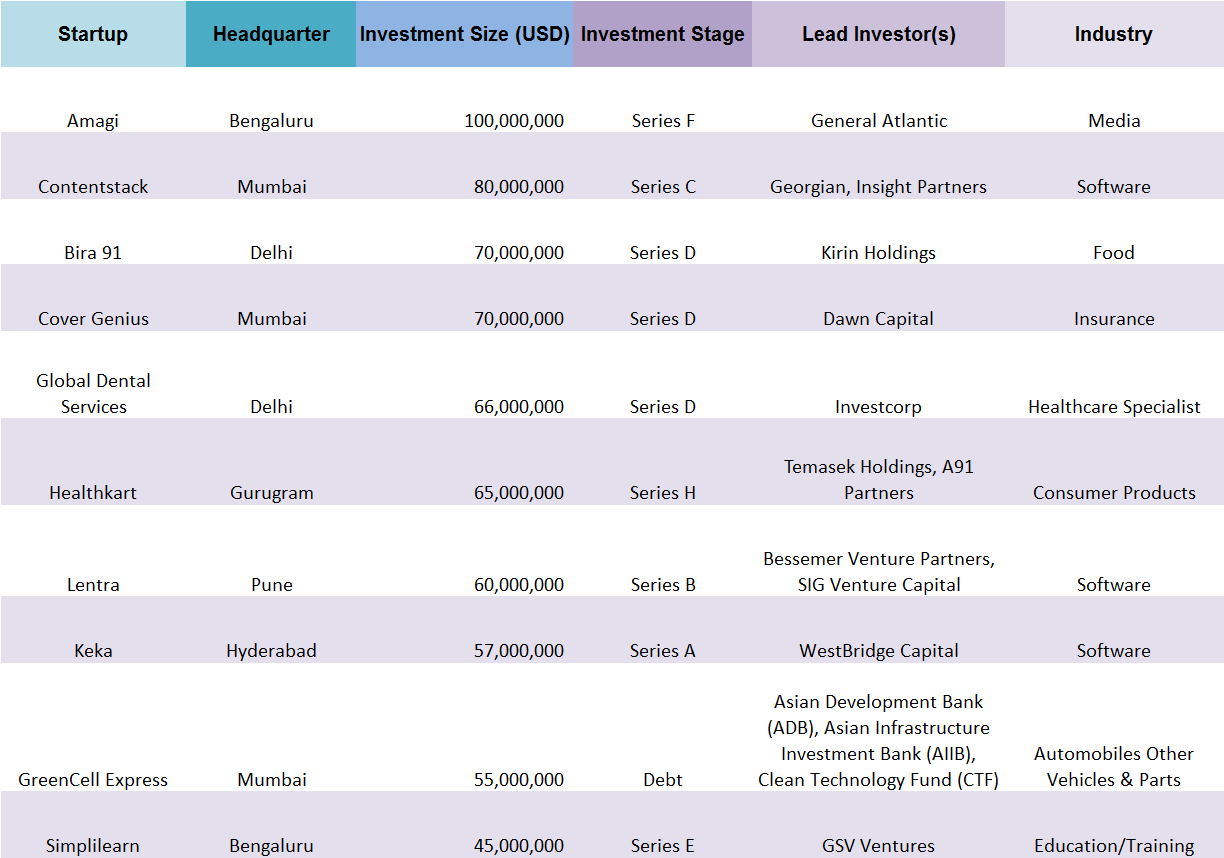

Top ten deals in November

Source: DealStreetAsia

The pace of creating new unicorns (startups valued at $1 billion and above) has also slowed down this year. No startup made it to the unicorn club in November as many late-stage startups avoided raising money this year owing to unfavourable market conditions.

The number of Indian startups entering the unicorn club this year may well be just half of last year, going by trends so far. While there were at least 45 new unicorns minted in 2021 with a combined valuation of a little over $97 billion, there have been only 24 till end-November this year with a combined valuation of $50 billion, according to data from DealStreetAsia DATA VANTAGE.

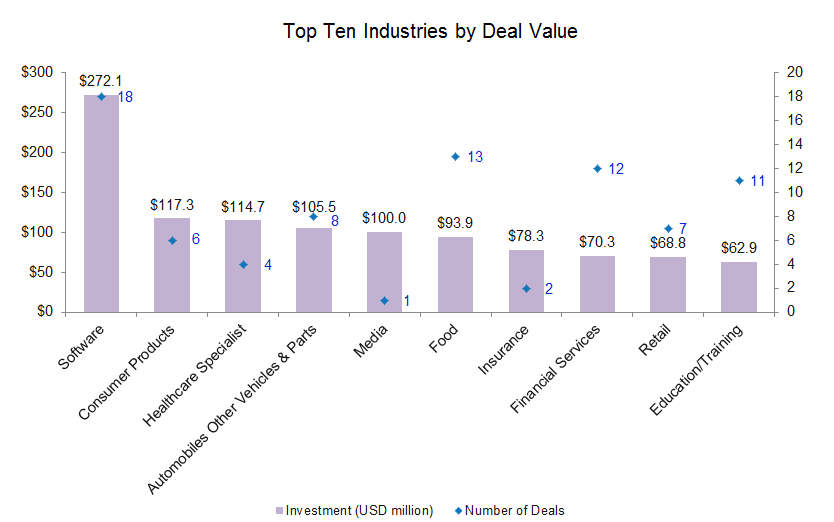

Software continues to shine

Software startups continued to lead the pack in November with a total of $272 million in their kitty across 18 transactions. Within software, content management and experience platform Contentstack raised the largest round of $80 million — a Series C round co-led by Georgian and Insight Partners. The financing also saw participation of Illuminate Ventures.

The other prominent deals within the industry include lending software provider Lentra ($60 million), human resources technology startup Keka ($57 million), consulting platform Celebal Technologies ($32 million), and Prismforce ($13.6 million).

Source: DealStreetAsia

Source: DealStreetAsia

Consumer products was the second most funded industry in the month with a total of $117 million across six deals. Healthkart led the industry with $65 million funding from investors including Temasek Holdings and A91 Partners. Besides, The Sleep Company, The Ayurveda Co., Iba Cosmetics, RapidBox, and Sanfe, too, raised funding in November.

Healthcare specialist industry was pushed to the third spot with Global Dental Services’ $66-million round. The company, which operates the nationwide chain of oral care clinics Clove Dental, raised this amount from Investcorp, Tybourne Capital Management, SeaLink Capital Partners, and others.

Together the top three industries – software, consumer products and healthcare specialist raised a total of $504 million, accounting for about 40% of the deal value in November.

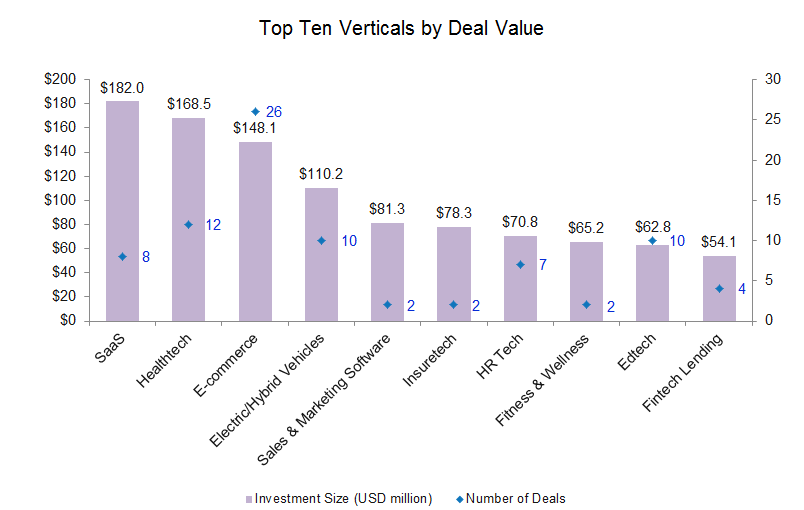

An uptick in growth-stage deals

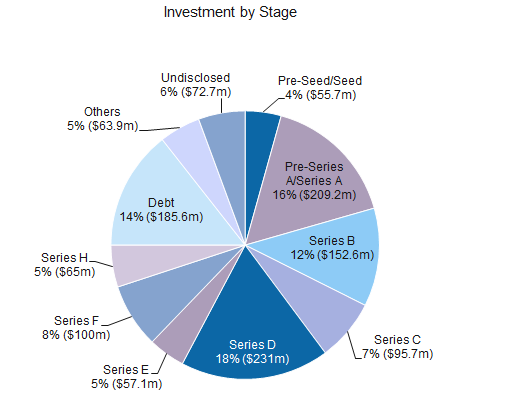

November proved to be a breather month for growth-stage startups. Growth-stage deals, defined as Series B or post-Series B rounds, accumulated $701 million across 17 transactions in November. This marks a growth of 30% in value over October, when growth-stage deals raked in a total of $537 million.

Amagi, Contentstack, Bira 91, Cover Genius, Global Dental Services, and Healthkart were among the startups that raised growth rounds in the month.

Source: DealStreetAsia

Early-stage startups continued to garner investor interest. Early-stage deals, from pre-seed to Series A stages, accounted for about 57% of the deal volume in November.

While the number of pre-seed and seed stage deals rose to 45 in November from 32 in October, the deal value was down 27% at $55.7 million. The startups that raised seed rounds during the month include Flash, RedBrick, Covvalent, Vetic, Driffle, AlmaBetter, Clean Electric, and Burma Burma, among others.

Startups at pre-Series A and Series A stages secured a total of $209 million across 30 transactions, registering a growth of about 20% in deal value over October. HR tech startup Keka raised the largest Series A round of $57 million from WestBridge Capital. Other startups that raised Series A rounds in the month include Indiagold ($22 million), The Ayurveda Co. ($15 million), Prismforce ($13.6 million), SolarSquare ($12 million), Supertails ($10 million) and ProcMart ($10 million).

Most active investors

Startup investing platform Inflection Point Ventures (IPV) emerged as the top investor in November by backing a total of seven startups. It led funding for companies including on-demand manufacturing startup Prodo, healthtech company Mocero Health, mobility solution provider Automovill, skilltech and careertech startup Suraasa, online marketplace for biofuels and wastes Buyofuel, and food agribusiness platform Fresh From Farm.

Early-stage investment firm LetsVenture occupied the second spot with a total of five investments, including SaaS-based physical security startup Spintly, online alternative fuel marketplace Buyofuel, drone delivery platform Skye Air Mobility, on-demand manufacturing startup Prodo, and feminine hygiene brand Sanfe.

Kalaari Capital followed with four investments including upskilling startup AlmaBetter, energy storage solutions startup Clean Electric, cashback and coupons platform CashKaro, and microblogging platform Koo.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Investors wrap up 220 deals in Nov, up 23.6% MoM, ahead of lean season

November saw a dealmaking sprint as venture investors in the Greater China market completed a total of 220 investments...

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls below $1b for the first time this year in Nov

November was the worst month so far this year for Southeast Asia’s startups in terms of both fundraising value and volume...